AUD/USD Price Analysis: Bears pressure 0.72 the figure, eyes on key employment data

- AUD/USD will start the week after a poor performance over the last couple of days.

- The Aussie jobs data will be eyed as bears test 0.72 the figure.

For the start of the week, AUD/USD has been on the backfoot having succumbed to a USD rebound on Friday. The following takes into account the price action in the greenback and the prospects for more upside which could tip the Aussie over the edge for the week ahead.

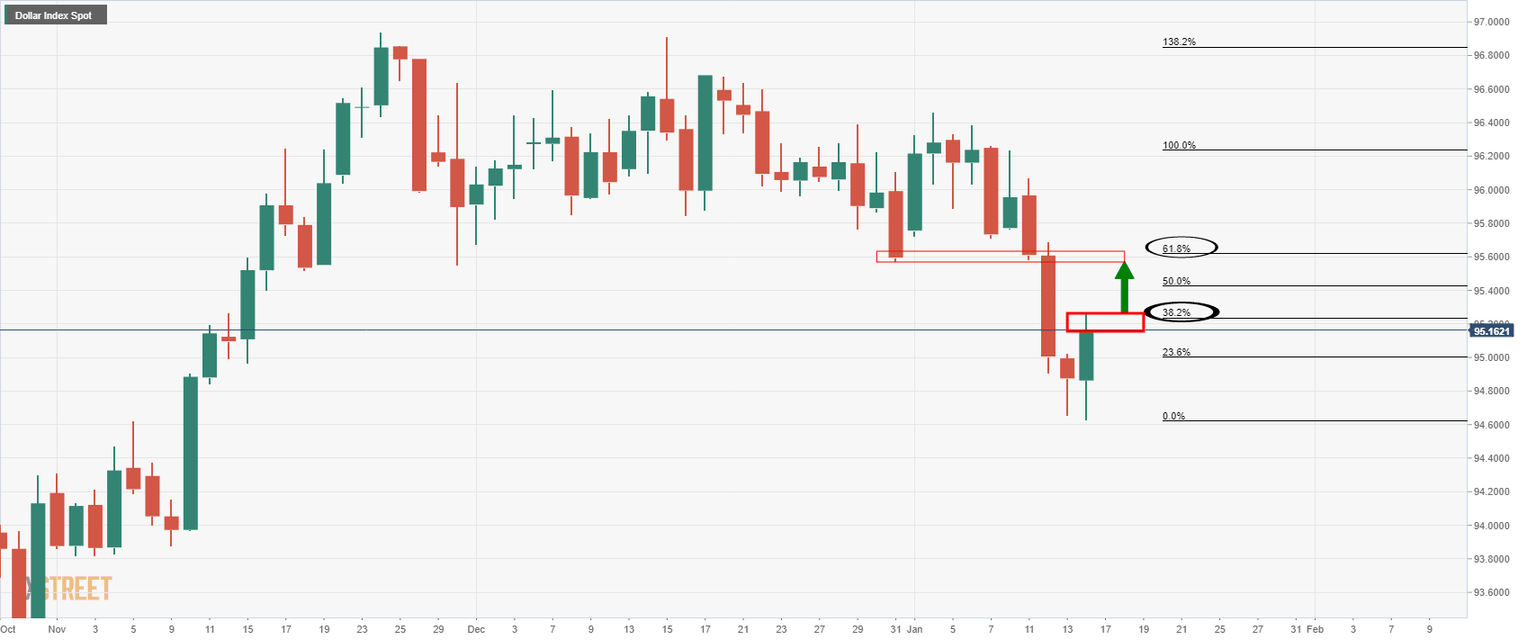

DXY daily charts

While the upside was forecasted, there could still be some more to go on a break of the 38.2% Fibonacci level near 95.24:

The 61.8% Fibonacci level is near 95.63 which has a confluence with prior support as illustrated above making for a compelling target.

This leaves the outlook for AUD/USD bearish, as follows:

A break 0.7200 support would be significant considering the psychological impact of a blowout of the dynamic trendline support. 0.7130 will be the next key support as prior lows ahead of 0.7080 prior lows.

On the other hand, the bullish inverse head and shoulders could play out as follows:

A move to the upside from the trendline support could be the start of the makings of the pattern. A bust through the neckline would be the nail in the coffin for the bears. This level comes in near 0.7320. Likely trigger points, one way or the other, would be with Chinese and Aussie data which is anticipated to be another positive report considering the easing of restrictions heading into the holiday period.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.