AUD/USD Price Analysis: Bears on the prowl below key resistance

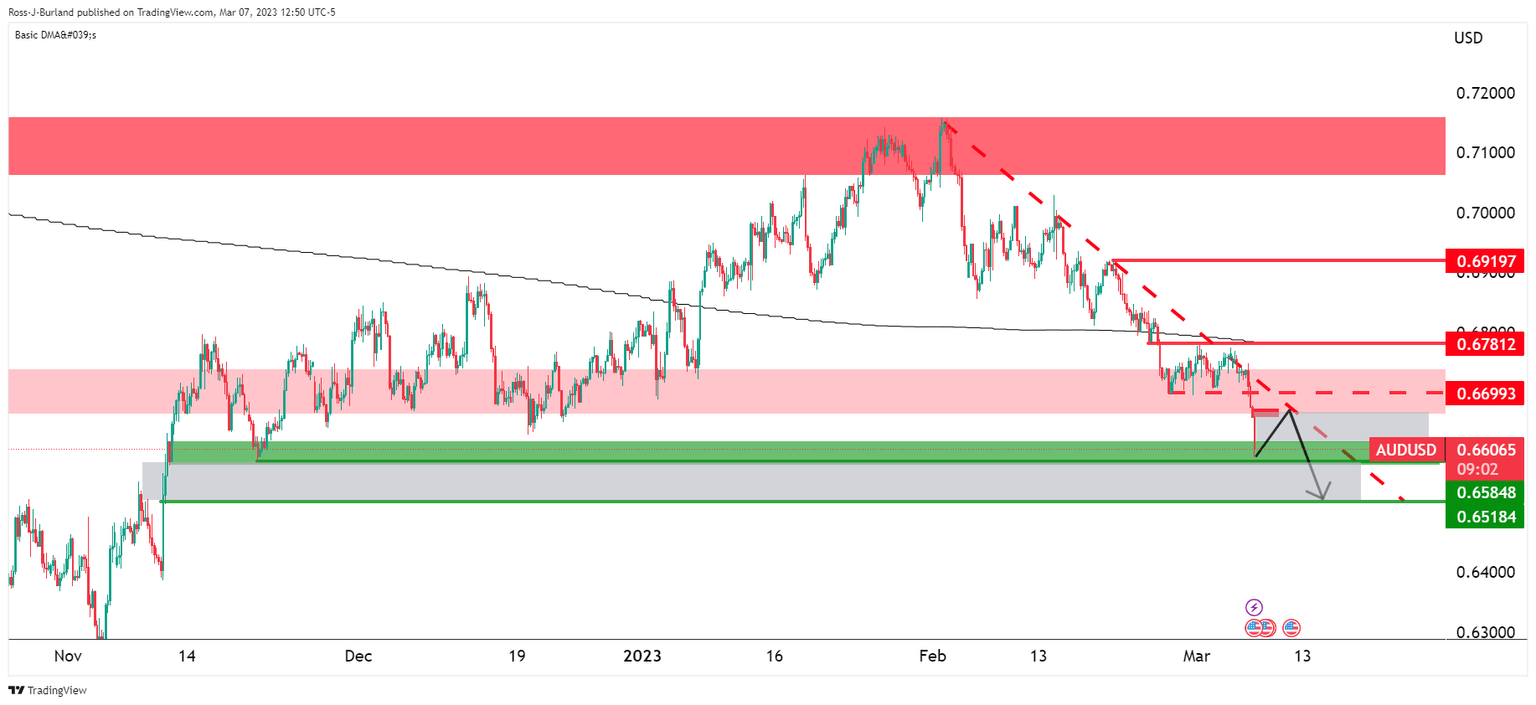

- AUD/USD bears eye a breakout to the downside.

- AUD/USD daily chart's 38.2% Fibonacci is yet to be tested higher up near 0.6650.

As per the prior analysis, AUD/USD Price Analysis: Bears eye a break to 0.6520, and AUD/USD falls heavily as bears move in towards the 0.6580s target area, AUD/USD moved in on the target and is now folding with a bearish bias still ahead of the US Nonfarm Payrolls this Friday.

AUD/USD prior analysis

''AUD/USD has already made a recovery that came in close contact with the 38.2% ratio which leaves prospects of a move to the downside with 0.6520 eyed.''

AUD/USD update

The price is carving out a geometrical box, an ascending triangle, in a downtrend which is considered a bearish chart pattern. Two-way price action can be expected from here with a bearish bias while on the front side of the bear trend and below the 200 DMA. 0.6520 is key in this regard as it guards a move towards 0.6380:

With all that being said, the daily chart's 38.2% Fibonacci is yet to be tested higher up near 0.6650.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.