AUD/USD Price Analysis: Bears are in control at critical support

- AUD/USD bears testing critical support for the open.

- Bears will look for a break below the 0.7160s.

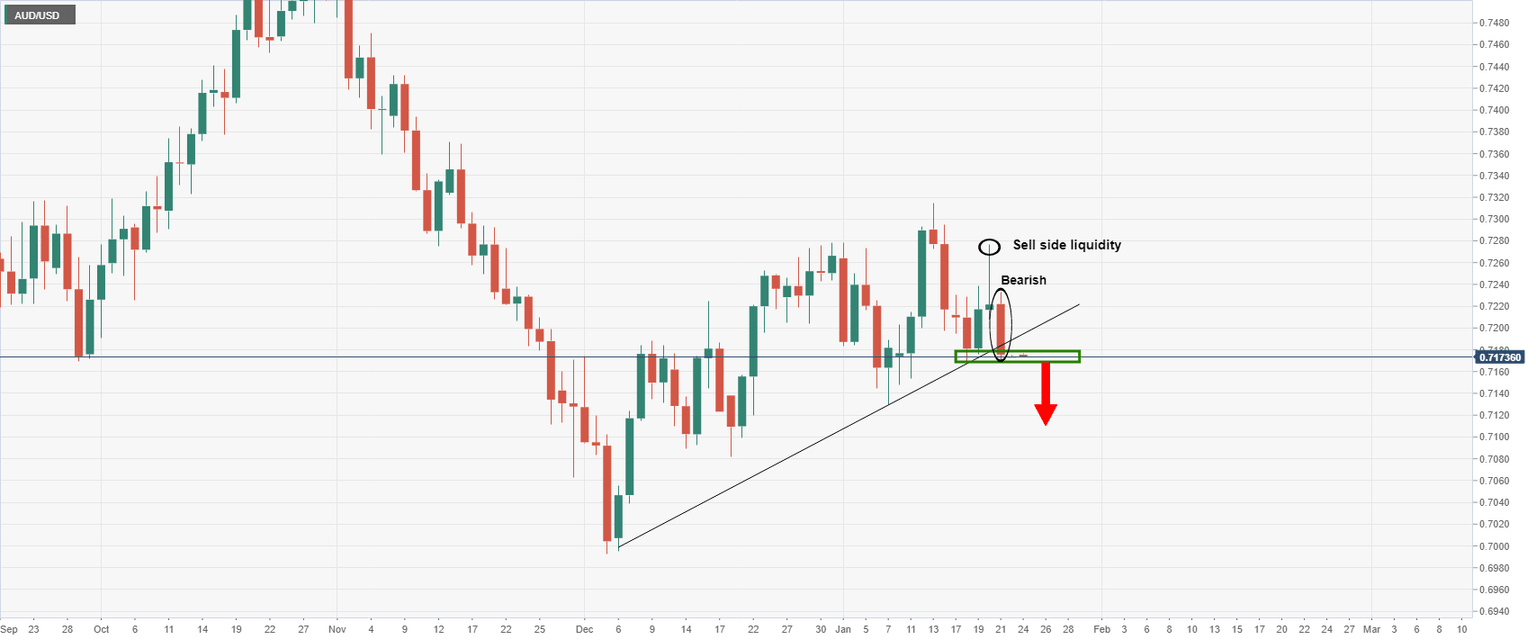

As per the prior analysis, AUD/USD Price Analysis: Bears taking charge and testing critical support, the price, despite a brief liquidity hunt, has continued to test critical support. The following illustrates the prospects for the opening sessions and week ahead from a technical perspective.

AUD/USD daily charts

The bears would argue that last week's Unemployment Rate fuelled spike was just the ticket for instigating the breakout of this critical level of support into month-end. The risk-off setting could see some follow-through over the opening sessions with markets in Asia yet to digest the rout in Friday's stock markets as well.

On the flipside, if there is a catalyst for a reversal in risk appetite or a hawkish bias towards the Reserve bank of Australia sentiment, then the Aussie would be expected to base around these levels. However, last week's bearish close leans more towards a test of the 0.7160s than the 0.7180s for the open:

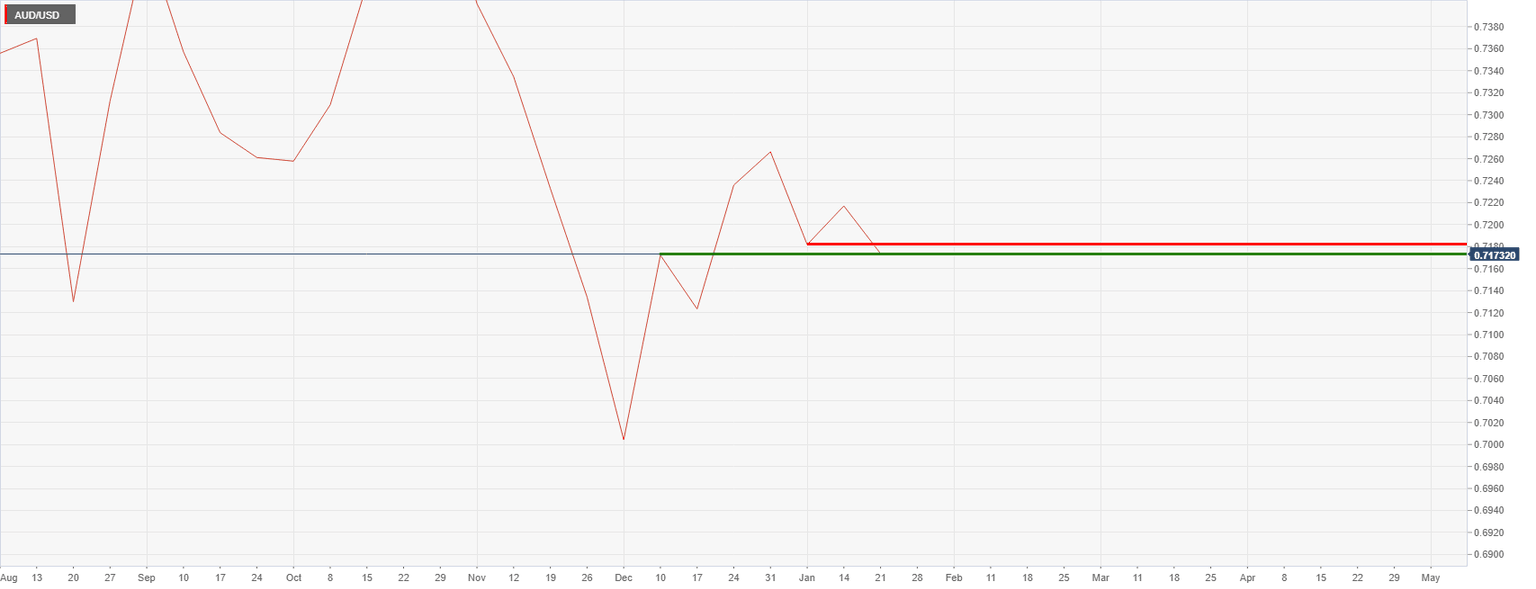

The above line chart represents the weekly W and M formation's necklines. These are considered to be key support and resistance levels. A break of either would indicate the bias for the days ahead.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.