AUD/USD persists near the lows of the year post-RBNZ hike, dovish US FOMC minutes

- AUD/USD remains downward pressured as Fed minutes reveal uncertain future for rate hikes.

- While some Fed officials see the May meeting’s 25 bps rate hike as potentially the last, others caution on the need for flexibility in future meetings.

- Although rate cuts seem unlikely in the near term, policymakers emphasize the need to remain open to rate hikes if necessary, stressing transparency in communication.

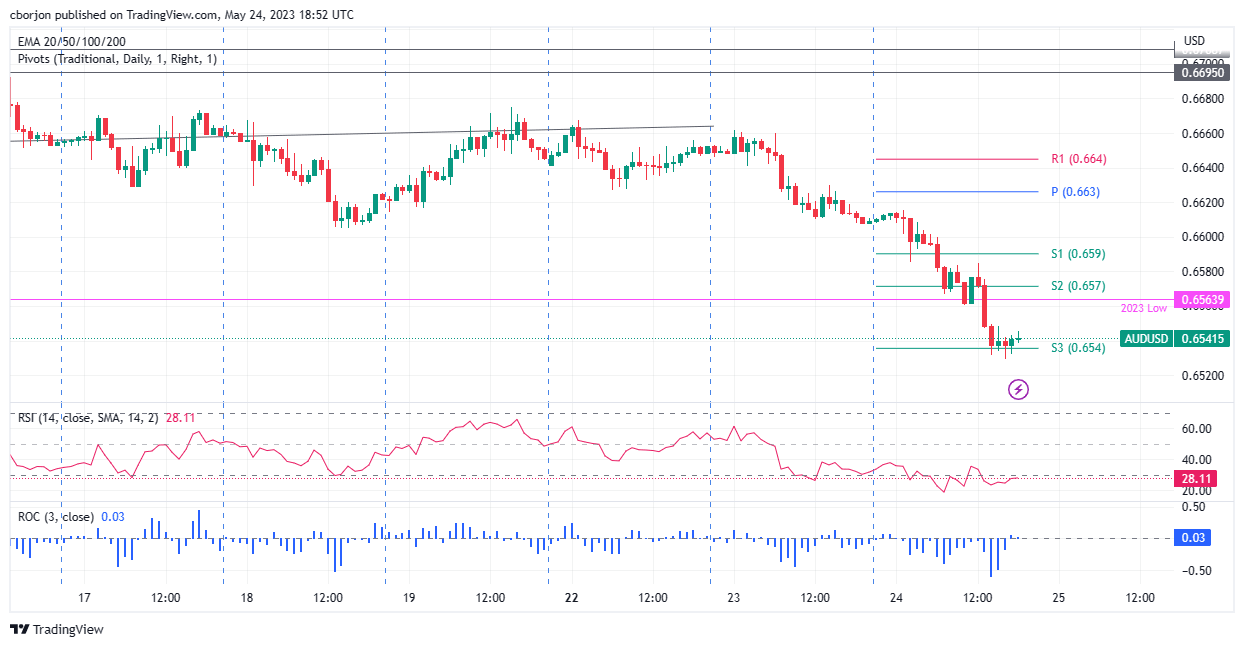

AUD/USD prolonged its fall after hitting a new year-to-date (YTD) low of 0.6529. It remains under downward pressure as the Federal Reserve Open Market Committee (FOMC) revealed its May minutes, which showed an uncertain scenario for further tightening. This hints the US central bank is open to holding rates unchanged if needed. At the time of writing, the AUD/USD is trading at 0.6542.

May FOMC’s minutes show uncertainty amongst Fed officials over future hikes

The recently released meeting minutes of the Federal Reserve’s May gathering shed light on the prevailing uncertainty among policymakers. While some officials approved a 25 basis points rate hike, they emphasized that this could potentially be the last one. On the other hand, several policymakers cautioned that flexibility should be maintained in the upcoming meetings.

Officials expressed their belief that if the economy continues to progress “along the lines of their current outlooks,” further tightening of monetary policy may not be necessary beyond the present meeting.

The staff of the Federal Reserve presented projections indicating a mild recession towards the end of the year. They highlighted evidence that the cumulative effect of previous tightening measures has started to impact the economy. In particular, concerns were raised by “almost all participants” regarding the risks to economic growth as bank credit conditions tighten.

During the meeting, participants generally agreed that rate cuts were unlikely in the near term. However, they emphasized the need to remain open to the possibility of rate increases if the circumstances warrant it. In this regard, the importance of transparently communicating the Fed’s data-dependent approach to the public was underscored. The Federal Reserve aims to maintain flexibility in responding to evolving economic conditions by adopting a meeting-by-meeting approach after the May meeting.

AUD/USD reaction to the FOMC’s minutes

The AUD/USD reaction was muted, following the NZD/USD pair path, after the Reserve Bank of New Zealand (RBNZ) dovish rate hike. Hence, the AUD/USD clashed with the S3 daily pivot before reversing its downward course, and so far is aiming toward the 0.6550 area. Nevertheless, the AUD/USD is still operating with losses, with upside risks at the S2 pivot point at 0.6570, before testing the 0.6600 figure. Conversely, a bearish continuation could open the door for further losses, below the YTD low of 0.6529, like the 0.6500 figure.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.