AUD/USD marches towards 0.6700 as fears of US banking crisis fade

- AUD/USD is aiming to recapture the 0.6700 resistance amid the improved risk appetite of the market participants.

- More than 50% of investors are advocating for the maintenance of a status quo by the Federal Reserve in its May policy meeting.

- Weak Australian Retail Sales data has provided some relief to the Reserve Bank of Australia.

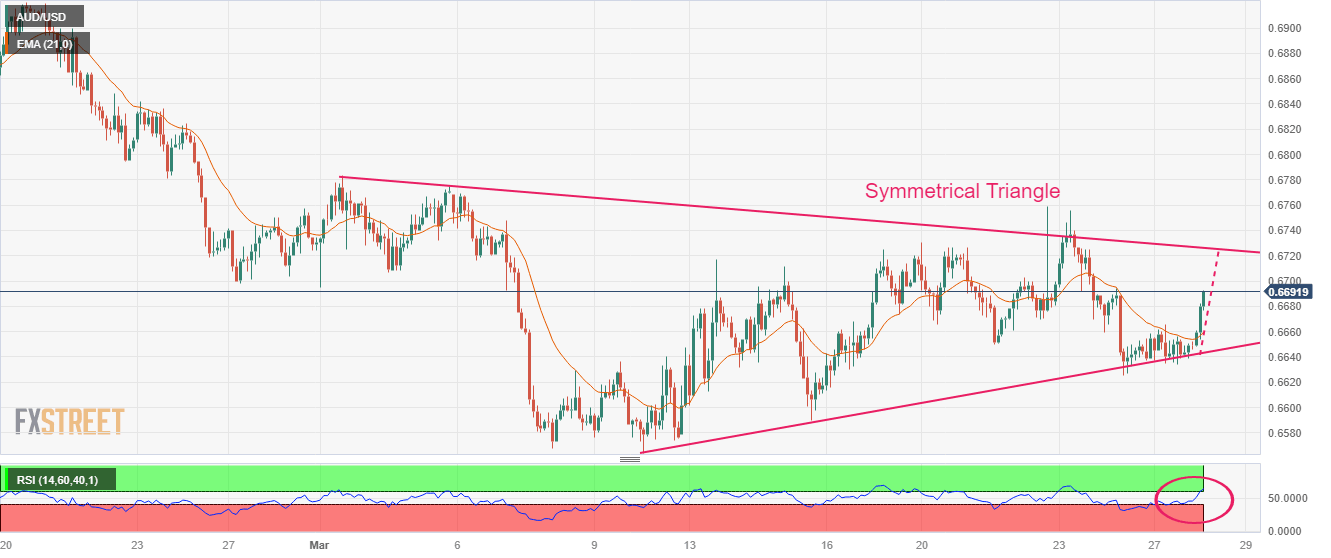

- AUD/USD is marching towards the downward-sloping trendline of the Symmetrical Triangle chart pattern.

AUD/USD has displayed a sheer upside after climbing above the critical resistance of 0.6660 in the Asian session. The Aussie asset is now marching towards the round-level resistance of 0.6700 as the US Dollar index (DXY) is going through turbulent times. The USD Index has extended its correction to near 102.60 amid rising efforts by United States authorities to restore the confidence of households that their deposits are safe in mid-size banks. The US Dollar Index is likely to continue its downside momentum further amid the absence of recovery signals near 102.60.

S&P500 futures have generated more gains in the Asian session after a three-day winning spell on hopes that restored the confidence of households will also support more investment in risk-perceived assets, portraying a solid risk appetite of the market participants.

Demand for US government bonds has shown some rebound after an intense sell-off on Monday. Investors dumped US government bonds after back-to-back positive headlines from US authorities for providing liquidity assistance to small US banks after the fiasco of three banks. The 10-year US Treasury yields have dropped to near 3.51%.

United States government to bail out banking sector

The debacle of three mid-size banks resulted in the loss of confidence of households in mid-size banking organizations. Reuters reported on Monday that households have withdrawn their deposits heavily from small US banks and firms are heavily relying on advances from them, which has made them prone to meltdown.

To contain the same, the US government came forward with an expansion of emergency liquidity assistance to small lenders. The headline was followed by the announcement of the acquisition of deposits and loans from failed Silicon Valley Bank (SVB) by First Citizens BancShares. The idea of bailing out SVB is going to deliver a message that the overall banking system is strong, resilient, and sufficient enough to face turbulence. Apart from that, US Treasury Undersecretary for Domestic Finance Nellie Liang stated, “The US government will continue using its tools to prevent contagion in the banking sector, as warranted, to ensure Americans’ deposits are safe,” as reported by Reuters.

Positive steps from the US government for bailing out collapsed banks and restoring of confidence of investors and households have impacted the US Dollar.

Investors split about Federal Reserve’s interest rate decision

After an eight consecutive rate hike by the Federal Reserve (Fed), interest rates have knocked the 5% figure. Federal Reserve chair Jerome Powell showed bravery and hiked rates further by 25 basis points (bps) despite fears of a banking sector meltdown. However, the further road to inflation containment looks tricky.

The investing community is split about whether the Federal Reserve will keep policy unchanged or will continue its policy-tightening spell. As per the CME Fedwatch tool, more than 50% of investors are advocating for the maintenance of a status quo by the Federal Reserve (Fed) in its May monetary policy meeting as tight credit conditions approach by US banks would actively weigh on US inflation. The approach has heavily impacted the USD index.

Australian Retail Sales reveal weaker Retail Sales

In the morning of Asia, the Australian Bureau of Statistics reported that Retail Sales have expanded by 0.2%, lower than the consensus of 0.4% and the former release of 1.9%. A weaker-than-expected retail demand indicates that households are bearing the burden of higher inflation and are facing issues in offsetting the impact of inflated products with current paying capacity.

Although Australian households are going through a rough phase, weak retail demand is music to the ears for the Reserve Bank of Australia (RBA). The central bank has been working on softening Australian inflation, which is extremely stubborn and not responding well to higher interest rates.

Till now, Reserve Bank of Australia chair Philip Lowe has already pushed the Official Cash Rate (OCR) to 3.60%. Going forward, the monthly Consumer Price Index (CPI) will remain in the spotlight, which is scheduled for Wednesday.

AUD/USD technical outlook

AUD/USD has rebounded firmly after sensing strength near the upward-sloping trendline of the Symmetrical Triangle chart pattern, which is placed from March 10 low at 0.6564 on a two-hour scale. The downward-sloping trendline of the chart pattern is plotted from March 01 high at 0.6784.

The asset has delivered a sharp break above the 20-period Exponential Moving Average (EMA) at 0.6659, which indicates sheer momentum in the Australian Dollar.

In addition to that, the Relative Strength Index (RSI) (14) has climbed above 60.00, which indicates that the bullish momentum has been activated.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.