AUD/USD depends on the Fed, but bears are waiting in the wings for downside daily extension

- AUD/USD bears are waiting in the wings of the Fed for a bullish outcome for the greenback.

- A fresh daily bearish impulse in AUD/USD could be in the making.

- However, a sell the fact outcome could play into the hands of the Aussie.

Trading near 0.7170, AUD/USD is firm ahead of the Federal Reserve at the top of the hour. The Aussie has benefitted this week from expectations of earlier domestic interest hikes, lower equity market volatility and a softer US dollar.

Since the start of the week, AUD/USD has climbed from a low of 0.7090 to a corrective high of 0.7177 in a technical move illustrated below. However, drivers from the geopolitical and central bank sentiments have underscored the bullish bias leading into today's showdown event in the Fed.

Risk sentiment improves ahead of Fed

Risk sentiment has improved on Wednesday with European stocks jumping. Eurostoxx50 was up 2.3% despite the Russia-Ukraine tensions that remain high. However, dialling down the angst, the Ukrainian Foreign Minister Dmytro Kuleba said Wednesday that Russia has not assembled sufficient forces to launch an imminent full-scale invasion of Ukraine.

This was in response to the Russian Foreign Minister Sergey Lavrov threatening "appropriate response measures" if the West continues its "aggressive line." Nevertheless, markets are of the mind that Word war III is not imminent as the West has said it is not going to get drawn in militarily. Instead, any sanctions for any invasion of Ukraine would be financial and economic.

Rising geopolitical tensions around Russia and Ukraine have weighed on the global equities market, and high beta currencies such as the Aussie, with the S&P 500 index flirting with a correction twice this week. However, Wall Street's main indexes have climbed on Wednesday after two turbulent sessions and ahead of the outcome of a Federal Reserve policy meeting, with a stellar outlook from Microsoft boosting technology stocks.

The US dollar has subsequently held below a 2-1/2 week high as risk sentiment stabilized hours before policymakers at the Federal Reserve are widely expected to indicate their readiness to start raising interest rates starting in March.

Nevertheless, the DXY is up for the third straight day and trading around 96.087 at the time of writing. The 2022 high near 96.462 is close but charts suggest an eventual test of the November high near 96.938, analysts at Brown Brothers Harriman argued.

''The dollar is mostly higher today, which supports our view that the dollar remains in the unique position of gaining during periods of both risk-on and risk-off. When all is said and done, the US fundamental story remains solid, giving the Fed confidence to continue removing accommodation at an accelerated pace. This is ultimately dollar-positive.''

Meanwhile, analysts at TD Securities said in a note today that ''USD resilience should persist through the January FOMC meeting, particularly on the risk of an earlier QT start. Barring that, the dollar bloc seem best positioned to weather the storm given tightening is already priced in. ''

What to watch for at the Fed release

''Chair Powell is likely to take the opportunity to prepare markets for liftoff,'' the analysts at TD Securities said.

''Any hints around the starting point for QT or "sooner" and "faster" on hikes could be market-moving. A March rate hike is almost fully priced in and the market is pencilling in nearly 4 hikes in 2022. Equity weakness could leave the Fed a bit concerned, but the Chair is likely to stress only gradual removal of accommodation.''

Meanwhile, the analysts at BBH warn of some possible “buy the rumour, sell the fact” price action after the decision.

''A very hawkish Fed is universally expected and if Powell and company deliver anything remotely cautious or dovish, there may be some knee-jerk profit-taking on the long dollar and short UST positions.''

''We advise investors to look through this price action and instead focus on the fundamental story. Given what we know about the US labour market and recent inflation trends, the underlying story remains dollar-positive,'' the analysts said.

AUD domestic drivers

AUD/USD has been finding some support from a bigger-than-expected drop in Australia’s unemployment in December (to 4.2%) and firm inflation data. Australia’s Core Consumer Prices surpassed the midpoint of the Reserve Bank’s 2-3% target for the first time since June 2014.

This lifted bond yields and narrowed the divergence between the US and AU rates. The surprise lifted expectations of earlier interest-rate hikes. Traders are trying to second guess whether these factors will see the Reserve Bank of Australia react to such improvements in data with a significant hawkish turn at the 1 February meeting.

AUD/USD technical analysis

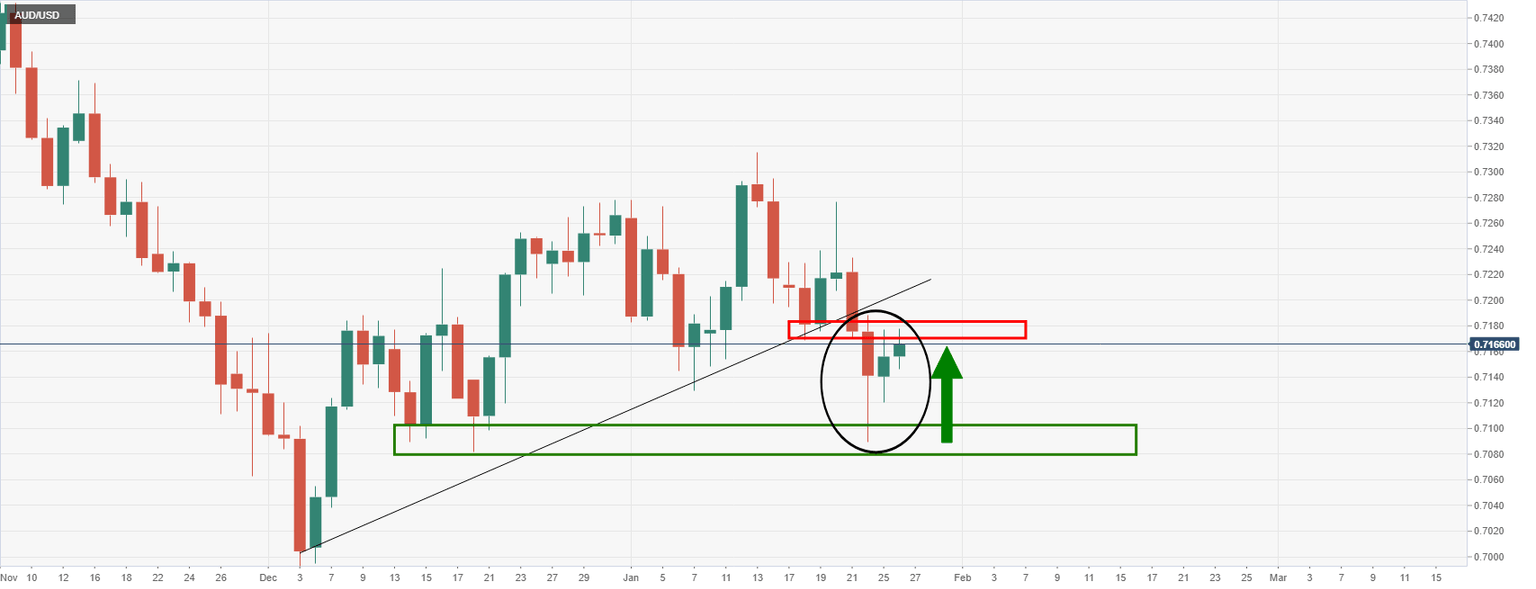

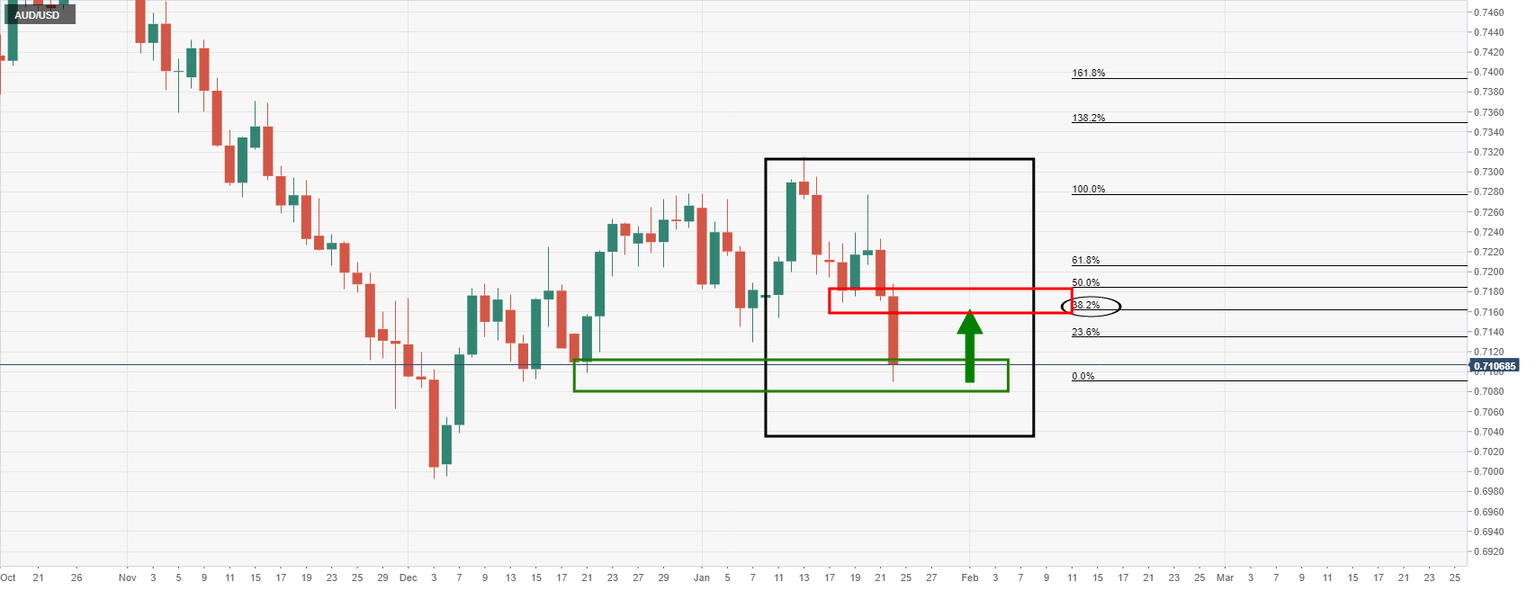

As per the prior analysis, AUD/USD Price Analysis: Bulls going against the grain to M-formation neckline target, the price has move din on the target as follows:

AUD/USD prior analysis

The M-formation was neckline was identified as a bullish target.

AUD/USD live market

The neckline has been reached and traders will now wait to see what the outcome of the Fed entails for the currency markets.

AUD/USD levels to watch around Fed

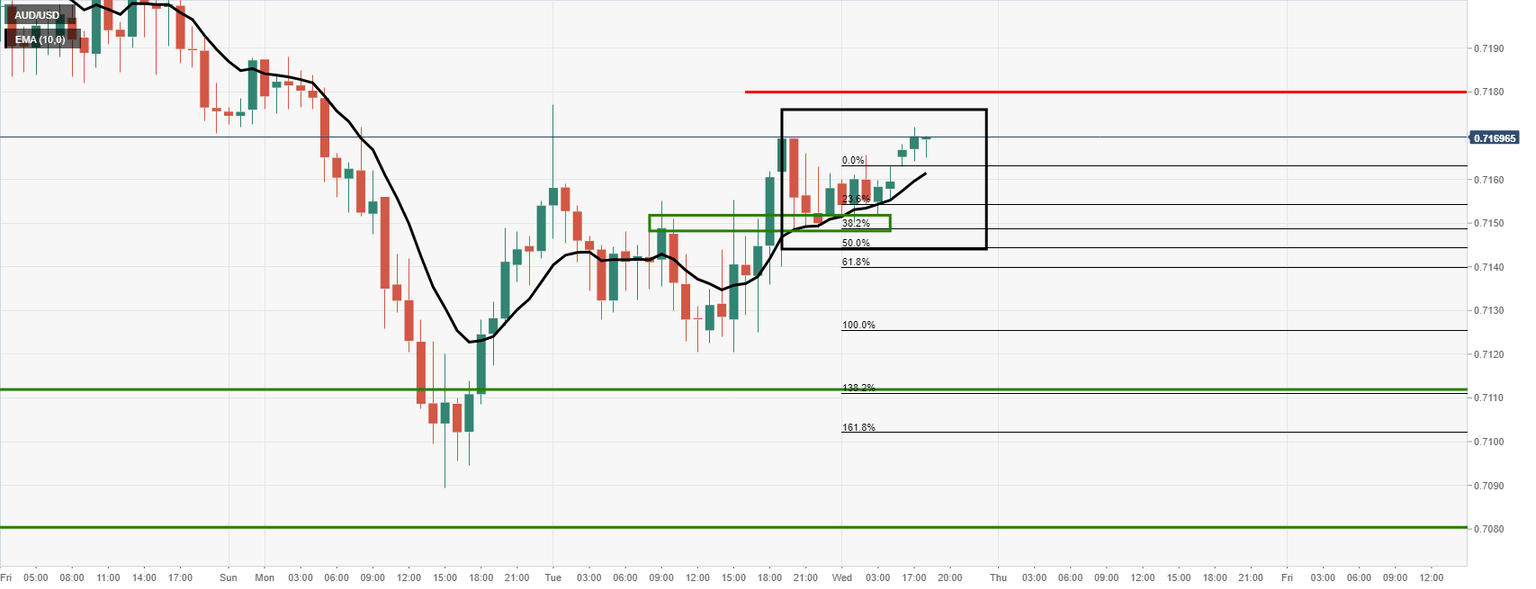

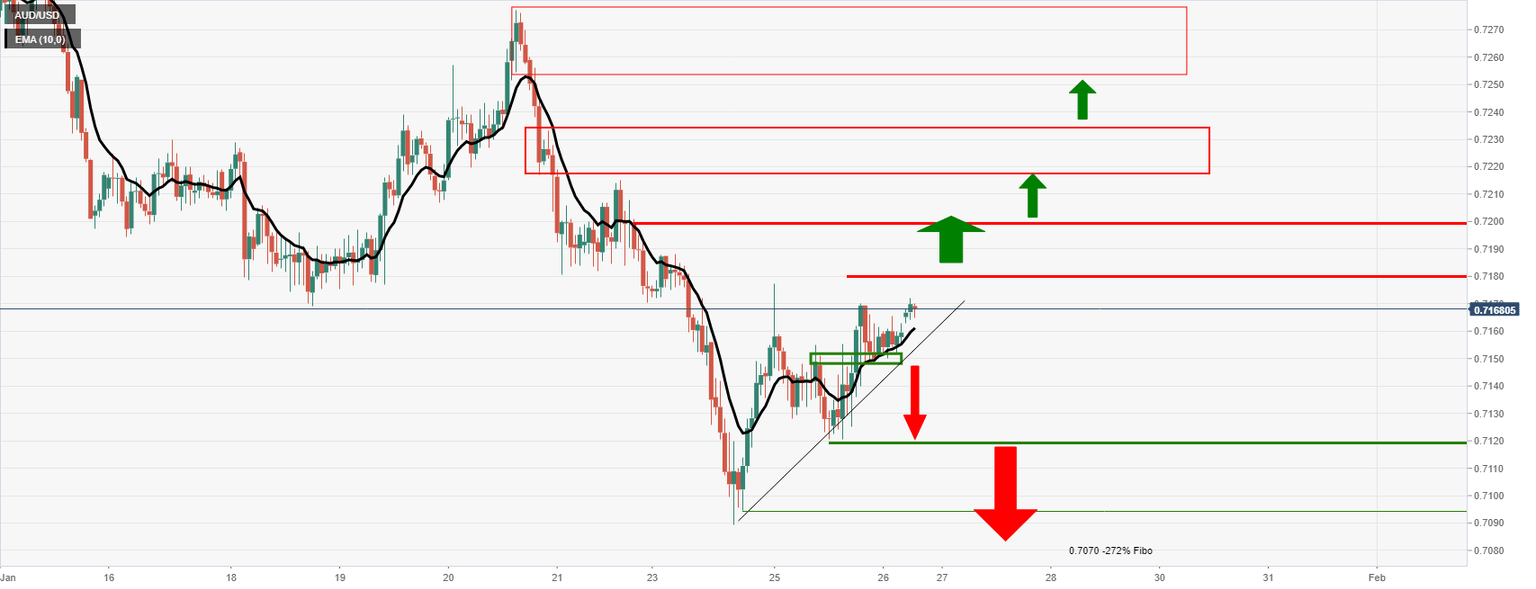

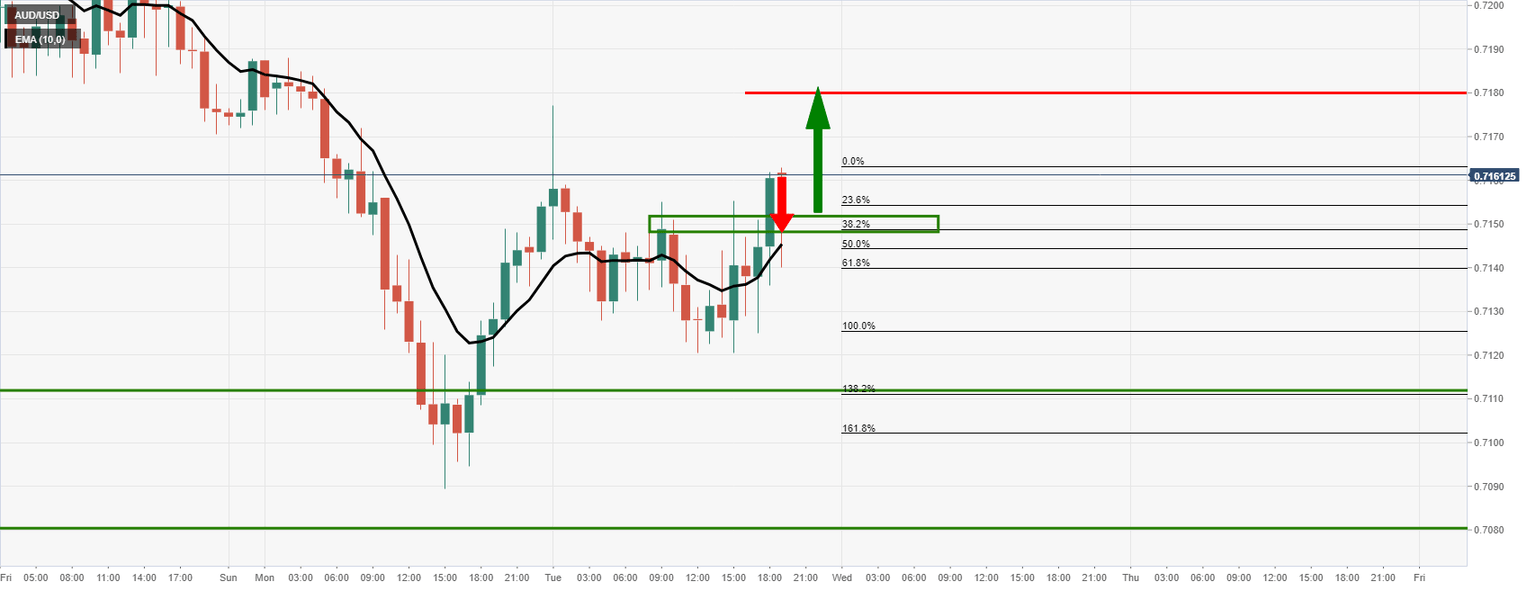

In yesterday's approach to the target, from a lower time frame basis, the market structure and flight path were illustrated and forecasted as follows:

The price indeed moved in on the support before moving higher towards the M-formation's neckline:

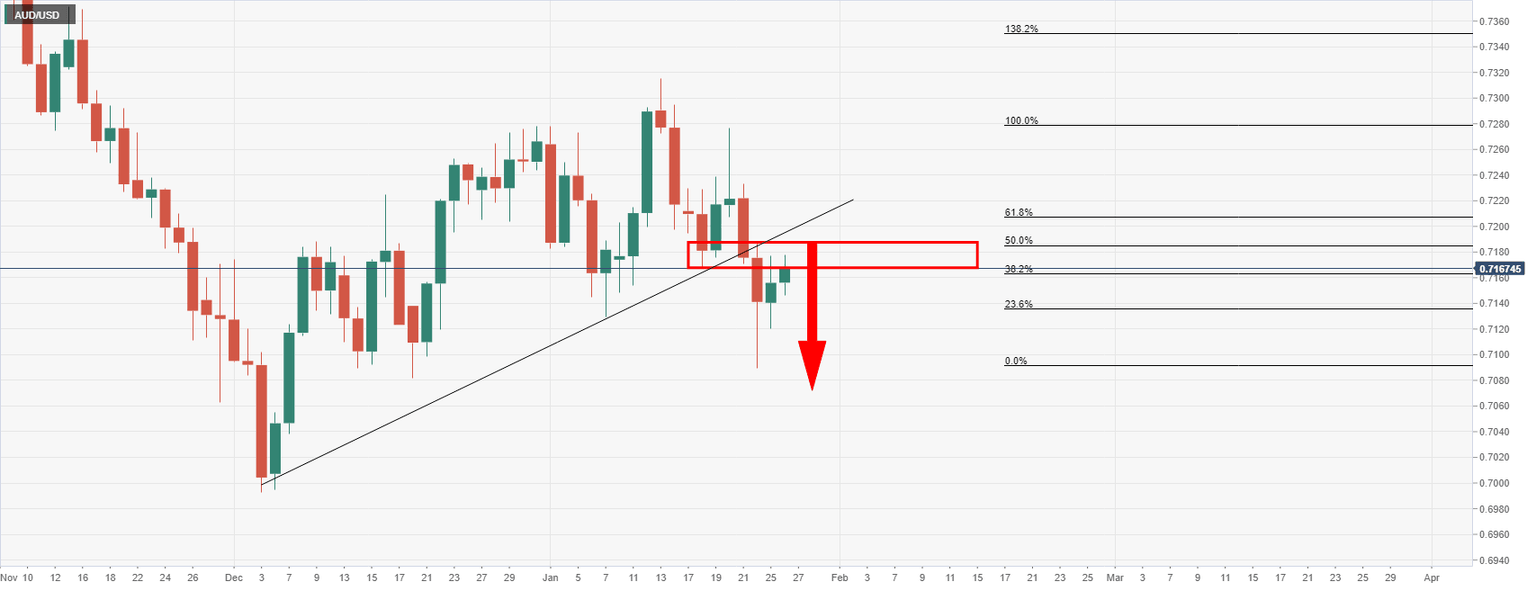

In doing so, 0.7180 is now only a handful of pips away. The level at 0.7150 is key support heading into the Fed which aligns with the dynamic trendline support that protects 0.7120. A break of 0.7120 opens the risk of a significant breach of the lows near 0.7190 and then 0.7070. On the upside, a break of 0.7180 will open 0.7200, then 0.7220/30 as the last major resistance before 0.7250/80:

AUD/USD daily bearish outlook

All in all, a bullish outcome for the US dollar would be expected to play out as a daily bearish continuation on the daily chart as illustrated above.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.