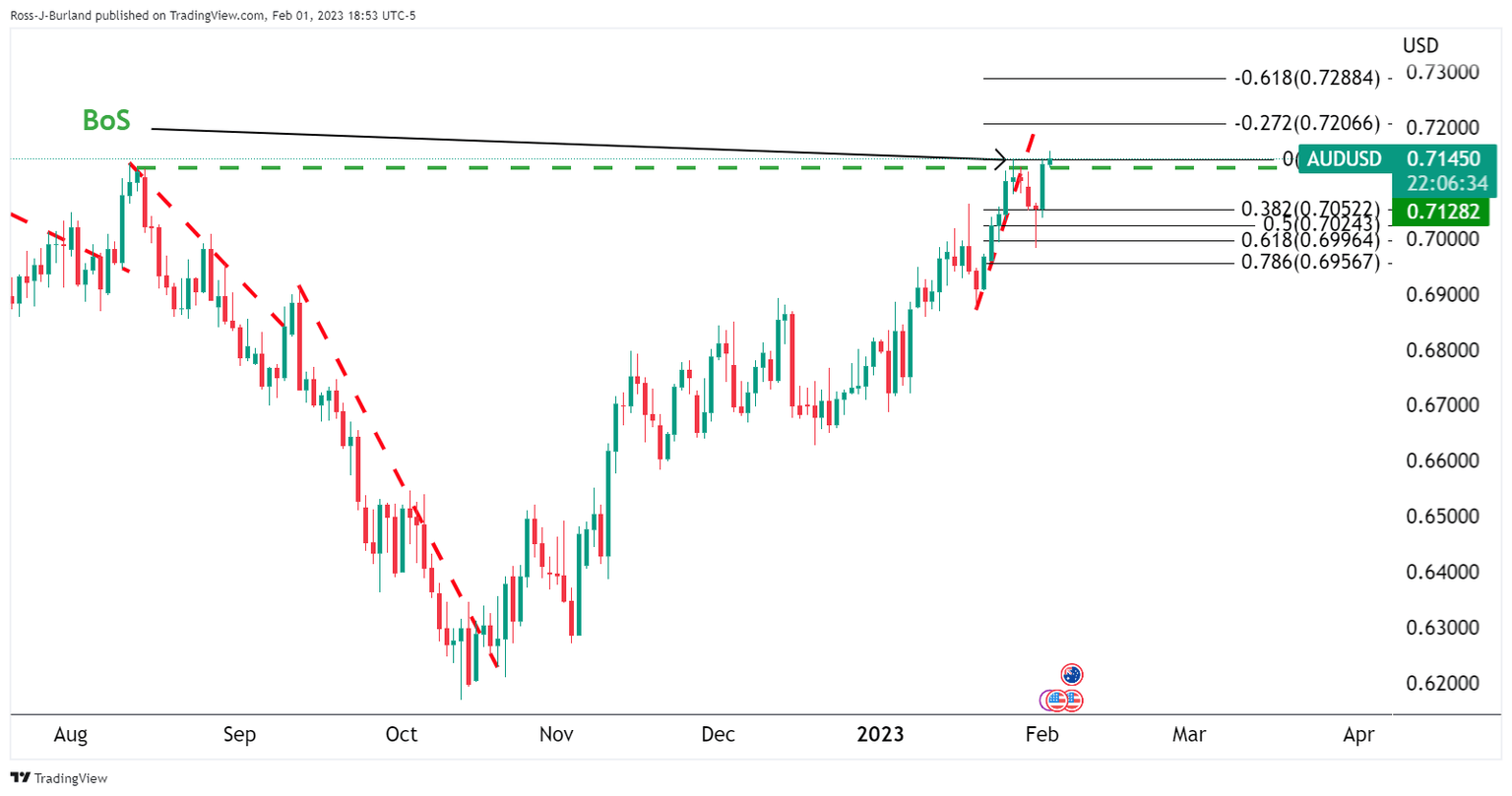

AUD/USD bulls eye a run to the 0.72s

- AUD/USD bulls have taken the price into the 0.7150s and are on course for the 09.7200s.

- Central bank sentiment is underpinning the Aussie following the Federal Reserve.

AUD/USD is trading at 0.7144 and has ranged between 0.7128 and 0.7157 so far in the Asian session following the Federal Reserve rally after the central; bank had its rates raised by 25bps to a range of 4.50-4.75% and signalled further rate hikes are appropriate.

The statement acknowledged inflation has “eased somewhat” and dropped the references to supply/demand imbalances, high food and energy prices, and broader price pressures. However, Fed guidance is wisely erring on the side of caution. Nevertheless, the greenback was sold off with the Fed funds futures traders expecting the benchmark overnight interest rate to peak at 4.89% in June, before falling back to 4.39% by December. Nevertheless, the Fed's last "dot plot" in December showed that Fed officials expected the rate to rise above 5%.

With that being said, the greenback extended losses on Wednesday and fell to a nine-month low against a basket of currencies after Federal Reserve Chair Jerome Powell's dovish follow-up comments during the Q&A when he spoke of making progress in bringing down inflation pressures. He also noted progress on disinflation, which he said is in its early stages and said the Fed will continue to make decisions on a meeting-by-meeting basis. Powell repeated his code words for no pivot in 2023, but his acknowledgement of the start of the disinflationary process was taken as dovish by the markets and led to a decline in US treasury yields. Analysts at Rabobank said that they continue to think that inflation will be too persistent for the Fed to start cutting rates in 2023.''In fact, in our view the risks are still to the upside.''

Meanwhile, looking at the Aussie, net AUD short positions were little changed for a second week having recently moved to their lowest level since October. Also, it is worth noting that the stronger-than-expected Australian Consumer Price Index inflation data has pushed back on recent speculation that the Reserve Bank of Australia could be nearing the peak of its interest rate cycle. '' The combination of the Fed and RBA sentiment is bullish for AUD and as the following technical analysis illustrates, there could be an advance towards 0.7280 on a break of 0.7250.

AUD/USD technical analysis

AUD/USD has broken structure around 0.7120/30 and is on the way towards the -272% ratio at 0.7206.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.