AUD/NZD Price Analysis: Bearsish pressures are building

- AUD/NZD bears are on the lookout for an opportunity.

- The bearish structure is in the making and the eyes are on the 1.0350s.

AUD/NZD finally met the M-formation's neckline target and now the emphasis is on the downside so long as the resistance holds up into the Reserve Bank of Australia meeting. The following illustrates the downside potential and opportunity fro a daily and 4-hour fractal basis:

AUD/NZD daily chart

As illustrated, the price has met the neckline of the M-formation and is now on the verge of a downside continuation. Of course, the RBA will be definitive of this technical setup, but this is one for the watch list for the coming sessions.

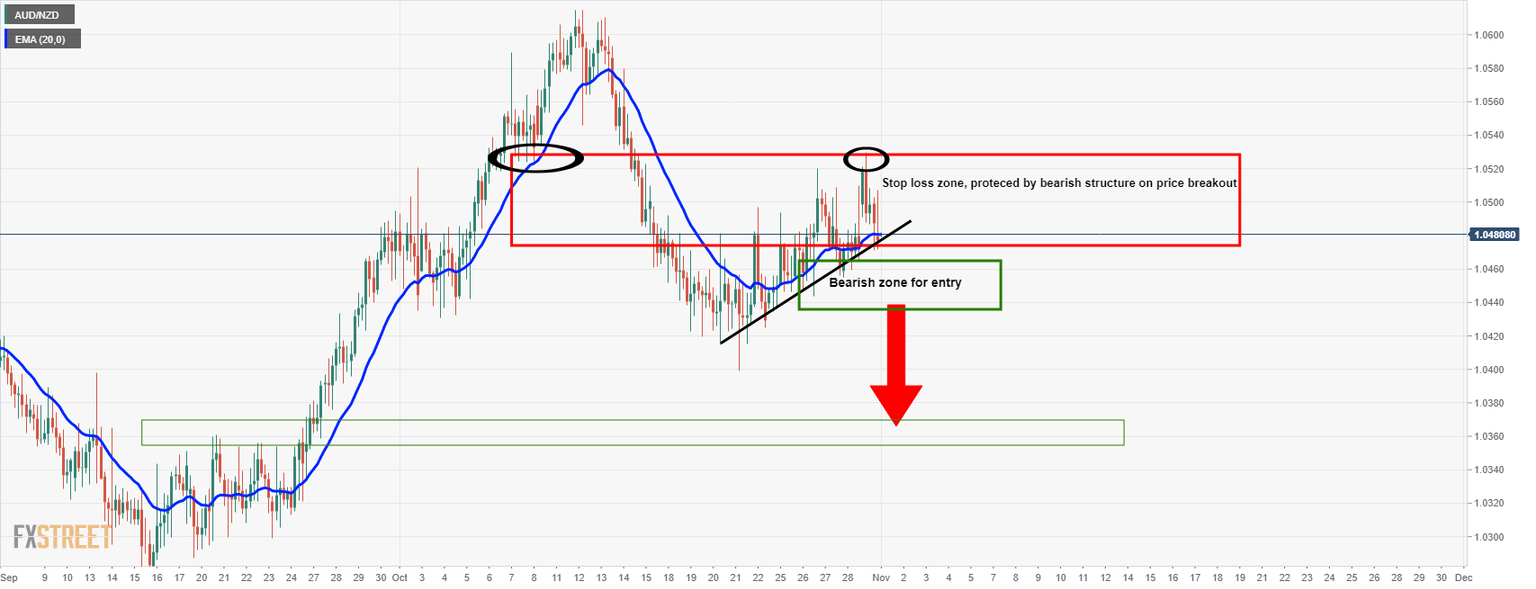

From a 4-hour perspective, the bears will want to see some bearish formation developed from which to protect a stop loss above structure in order to target the next liquidity zone to the downside in the 1.0320/50 zone.

AUD/NZD 4-hour chart

The above illustrates the potential shorting opportunity for the coming days ahead. A break of the dynamic support will be the first step towards a bearish opportunity on a retest of what will be a counter trendline.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.