AUD/JPY Technical Analysis: Confronts two-week-old range resistance after China data

- AUD/JPY takes the bids to near-term key resistance after China’s upbeat Caixin Manufacturing PMI.

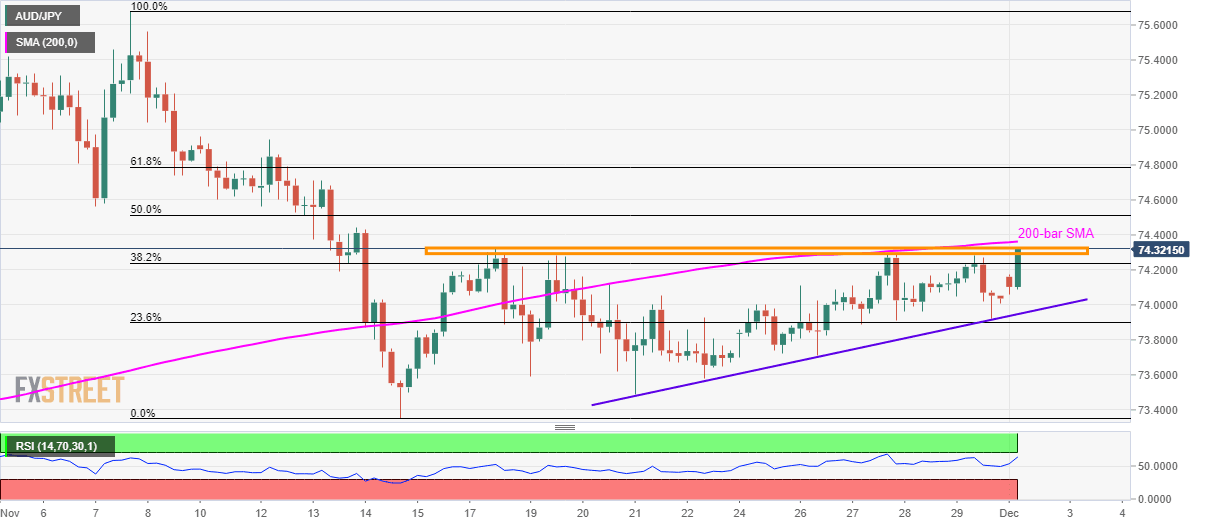

- 200-bar SMA adds to resistance whereas the short-term rising trend line can limit immediate declines.

AUD/JPY rise to 74.30 after Caixin Manufacturing PMI from China pleased the buyers during Monday’s Asian session.

China’s Caixin manufacturing Purchasing Managers’ Index (PMI) followed the footsteps of the official readings in November while beating the forecast of 51.4 with 51.8 level.

In a reaction, the AUD/JPY pair buyers extend previous upside bias and propel the quote to the upper limit of 74.30/33 range established since November 18.

Though, an upside clearance of 74.33 isn’t a trigger to pair’s run-up towards November 12 high surrounding 74.95 as 200-bar Simple Moving Average (SMA) level near 74.36 acts as a confirmation point.

On the contrary, an ascending trend line since November 21, at 73.95, will be on sellers’ radar during the pair’s pullback.

AUD/JPY 4-hour chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.