AUD/JPY Price Analysis: Shrugs off sour sentiment and climbs, targeting 99.00

- AUD/JPY advances, navigating through mixed market signals and intervention concerns, marking a 0.38% increase.

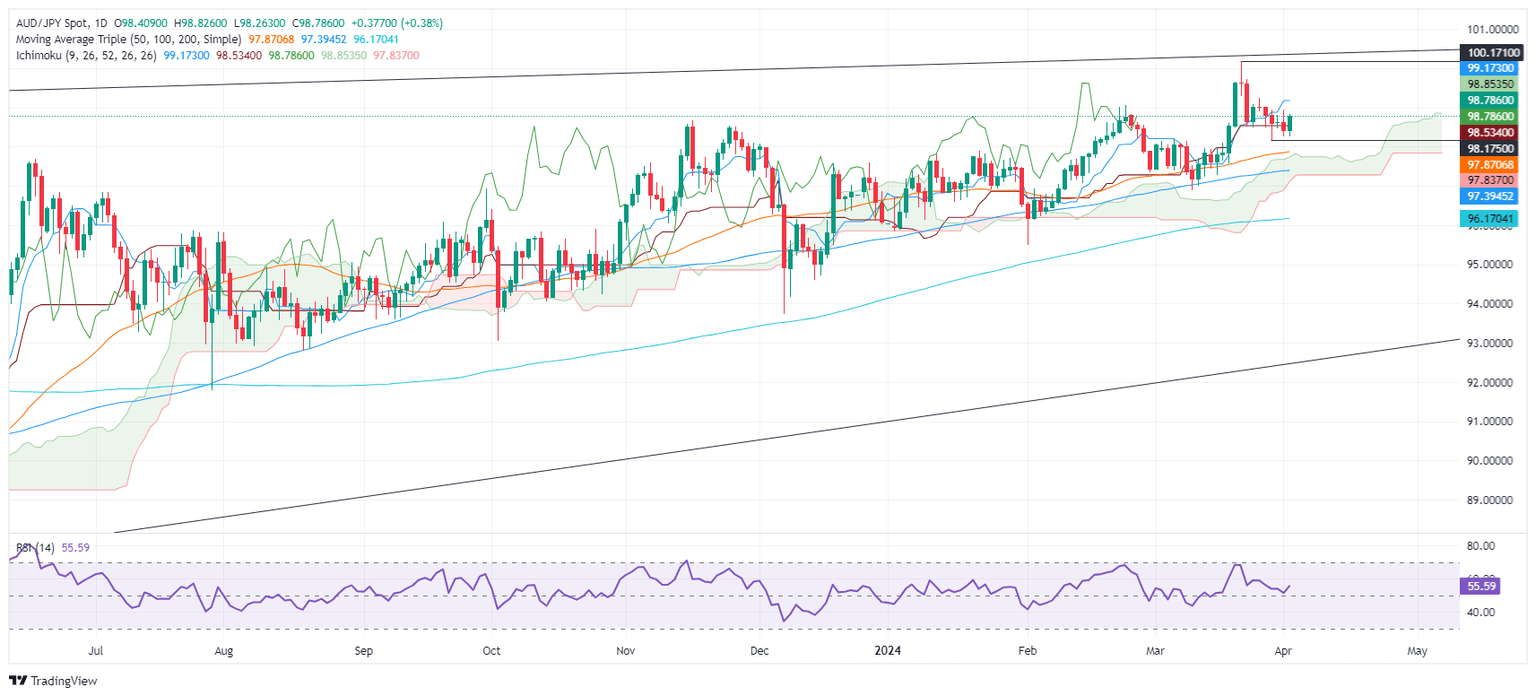

- Technical indicators point to the first significant resistance at the Tenkan-Sen, with potential to test year-to-date highs.

- Downside risks remain, with support levels identified at the Kijun-Sen and the 50-day moving average.

The AUD/JPY registered gains of 0.38% on Tuesday, amid a risk-off impulse as depicted by Wall Street. US equities posted mild losses, though it was ignored by risk-perceived currencies in the FX markets, like the Australian Dollar.

AUD/JPY Price Analysis: Technical outlook

The threats of an intervention in the Forex markets to boost the Japanese Yen (JPY) by Japanese authorities, keeps traders at bay, uncommitted to open fresh long bets that could send the AUD/JPY toward the -year-to-date (YTD) high if 100.17. The Relative Strength Index (RSI) depicts that buyers are in charge.

That said, the AUD/JPY first resistance level would be the Tenkan-Sen at 99.17, followed by the YTD high. A breach of the latter will expose the psychological 100.50 mark, followed by the 101.00 mark.

On the flip side, if sellers move in and push prices below the Kijun-Sen of 98.53, that can pave the way to test 98.00. Once surpassed, the next stop would be the 50-day moving average (DMA) at 97.87, ahead of testing the Ichimoku Cloud (Kumo) top at 97.80.

AUD/JPY Price Action – Daily Chart

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.