AUD/JPY Price Analysis: Sellers attack 11-week-old support line

- AUD/JPY stays depressed near two-week low after posting the heaviest declines since the early-June.

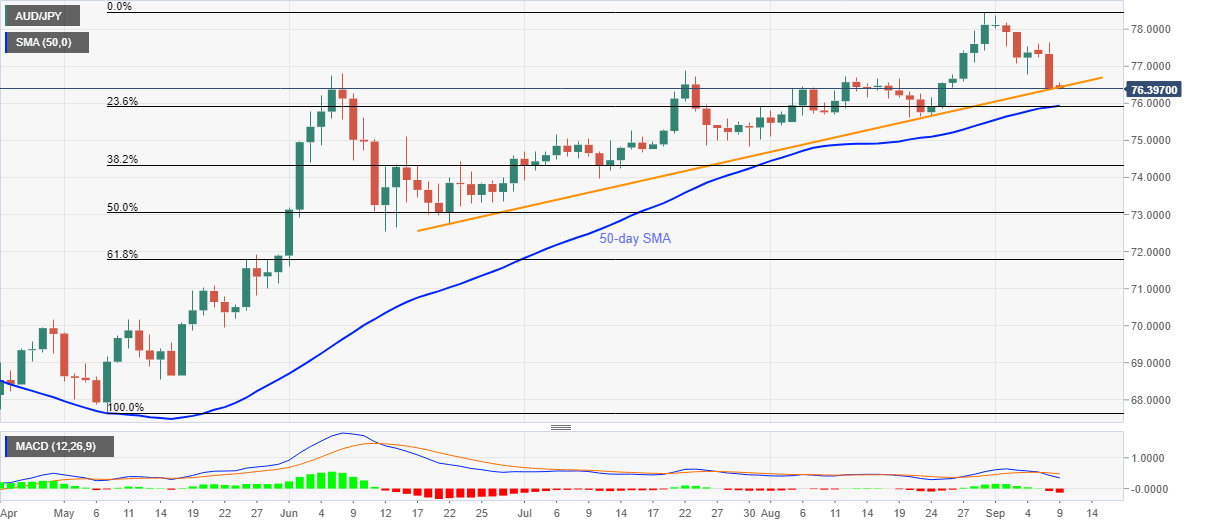

- A sustained break of support line will attack 50-day SMA, 23.6% of Fibonacci retracement.

- MACD extends the bearish signals flashed Tuesday, downside break of June month’s high also favor sellers.

AUD/JPY aptly portrays the market mood while dwindling near 76.40, the lowest since August 25, amid the early Wednesday morning in Asia. The quote marked the heaviest losses in three months the previous day to question the strength of an ascending support line from June 22.

Additionally, the pair’s sustained trading below June top, backed by bearish MACD, also suggests that the quote’s further weakness is on the cards.

However, a daily closing below 76.40 will be necessary for the sellers to aim for a 50-day SMA and 23.6% Fibonacci retracement of May-August upside, around 75.95/90.

During the additional south-run past-75.90, August 20 bottom close to 75.60 will precede the previous month’s trough surrounding 75.10 to grab the market attention.

Meanwhile, June month’s high near 76.80 acts as immediate resistance for the pair ahead of the weekly top near 77.60/65 and 78.00.

AUD/JPY daily chart

Trend: Bearish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.