ATVI Stock Forecast: Activision Blizzard closes the week higher as NASDAQ rebounds

- NASDAQ:ATVI gained 0.30% during Friday’s trading session.

- Some details emerge on Activision Blizzard’s existing intellectual property.

- Microsoft will need to deal with Activision Blizzard’s toxic culture.

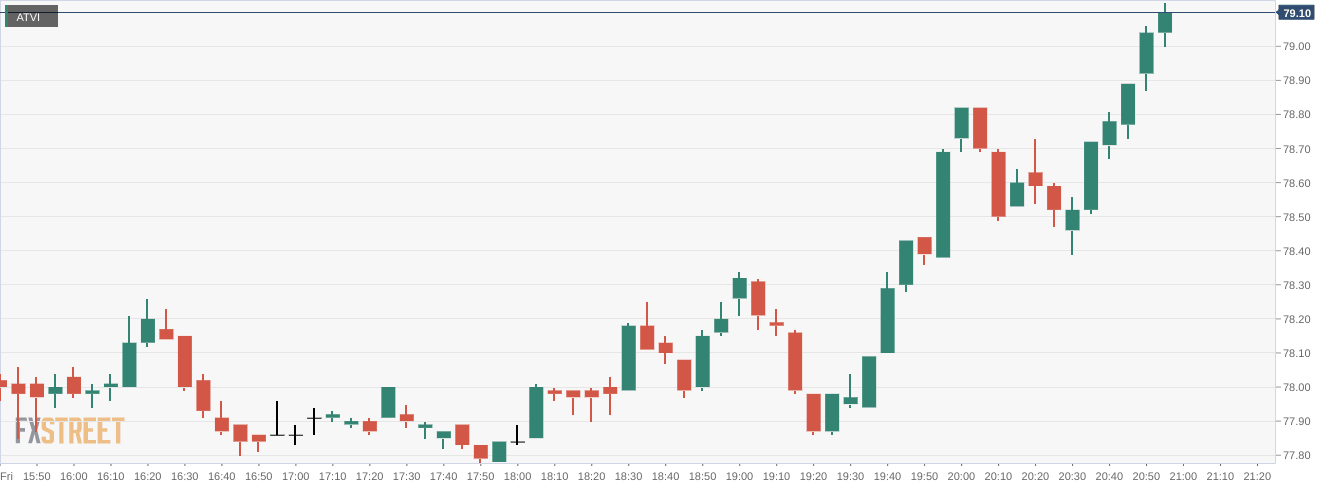

NASDAQ:ATVI closed the week on a positive note as investors continue to digest the company’s acquisition by Microsoft (NASDAQ:MSFT) ten days ago. On Friday, shares of ATVI gained 0.30% and edged higher to close the week at $79.14. Activision Blizzard still lagged the broader markets though as the NASDAQ bounced back in a big way, gaining 3.13% after a strong push into the closing bell. Microsoft added 2.81% on Friday as the tech giant saw momentum from a strong quarterly earnings call from Apple (NASDAQ:AAPL). Microsoft itself reported its results earlier this week, as mega-cap tech companies continue to shoulder the load for the broader markets.

Stay up to speed with hot stocks' news!

Some more details have emerged regarding what will happen with Activision Blizzard once it has been absorbed by Microsoft at some point in 2023. The brand’s flagship franchise, Call of Duty, will remain a multi-console game which means it will remain available to owners of Sony’s Playstation 5. Before the acquisition, Activision Blizzard had put an agreement into place that will see Call of Duty be released for the Playstation until at least 2024. What happened to the franchise following the expiration of that agreement has yet to be determined. So it seems that for the time being, none of the company’s premier intellectual property will be made into Xbox exclusives.

Activision stock news

Another issue that Microsoft will need to sort out is the ongoing allegations of a toxic work culture at Activision Blizzard. Several allegations of sexual harrassment and a frat boy culture led to mass firing of employees and even a protest by its workers. It is rumored that current Activision Blizzard CEO will leave once the merger is finalized. Microsoft was battling its own allegations last year when its founder Bill Gates was accused of having relations with a female employee. Gates left the Board of Directors for the company shortly thereafter.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet