Are we in a recession? Retail earnings preview: Costco, Dollar General, Dollar Tree, BIG

- Walmart and Target have spoken, and the market did not like it.

- Consumer spending is already being hit by inflation.

- Next week sees more retailers report earnings.

This week was shock and awe in terms of retail and consumer stocks. Traditionally viewed as a safe haven in times of market stress, Walmart (WMT) kicked things off with a downbeat outlook, but Target (TGT) really set investor fears on high alert with its clearly bearish outlook. Both companies reported declining margins as cost pressures ramped up. Even more worrying though was the noted shift in consumer demand to lower cost, lower margin items, meaning this could be a permanent trend. Lower margins mean lower profits for the retailers, and investors moved to immediately price in a likely recessionary outcome.

Next week is now interestingly teed up for a counter-trend rally. Retailers such as Costco (COST), Dollar General (DG), and Dollar Tree (DLTR) all report along with plenty of others in what is shaping up to be a key week to gauge the strength of the US consumer. Big Lots (BIG), Best Buy (BBY) and Williams Sonoma (WSM) complete the lineup. Our base case is the risk-reward is now favoring outperformance to the upside. We have no visibility on earnings (that would be insider trading!), but we do have a line of sight on investor sentiment and positioning. Both are now at extremely negative levels toward consumer stocks. Any positive surprises or even inline earnings will see relief rallies. Disappointment is already priced into retailer's share prices in our view. Costco stock is down 15% in the last two sessions, Dollar General is -11% for the same period, while DLTR stock dropped 15% on Wednesday. Williams Sonoma (WSM) is down 15%, and Best Buy (BBY) is down 13% this week. Certainly, things can get worse and likely will as inflation takes its toll, but the short-term risk reward is higher in our view.

Source: CNN.com

Costco Earnings Preview

Costco is expected to post EPS of $3.03 and revenue of $51.16 billion when it reports after the close on Thursday, May 26.

COST stock chart, daily

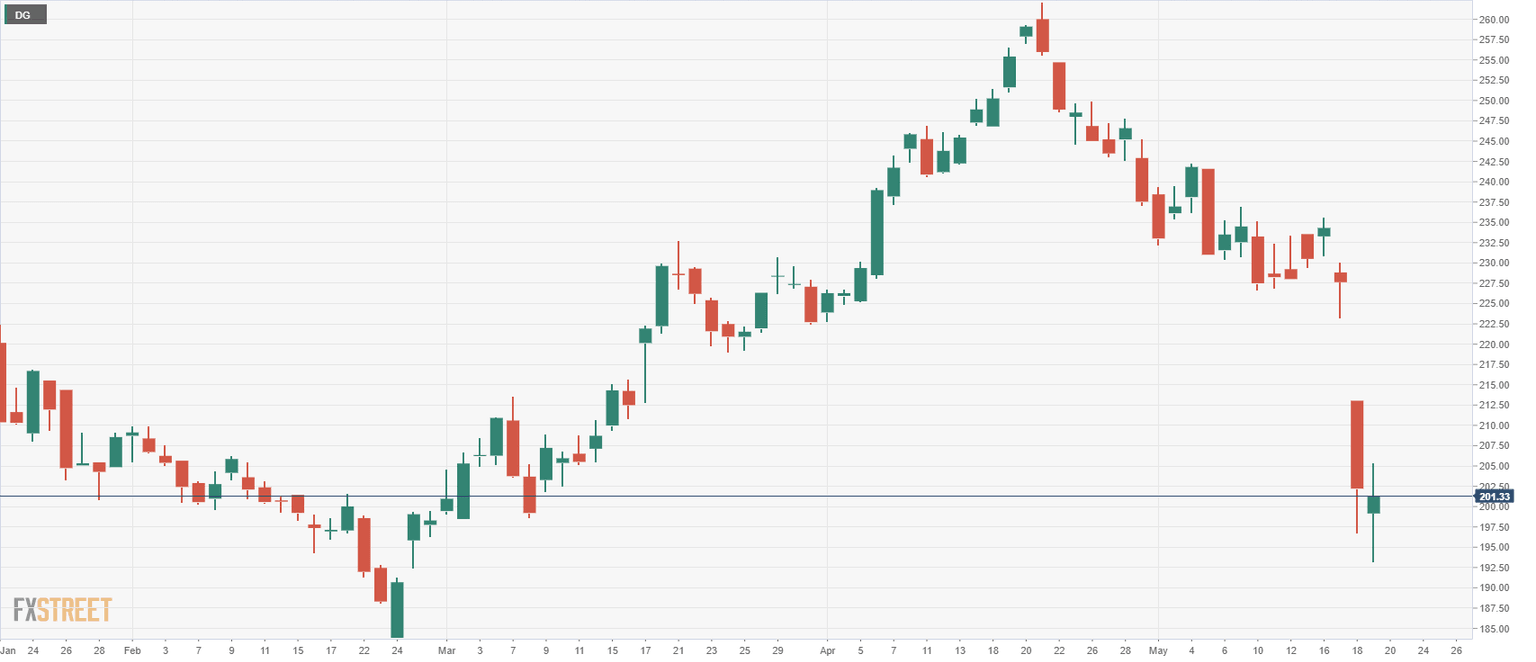

Dollar General Earnings Preview

Dollar General is expected to post EPS of $2.32 and revenue of $8.71 billion when it reports after the close on Thursday, May 26.

DG stock chart, daily

Dollar Tree Earnings Preview

Dollar Tree (DLTR) is expected to post EPS of $1.99 and revenue of $6.77 billion when it reports also on super Thursday, May 26. But Dollar Tree reports before the open.

DLTR stock chart, daily

Best Buy Earnings Preview

Best Buy will report on Tuesday, May 24, before the open. EPS is expected to be $1.59 on revenue of $10.456 billion.

Williams Sonoma Earnings Preview

Williams Sonoma (WSM) will release earnings on Wednesday, May 25, after the close. EPS is expected to come in at $2.88 and revenue at $1.81 billion.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.