Apple stock continues advance to 200-day moving average after Wednesday's $100 billion announcement

- Apple is the leading stock in the Dow Jones on Thursday, up 3%.

- Apple announced an additional $100 billion investment in US manufacturing on Wednesday.

- Wells Fargo argues that CEO Tim Cook is angling for a further tariff exemption.

- New Trump administration tariff on India has risen to 50%.

Apple (AAPL) stock advanced on Thursday morning as increased focus shifted to the consumer electronics maker seemingly trading an additional $100 billion manufacturing investment for tariff exemptions with the Trump administration. AAPL shares have led the Dow Jones Industrial Average's (DJIA) 30 components so far in the session.

After gaining an unusual 5% on Wednesday following the announcement, AAPL stock has risen another 3% to $220, a level it hasn't reached since early April.

The broader market is mixed on Thursday as Salesforce (CRM) and Caterpillar (CAT) lead the Dow Jones down 0.7% at the time of writing. The S&P 500 is trading sideways, and the NASDAQ has risen 0.4%. The market is starting to take stock of the Trump administration's tariffs that went into effect on Thursday morning.

Apple stock news

Apple's announcement on Wednesday that it would increase its initial $500 billion promise of US investment, announced in February, by $100 billion was made at the White House in the presence of President Donald Trump.

With a $245 price target on AAPL shares, Wells Fargo analyst Aaron Rakers argues in a client note that this is the point. The whole endeavor is simply a means of appeasing the king.

"Apple's announcement of an additional $100B investment in the US will (should) be viewed as more about posturing/a deal to minimize tariff impacts, i.e., companies committed to building in the US would be exempt from tariffs," said analysts led by Aaron Rakers.

That's important after Trump added an additional 25% tariff to India the day before most tariffs are set to take effect. India's new tariff rate is now 50% and is where Apple has begun moving plenty of its iPhone production to after reducing its reliance on China earlier this year.

Rakers noted that the announcement did not suggest that Apple would be moving iPhone production to the US but also viewed CEO Tim Cook and Trump's exchange as reason to expect another exemption as Apple obtained earlier this year.

While Trump has suggested he will place a 100% tariff on foreign-made semiconductors, "[T]he good news for companies like Apple is if you’re building in the United States or have committed to build, without question, committed to build in the United States, there will be no charge," Rakers wrote.

Apple said in a statement that it would be increasing its manufacturing and supplier partnerships via the American Manufacturing Partnership with companies including Corning (GLW), Coherent (COHR) GlobalWafers America, Applied Materials (AMAT), Texas Instruments (TXN), Samsung (SSNLF), GlobalFoundries (GFS), Amkor (AMKR) and Broadcom (AVGO). Apple said that all iPhones and Apples Watches would soon be made with Corning's glass manufactured in Kentucky.

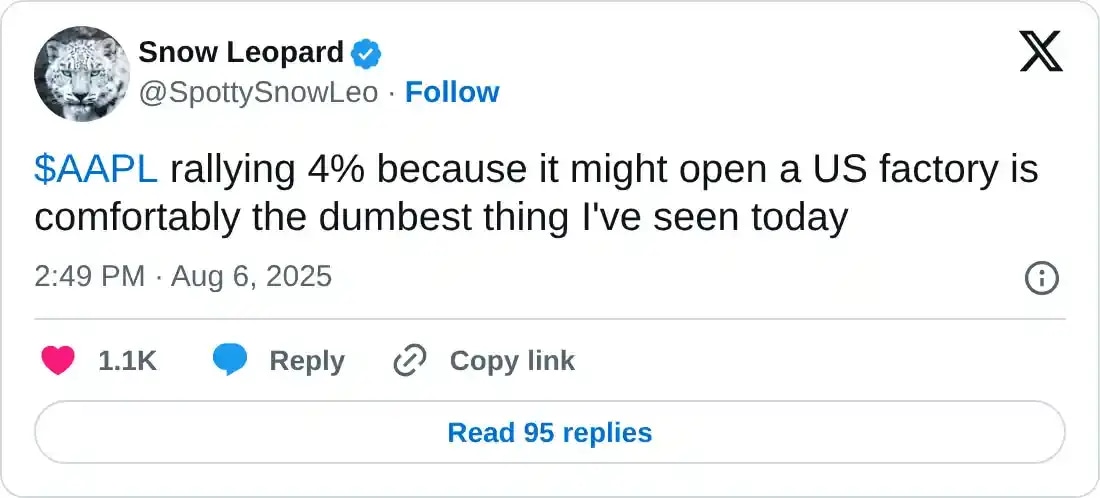

While shares have spent two sessions in rally mode, many critics of the announcement emerged, citing the extremely large figures being bandied about and why a probable reduction in operating margins would increase the share price.

Post on X.com from August 6, 2025

Others view the deal as a mirage that Apple wouldn't be able to pay for easily without taking on extreme levels of debt, rendering it an unlikely corporate prospect and more of a political strategy.

X.com post from August 7, 2025

Apple stock forecast

Apple stock traded back up to its 200-day Simple Moving Average (SMA) on Thursday, which should tell you in what state the share price is in. Apple has spent months moving decisively lower off its December 30, 2024 all-time high near $260.

While most other Mag7 stocks are making new all-time highs, Apple is being left behind as slower growth takes its toll on the company. Still, the present rally is a good sign, but AAPL will need to hold the 200-day SMA definitively before further upside is in the cards.

The 50-day and 100-day SMAs have coalesced near $206, and that gives AAPL stock a measure of nearby support in case of weakness. A further bout of bearish behavior would surely send Apple shares down to support near $196.

AAPL daily stock chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Clay Webster

FXStreet

Clay Webster grew up in the US outside Buffalo, New York and Lancaster, Pennsylvania. He began investing after college following the 2008 financial crisis.