Apple (AAPL) Stock Price and Forecast: Is it time to buy Apple?

- Apple stock falls heavily on Monday along with most others.

- Only airline stocks get a lift as stocks fall on Evergrande fears.

- AAPL stock has retraced to a key support level.

Is it time to buy the dip? After all, that has been the trade of 2021. Every time we think this time is different, this time it is for real, the market just snaps back again and keeps on pushing higher. This time the dip may be larger. With such a backdrop of loose monetary policy, pent-up demand strong earnings, and record buybacks it will be hard for bears to persevere. Speaking of loose monetary policy is one of the concerns of late as the Fed may talk taper this week, which would send equities into a further tailspin. No one really knows. All you can do is guess and try to manage the risk-reward, so the end result is in your account's favour. Apple stock fell 2% yesterday, pretty much in line with US indices in what was an ugly day. Given where stocks opened though, the remainder of the session was actually something of stabilisation. Predictions of doom will have to wait. A 2% fall from near-record highs would be acceptable to most portfolios. Apple did fall as the session wore on but rallied toward the close to limit losses to just over 2% on the day and close at $142.94.

Apple 15 min

Apple will get some preorder data for the new series of iPhones it launched last week at its product event day. Bank of America says this year is looking at slightly longer lead-in times for orders, possibly due to supply issues. Bank of America is forecasting iPhone sales to drop in 2022.

Apple key statistics

| Market Cap | $2.4 trillion |

| Enterprise Value | $2.3 trillion |

| Price/Earnings (P/E) | 29 |

|

Price/Book | 38 |

| Price/Sales | 9 |

| Gross Margin | 41% |

| Net Margin | 25% |

| EBITDA | $112 billion |

| 52 week low | $103.10 |

| 52 week high | $157.26 |

| Average Wall Street rating and price target |

Buy $166.7 |

Apple stock forecast

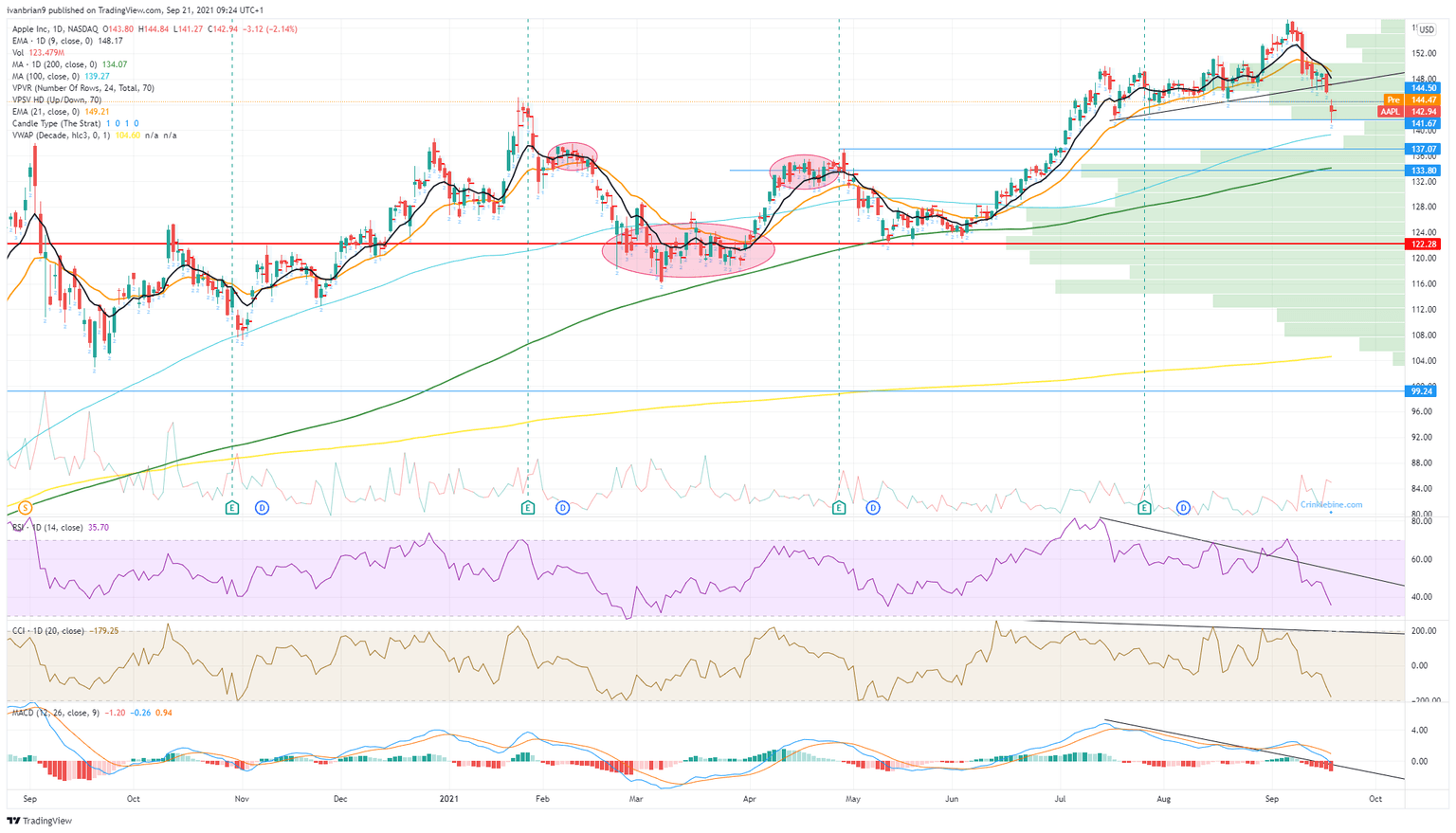

Here is the opportunity to buy the dip, but is it worth trying? We think so despite remaining neutral on the stock in the short term based on the technical picture. $141.67 is the last dip before Apple gets into a light volume zone, so then we wait for support at the $134 region. At $134 volume is strong and the 200-day moving average provides further support. Try buying a dip, but use a tight stop. The first target is the $146 zone as this fills the gap created by yesterday's open and the the 9-day moving average at $148.

FXStreet View: Neutral, bullish above $150, bearish below $141.67.

FXStreet Trade Ideas: Buy a dip around $141.67 with a tight stop as a break could be sharp. Next support at $134.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.

-637678091733795570.png&w=1536&q=95)