AMC Stock News: AMC Entertainment plunges on possible Cineworld bankruptcy

- NYSE: AMC fell by 6.58% during Friday’s trading session.

- Meme stocks plummet to close out another volatile week of trading.

- Cineworld shares fall by 60% as the company prepares for bankruptcy.

UPDATE: AMC stock has lost a whopping 39% to trade at $11 on Monday. It sure seems the meme rally of late summer is over. Last Friday fellow meme stock Bed Bad & Beyond (BBBY) lost 40% as well after two major shareholders dumped the stock that week. AMC's plunging share price today comes after Cineworld announced the possibility of filing a Chapter 11 bankruptcy in the US. In a statement to the London Stock Exchange, Cineworld wrote, "Cineworld and Regal theaters globally are open for business as usual and continue to welcome guests and members. The strategic options through which Cineworld may achieve its restructuring objectives include a possible voluntary Chapter 11 filing in the United States and associated ancillary proceedings in other jurisdictions as part of an orderly implementation process." AMC will distribute new preferred units under the ticker APE at the market close on Monday. The general perception among experts is that these APE preferred units will eventually convert into AMC common stock and thus dilute existing shareholders.

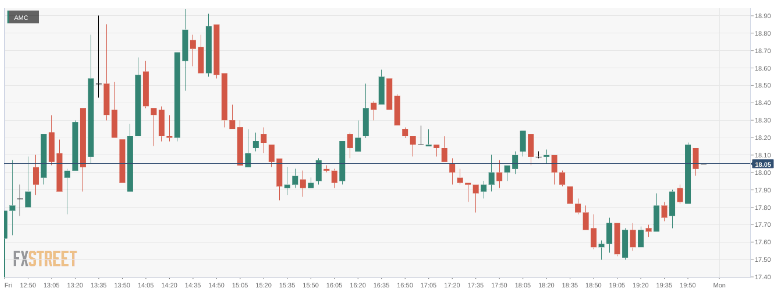

NYSE: AMC closed out the week with yet another decline as the movie theater chain amassed a 25% loss for the week. On Friday, shares of AMC dropped lower by 6.58% and closed the trading week at $18.02. Stocks fell lower on Friday as all three major averages had their worst showing of the week. Additional comments from the Fed on Friday put a damper on investors’ hopes for a turnaround on interest rate hikes. Overall, the Dow Jones dropped by 292 basis points, the S&P 500 fell by 1.29%, and the NASDAQ sank lower by 2.01% during the session.

Stay up to speed with hot stocks' news!

Can we say that the meme stock rally is officially over? After GameStop (NYSE: GME) Chairman Ryan Cohen sold his stake in BBBY on Thursday, shares of the stock tumbled by 40.54% on Friday to close the week. AMC and GameStop both fell in sympathy to Bed Bath and Beyond, as did FuboTV (NYSE: FUBO) which saw a further 8.81% loss. After being up by as much as 100% earlier in the week, shares of Bed Bath and Beyond closed out Friday’s session down by more than 26% over the past five trading sessions. This has been a prime example of the volatility involved in short squeezes.

AMC stock forecast

Shares of AMC rival Cineworld (LON: CINE) which trades on the London Stock Exchange had a bad to say the least. The stock fell by 58.27% on Friday as the company announced that it would be preparing for bankruptcy. With movie theaters struggling to regain pre-COVID popularity, shares of AMC also fell as a result.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet