Alibaba Stock News and Forecast: Why BABA stock keeps falling

- BABA shares have fallen sharply on fears over delisting.

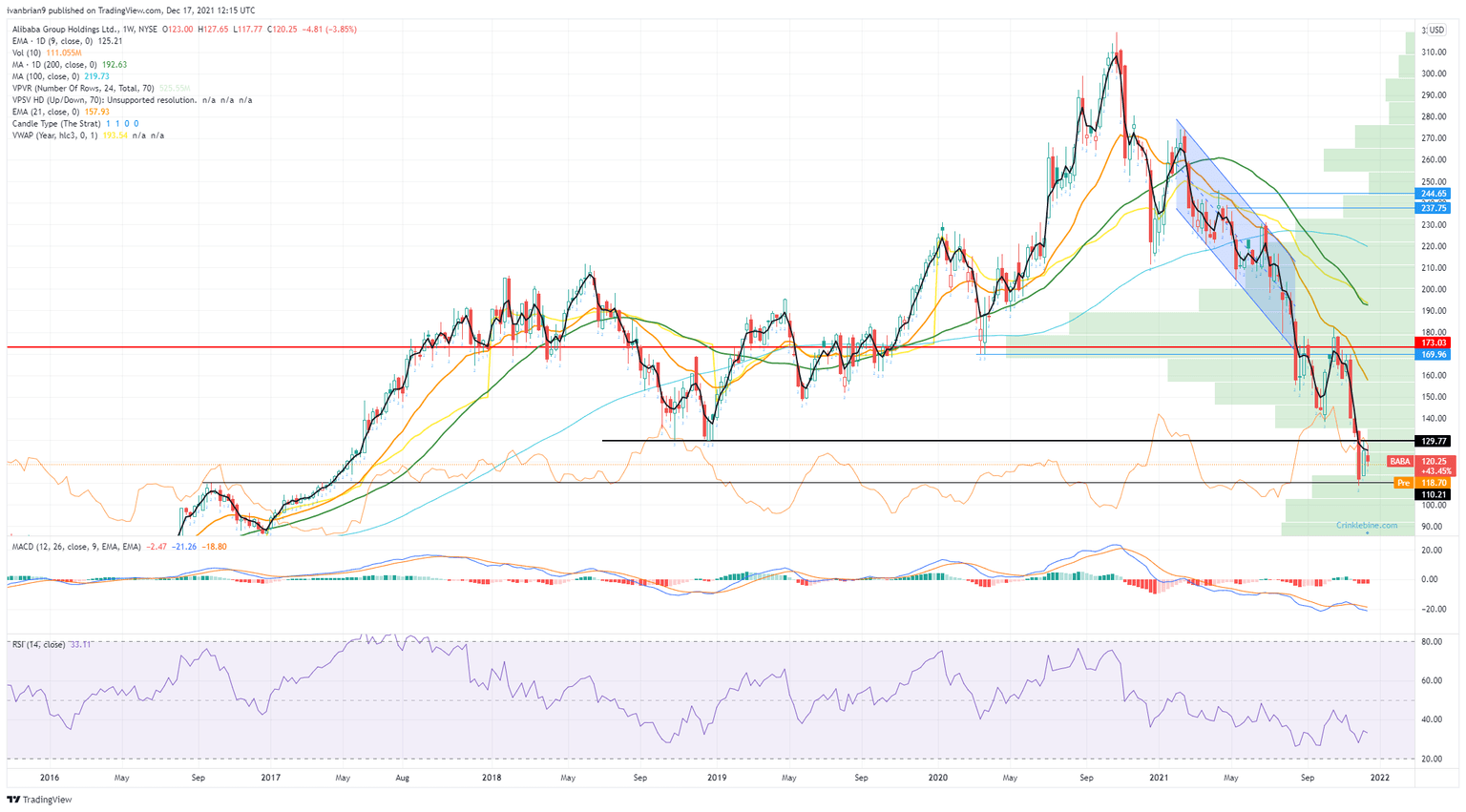

- Alibaba stock is now down at 5-year lows.

- $100 is the next major support as $110 is held for now.

Alibaba (BABA) continues to suffer from repeated selling pressure as the original Chinese tech stock suffers backlash effects. Alibaba can be said to have set off the whole Chinese regulatory crackdown. Alibaba was due to spin off its payment subsidiary ANT Group about 14 months ago. The deal fell through, however, after Alibaba CEO Jack Ma appeared to question the Chinese hierarchy. This was the catalyst for a reexamination by China of its burgeoning tech space.

Most notably, intense regulatory scrutiny focused on the huge amounts of data generated and stored by Chinese tech names. China saw this as a matter of concern over national security. DIDI was next in the crosshairs. It had IPO'd successfully in New York in early 2021. The stock had listed in New York in apparent defiance of Chinese officials. Once China set its sights on DIDI, panic soon ensued among Chinese tech investors, and BABA and others suffered contagion effects. The trend has been powerful with momentum completely vanishing. BABA shares are down 25% in the last three months, taking total losses for 2021 to 48%.

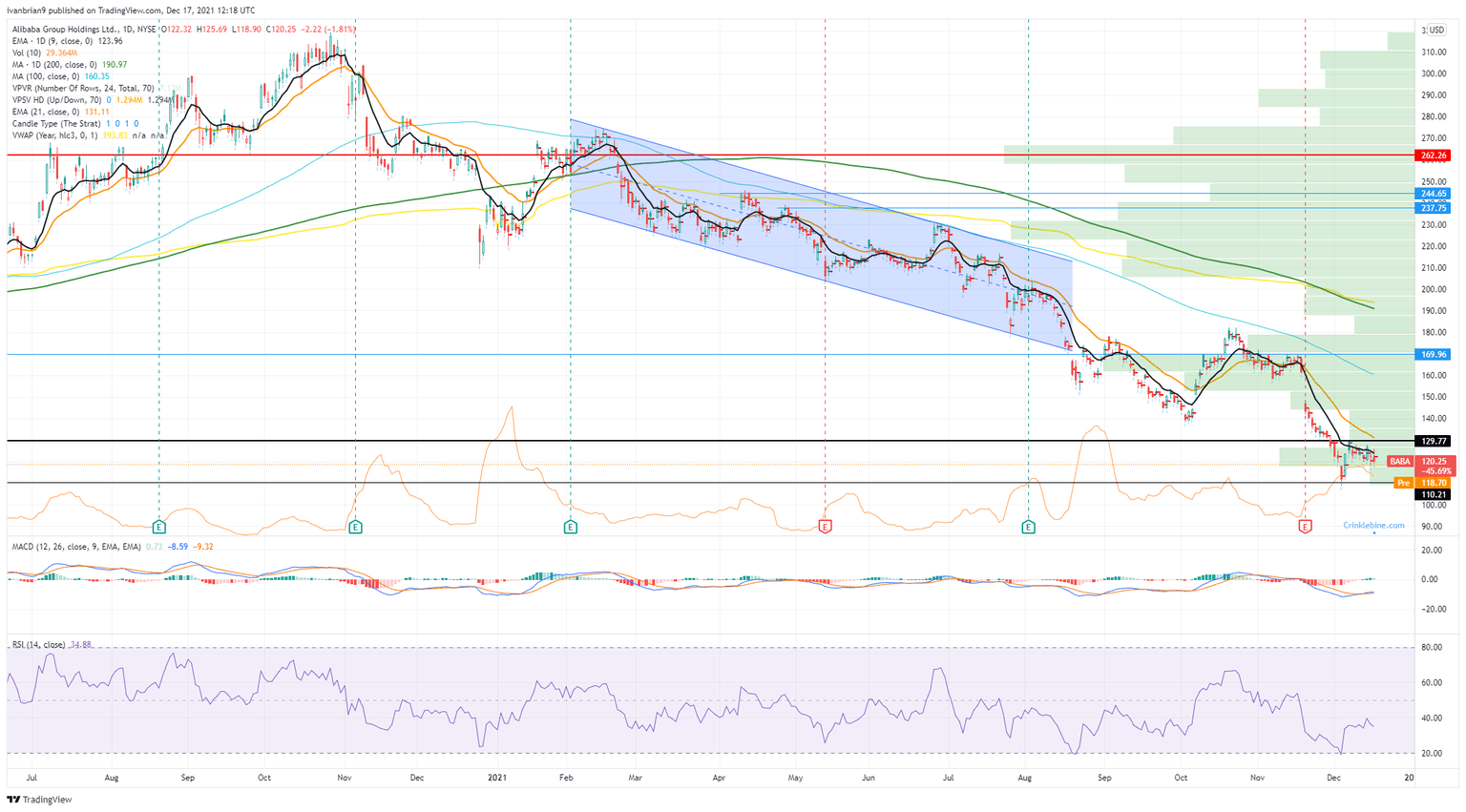

Alibaba (BABA) chart, daily

Alibaba (BABA) stock news

Alibaba was once known as the Chinese Amazon, and for good reason. The company is still highly profitable. Revenues have grown from $158 billion in 2017 to $717 billion in 2021. This represents a growth rate of nearly 50% from 2020. Despite this, the share price is down a similar amount as mentioned. Gross profit grew 30% to March 2021. Revenue continued to grow as the Chinese tech bubble burst. Revenue is forecast to remain strong, growing by 22% in 2022 and 17% for 2023 and 2024. Revenue will, if those targets are met, have grown to $1.2 trillion by 2024. This represents a near doubling from current levels.

Alibaba was hit with a heavy fine by the Chinese authorities after the ANT Group debacle. Investors had hoped the matter was finally settled, but the power of investor fear resurfaced once China restarted its scrutiny of US-listed names, this time with DIDI being the poster child. This fear is likely to remain elevated as Chinese and US tensions are unlikely to subside anytime soon. China is also not likely done with its crackdown and delisting plans for some of its tech names.

This presents opportunities and challenges. BABA may be overvalued fundamentally with strong revenue growth, but momentum and fear are powerful factors. More important is uncertainty. Markets hate uncertainty, and that is currently the main headwind for Alibaba and other Chinese tech names.

Alibaba (BABA) stock forecast

Breaking support at $130 has led to an obvious fascination with $100. Before that, there is a last chance saloon support at $110. This is the September 2016 high.

The daily chart has registered an oversold Relative Strength Index (RSI) reading. The Moving Average Convergence Divergence (MACD) has also crossed into bullish territory. A close above the 9-day moving average is needed to get short-term traders interested. Long-term players will need to see a move above $170. The short-term trend is bearish until the 9-day moving average is broken. The stock remains bullish in the short term on a break of $130 in our view. This is high risk, so please use stops.

BABA 1-day chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.

-637753388861440359.png&w=1536&q=95)