Alibaba (BABA) Stock Price and News: Breaks key support and $200 as DIDI weighs

- BABA shares slump on Thursday as DIDI concerns continue to hit.

- Crackdown on DIDI brings back deja vu for BABA shareholders.

- BABA shares have struggled since ANT Group IPO was cancelled in late 2020.

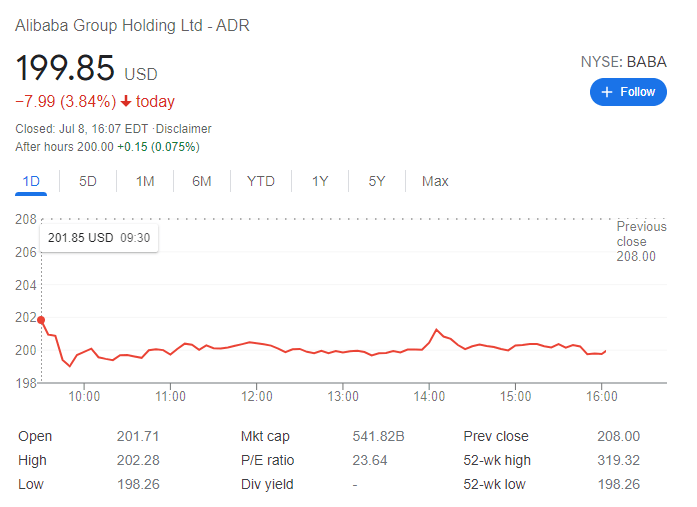

Update July 9: Shares in ALibaba slumped again on THursday as concerns from the DIDI case caused investors to rethink investment strategies in a number of Chinese and Chinese related stocks. BABA had been the subject of Chinese regulatory scrutiny earlier this year and that is still not resolved with its ANT group subsidiary. Thursday saw BABA slip below the support at $204.39 and break the psyschological $200. The shares closed at $199.85

Update July 7: Alibaba Group Holding Ltd - ADR (NYSE: BABA) closed Thursday in the red amid a prevalent risk-off mood. The share lost 3.92% on the day, settling at $199.85, not far above a daily low of $198.26. Demand for high-yielding assets plummeted on signs of slowing global growth. Speculative interest turned to government bonds, with the yield on the 10-year US Treasury note falling to 1.25%, its lowest since last February.

Previous update: Alibaba Group Holding Ltd - ADR (NYSE: BABA) has slipped below $211 on Wednesday, shedding another 0.5% in the fifth consecutive day of falls. The Hangzhou-based firm has been coming under immense pressure from investors worried about Chinese action against Didi. Regulators in Beijing removed the "Chinese Uber" from application stores in the world's second-largest economy. Earlier, Alibaba's founder Jack Ma disappeared from public sight after criticizing authorities. Markets are worried that Beijing would tighten its screws against influential private companies if they stray away from the party line.

Alibaba (BABA) is back with unwanted attention as Chinese shares bear the brunt of further scrutiny by Chinese regulatory authorities. This time recently IPO'ed DiDi Global (DIDI) is in the spotlight as China's Cyberspace Administration takes a closer look at the company with a focus on its data handling practices. China has pulled DIDI's app from app stores with DIDI saying this will hurt revenue (see more).

"Once the 'DiDi Chuxing' app is taken down from app stores in China, the app can no longer be downloaded in China, although existing users who had previously downloaded and installed the app on their phones prior to the takedown may continue using it," the company said in a press statement.

This all brings back a sense of deja vu for BABA investors as its IPO spin-off of ANT Group was pulled at the last minute as China had concerns over the firm, which were not helped when Jack Ma appeared publicly critical of the Chinese administration. The situation is still not resolved. The Wall Street Journal reported on June 23 that ANT Group was in discussion with Chinese state-owned enterprises to form a credit scoring company so that ANT Group's data was under Chinese regulatory control. Again China was concerned with the huge amount of data ANT Group would generate on Chinese users and a similar story is emerging with DIDI as it too produces huge amounts of user data. Either way it has spooked investors with DIDI dropping nearly 25% at one stage in Tuesday's premarket and most other Chinese names falling even if they are not directly affected.

Alibaba (BABA) key statistics

| Market Cap | $592 billion |

| Price/Earnings | 27 |

| Price/Sales | 5.7 |

| Price/Book | 4 |

| Enterprise Value | $579 billion |

| Gross Margin | 0.43 |

| Net Margin |

0.21 |

| Average Wall Street Rating and Price Target | Buy $294 |

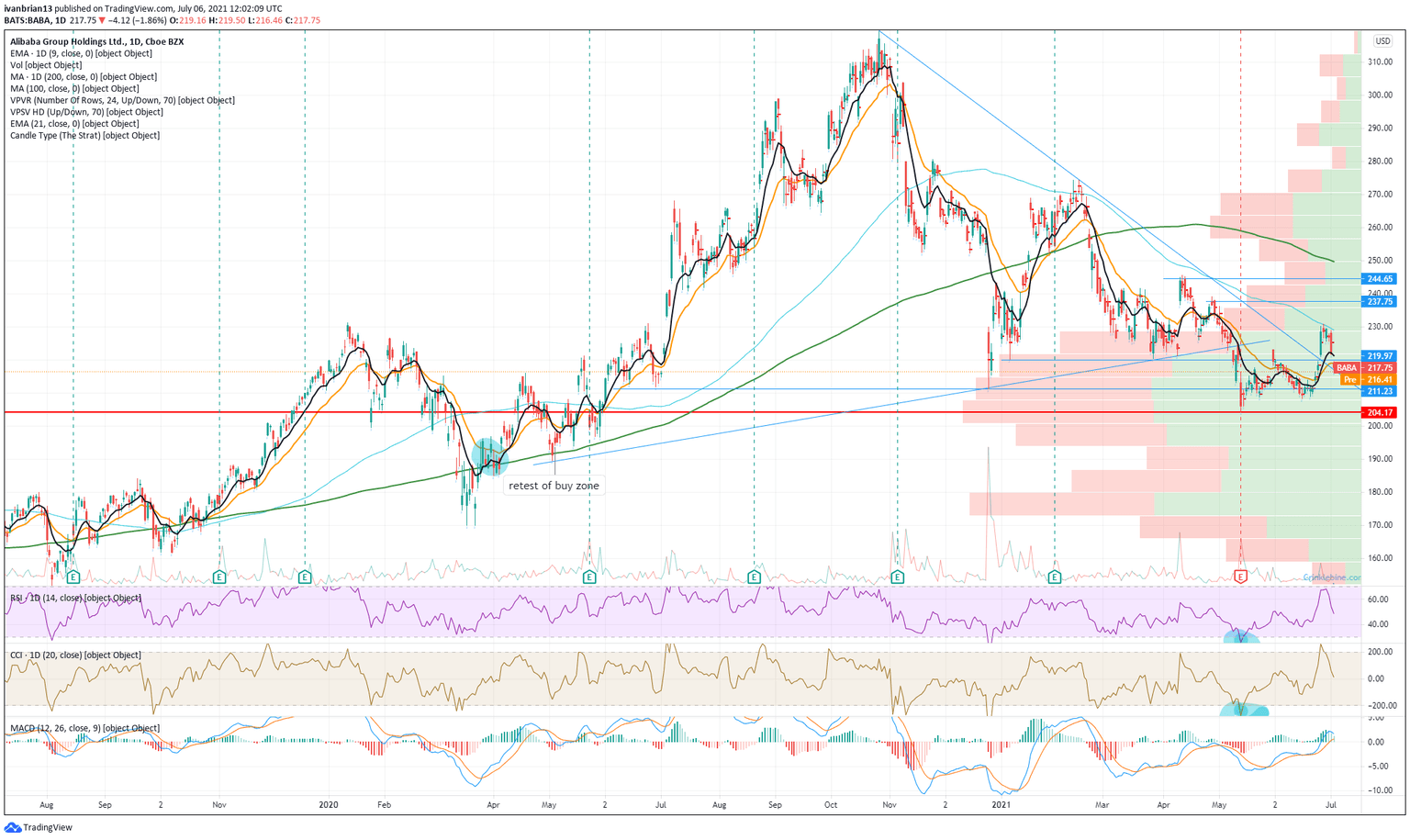

BABA stock forecast

BABA had finally broken out of the long-term downtrend line on June 25, but now this is beginning to look questionable. The 9 and 21-day moving averages have been broken and now BABA stock has retraced to the trend line at $215. There is some hope here as this is a strong support zone on the volume profile with the point of control at $213.87. The point of control is the price at which the highest amount of volume was transacted. From here until $200 is a relatively strong support zone, but a break below would bring a test of lows at $170 from March 2020 into target.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.