3 under-the-radar stocks that are primed to become e-commerce leaders: PlantX, Revolve, Coupang

The pandemic was a boon for the e-commerce industry due to social distancing measures and mobility restrictions. However, according to the Mastercard SpendingPulse report, e-commerce spending is down 1.8% YoY, while in-store sales are up 10%. As a result, major e-commerce stocks have dropped this week. After two years of unpredictability and atypical growth patterns, the slowdown in spending was expected, mostly owing to inflation, which is causing customers to cut back on some purchases to afford the necessities. Furthermore, buyers are also saving up to spend on travel.

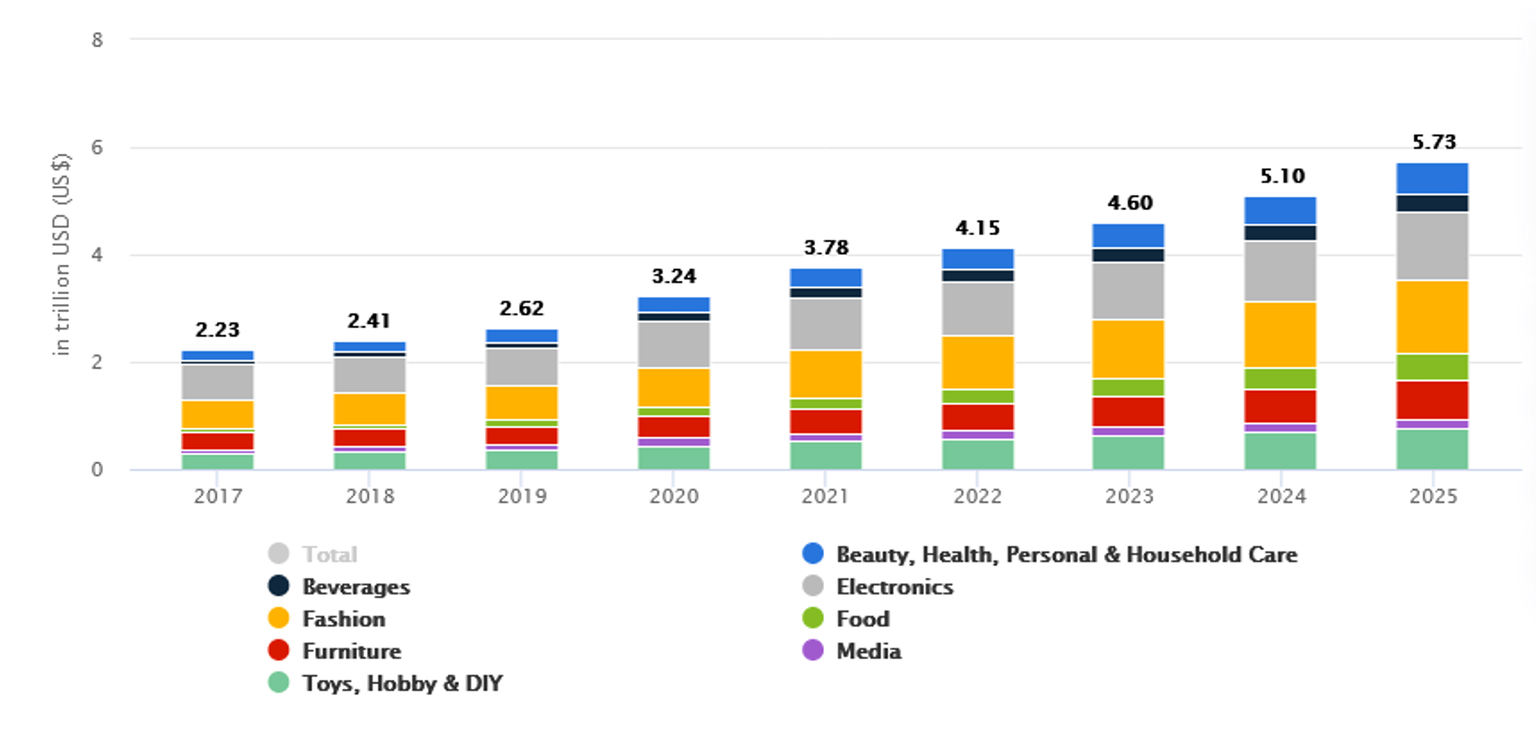

While investors may be concerned that growth will slow and hurt the profitability of e-commerce companies, overall new spending is projected to be massive. According to Statista, revenue in the e-commerce market is expected to reach $4.15 trillion in 2022 and $5.73 trillion in 2025, rising at a CAGR of 11.35% between 2022 and 2025.

Worldwide e-commerce revenue

Source: Statista

The pandemic has resulted in a long-term change in consumer buying behavior. The simplicity and convenience of online buying will continue to drive industry growth. Here are three of the best stocks to buy right now that will gain from long-term e-commerce spending increases.

PlantX Life Inc. (CSE: VEGA) (Frankfurt: WNT1) (OTCQB: PLTXF)

PlantX is the Amazon of the plant-based/health food/vegan community, which is capitalizing on the massive growth potential of the industry. The company currently offers over 5,000 vegan products, as well as meal and indoor plant delivery services. On April 19, the company announced that it generated $1.7 million in monthly gross revenue in March 2022, a 28% increase over February 2022. To grow its customer base, the company has formed partnerships with celebrity chefs, and well-known vegan brands. PlantX is leveraging the growing e-commerce market to offer high-quality items to the plant-based community. Its products can be found on thebay.com, amazon.com, walmart.com, and walmart.ca. The company is becoming a go-to plant-based brand with a growing customer base, and as it expands its online presence, there will be more lucrative opportunities in the future. PlantX stock currently seems undervalued, and it seems to be a good time to invest in the company to gain exposure to the plant-based market.

Revolve Group, Inc. (RVLV)

Revolve Group is an online fashion retailer that caters to Millennials and Generation Z. REVOLVE and FWRD are the two retail segments of the company that sells a combination of third-party, iconic luxury brands, and owned brands. The platform includes beauty items, shoes, and accessories in addition to clothing for events such as festivals, weddings, and other social occasions. Although 2020 was a massive growth year for many online retailers, Revolve faced a significant headwind due to the cancellation of major social events. But with pandemic restrictions easing, the company is once again experiencing stellar growth.

Revenue of the company increased 58% to $283 million in Q1 2022, while net income increased 1% to $22.5 million, aided by an increase in active customers. The number of active customers increased by 38% YoY to 2 million. This robust growth trend has continued into the second quarter of 2022 as well, with net sales increasing by more than 30% in April 2022. As core customers prepare for summer travel, the company expects the second quarter to be the most profitable of the year. The return of the largest U.S. music festival, Coachella, last month, where REVOLVE Festival also took place for the first time in three years, also contributed to sales growth. With the return of festivals and social events, Revolve's growth could accelerate even further in the coming quarters.

Coupang, Inc (CPNG)

Coupang is a South Korean e-commerce company popularly known as "South Korea's Amazon.” The company offers services such as same-day and next-day grocery and general products delivery, Coupang Eats meal delivery, and Coupang Play video streaming. The company also serves other markets including Beijing, Los Angeles, Seattle, Seoul, Singapore, Shanghai, Silicon Valley, Taipei, and Tokyo. Coupang is the biggest online marketplace in South Korea and about 70% of Korean residents live within seven miles of a logistics center allowing the company to offer same-day, next-day, or dawn delivery for almost all orders. Coupang's net sales increased by 54% to $18.4 billion in 2021, with active consumers reaching 18 million by the end of the year. In the fourth quarter of 2021, Coupang's revenue per active customer increased by 11% YoY, from $256 to $283.

Coupang's large footprint in Korea, together with an incredibly strong brand name and high customer satisfaction, makes it exceptional. Coupang is growing fast, and its shares are trading at a cheap price-to-sales ratio, suggesting that it could be a good long-term investment.

Conclusion

E-commerce is slowly becoming the primary method for consumers to order things today. Some regions have yet to fully embrace e-commerce for their retail needs, but the trend is slowly but surely turning in favor of online shopping in almost all regions of the world. This is good news for both established and young players in the global e-commerce industry.

Author

Max Golderstein

Independent Analyst

Max Golderstein is a veteran analyst and writer. His areas of research focus on Pharma, FoodTech, Cannabis, Cyber and Blockchain.