Financial market instability, persistent inflation and geopolitical uncertainties are prompting more and more investors to seek solid safe havens. In this climate, Gold is regaining its relevance, not only as a hedge against systemic risks, but also as a strategic tool for building long-term wealth.

This trend is particularly marked among millennials, who are showing a growing appetite for Gold as part of their retirement planning, including the integration of the yellow metal into individual retirement accounts, and more specifically, Gold IRAs, which are becoming more popular.

Understanding how a Gold IRA works

A Gold IRA, or Gold-backed Individual Retirement Account, is a self-directed individual retirement account for the purchase of physical precious metals (mainly Gold, but also Silver, Platinum or Palladium).

Unlike traditional IRAs, these accounts offer real portfolio diversification through tangible assets, while retaining the tax advantages specific to pensions, whether deferred (traditional IRA) or exempt (Roth IRA).

Metals must be stored in secure, IRS-approved repositories, and are managed by specialized custodians.

Unlike traditional employer-sponsored 401(k) plans, the Gold IRA offers more flexibility in asset selection, allowing direct exposure to physical Gold or its listed equivalents.

Millennials, the new Gold champions

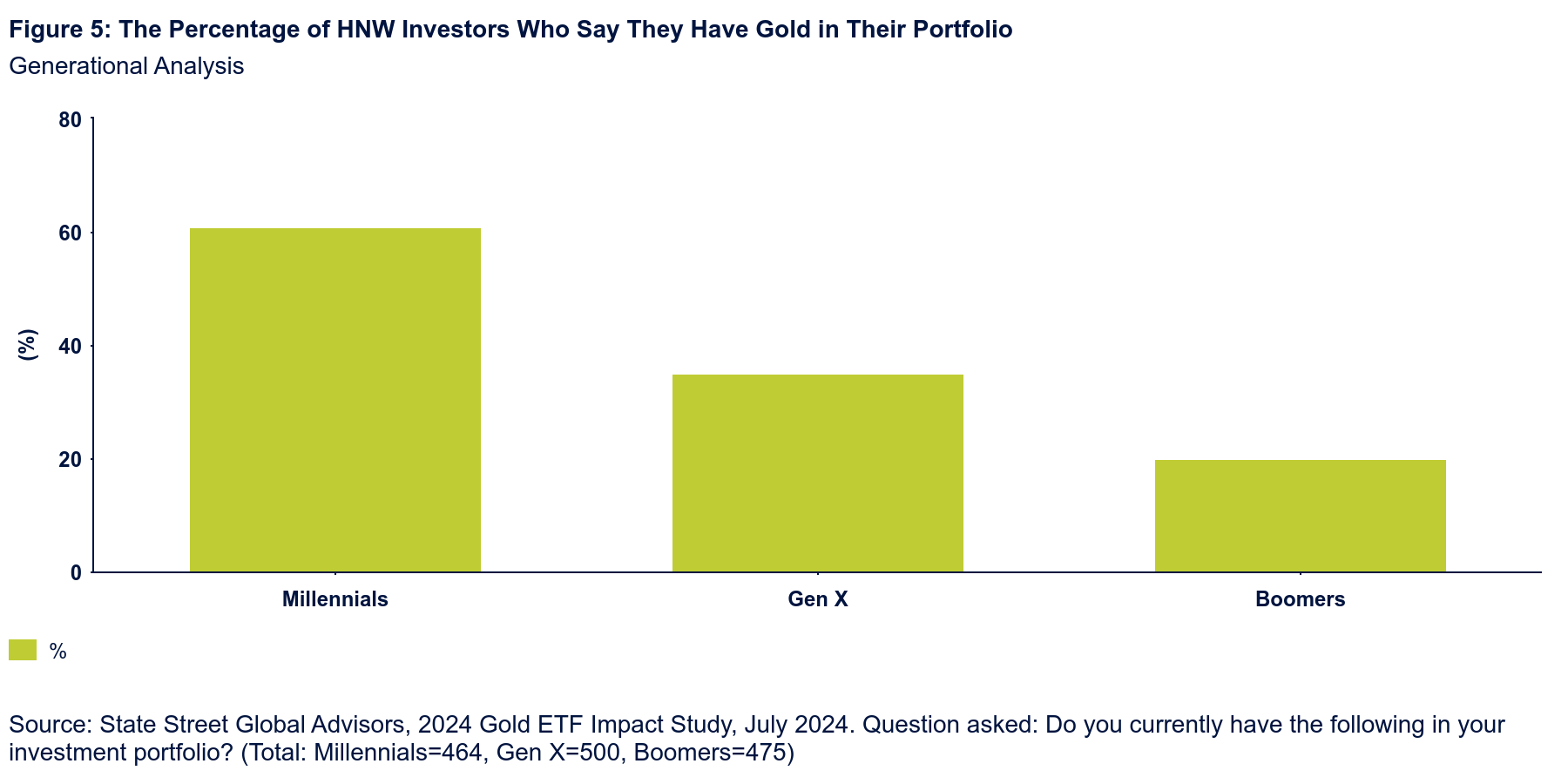

Data from the State Street Global Advisors Research Center's 2024 Gold ETF Impact Study is unequivocal: millennials now dominate Gold ownership among affluent generations.

Over 60% of millennials say they hold Gold in their portfolios, compared to just 35% of Gen Xers and 20% of baby boomers.

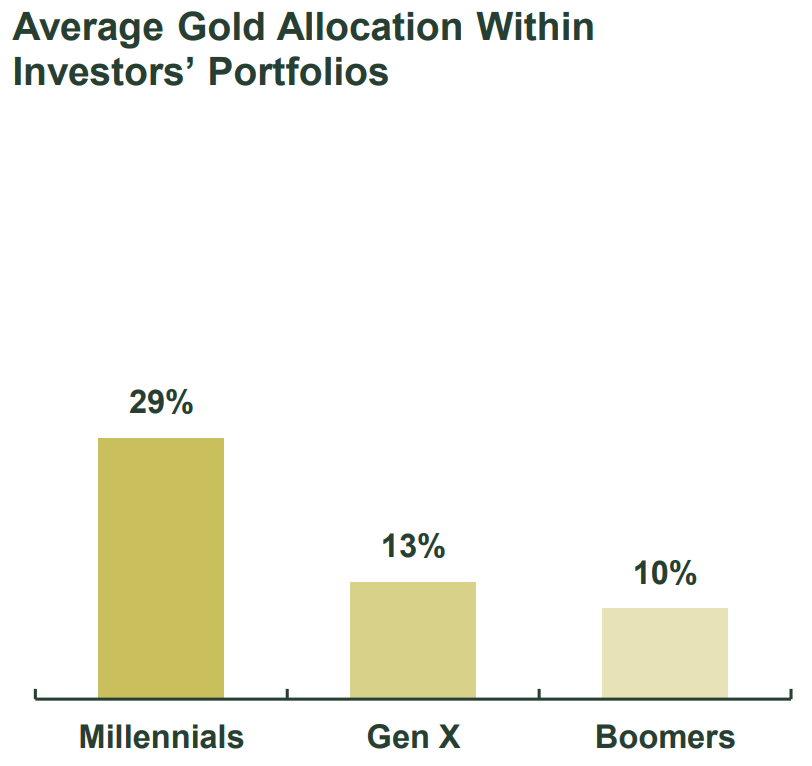

Their average allocation is 29%, up sharply from 17% in 2023. This interest is not a passing fad, but a conscious strategy to protect and grow their assets.

Source: State Street Global Advisors

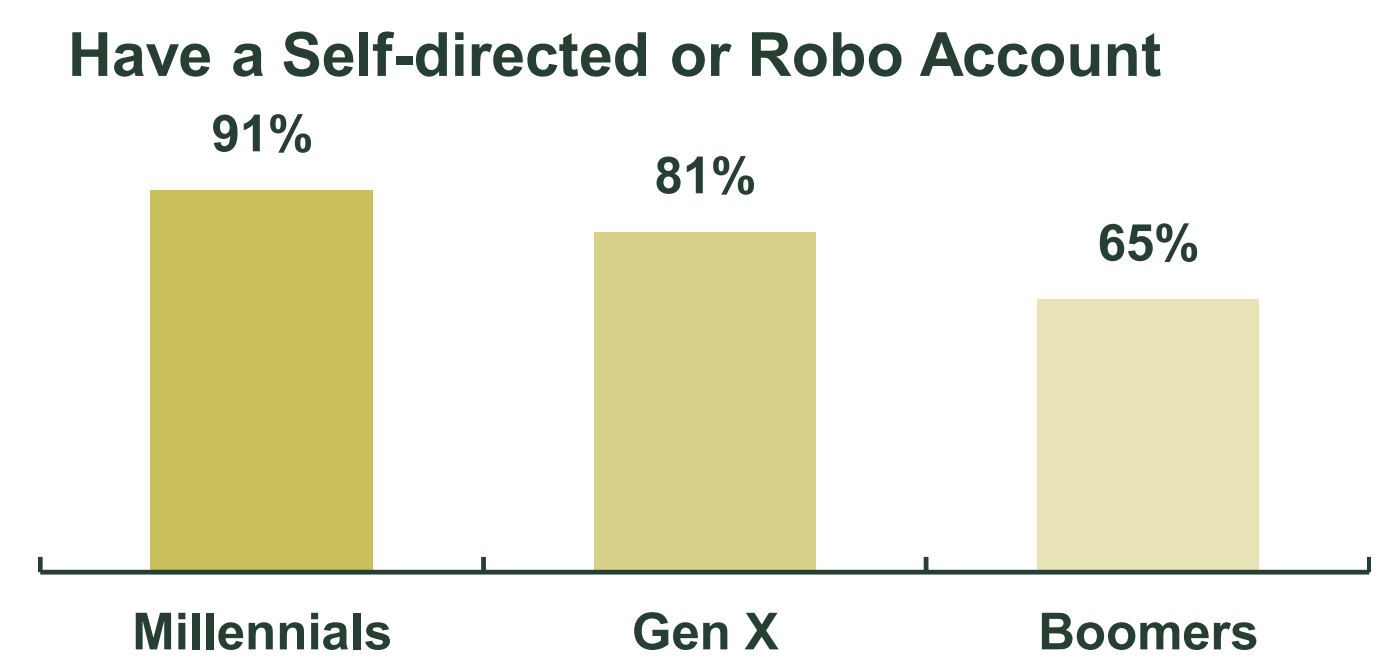

The profile of millennial investors confirms this strategic orientation: they are more highly educated than their elders, make massive use of online wealth management platforms, and don't hesitate to steer their investments themselves.

Source: State Street Global Advisors

Their adoption of the Gold IRA is in line with their desire for financial autonomy and greater control over their future. Many of them use self-managed Roth IRAs, in which they integrate Gold ETFs to combine ease of management with tax efficiency.

The key role of financial advisors

The success of Gold IRAs with millennials cannot be understood without the active role played by financial advisors.

The study shows that over 90% of millennials who have invested in Gold have discussed this choice with an advisor. The latter widely recommend Gold-backed ETFs, perceived as more accessible, more liquid and better suited to the diversification objectives of modern portfolios.

These exchanges reinforce financial education and facilitate decision-making among young investors.

Gold ETFs for diversification

Gold ETFs, listed financial products that replicate the price of Gold, are emerging as the most popular form of access to Gold for millennials.

Nearly half of wealthy young investors hold them, appreciating their low cost, tax advantages and compatibility with Roth IRAs.

According to the study, 84% of Gold ETF holders believe that these products have improved the overall performance of their portfolios. This finding reinforces their status as a pillar of modern retirement planning.

Roth IRA, a pillar of tax-optimized retirement

In addition to the security offered by Gold as a tangible asset, millennials are taking full advantage of the Roth IRA's tax benefits.

By investing income that is already taxed, they ensure tax-free withdrawals at retirement. This strategy is particularly well-suited to a generation that anticipates increasing tax pressure in the decades ahead.

By combining Gold ETFs and Roth IRAs, they aim to build robust, diversified and tax-efficient retirement planning.

For many millennials, the Gold IRA now complements a 401(k), bringing a dimension of security and diversification that traditional investments don't always offer.

Towards widespread adoption of Gold IRAs?

The signals are clear: the behavior of millennials could well inspire the entire market. As Gold's performance continues to make headlines and global demand remains buoyant, more and more investors, including those in middle-income brackets, are taking an interest in Gold IRAs.

Expanding the investor base could be facilitated by better financial education, particularly on the benefits of ETFs.

Millennials mark a clear break with the investment habits of previous generations. By including Gold in their Roth IRAs via ETFs, they combine tradition and modernity, security and performance, prudence and anticipation.

Their structured, well-informed approach offers a new reading of retirement planning, in which Gold regains its relevance as a foundation of stability. Far from being a simple return to a safe-haven asset, this 2025 version of the Gold rush is, above all, a generational strategy.

Gold Market Movers: Recovery extends to $3,350 on broad USD weakness

Gold price chart. Source: FXStreet.

US President Donald Trump expressed frustration over stalled US-Japan trade negotiations and also threatened to raise tariffs on certain countries as his July 9 deadline approaches. Adding to this, White House spokesperson Karoline Leavitt said that Trump would meet with his trade team to set tariff rates for countries if they don't come to the table to negotiate in good faith.

Meanwhile, US Treasury Secretary Scott Bessent warned that countries could be notified that tariff rates are scheduled to rise sharply from a temporary 10% level to rates of 11% to 50% announced on April 2. This, in turn, drives some safe-haven flows during the Asian session on Tuesday and assists the Gold price to build on the overnight goodish recovery move.

Trump steps up his pressure campaign on Federal Reserve Chair Jerome Powell to lower borrowing costs in a handwritten note on Monday. This comes after the US Personal Consumption Expenditures (PCE) report showed on Friday that consumer spending unexpectedly declined in May and keeps the door open for further monetary policy easing by the central bank.

The markets are currently pricing in a smaller chance that the next rate reduction by the Fed will come in July and see a roughly 74% probability of a rate cut as soon as September. This, along with concerns about the worsening US fiscal condition, drags the US Dollar to its lowest level since February 2022 on Tuesday and lends additional support to the XAU/USD pair.

The Senate narrowly approved a procedural vote to open debate on Trump’s comprehensive “One Big Beautiful Bill,” which would add approximately $3.3 trillion to the federal deficit over the next decade. This should keep the USD on the defensive ahead of this week's key US macro releases and support prospects for a further appreciating move for the commodity.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD looks sidelined around 1.1850

EUR/USD remains on the back foot, extending its bearish tone and sliding towards the 1.1850 area to print fresh daily lows on Monday. The move lower comes as the US Dollar gathers modest traction, with thin liquidity and subdued volatility amplifying price swings amid the US market holiday.

GBP/USD flirts with daily lows near 1.3630

GBP/USD has quickly given back Friday’s solid gains, turning lower at the start of the week and drifting back towards the 1.3630 area. The focus now shifts squarely to Tuesday’s UK labour market report, which is likely to keep the quid firmly in the spotlight and could set the tone for Cable’s next move.

Gold loses momentum, eases below $5,000

Gold is giving back part of Friday’s sharp rebound, deflating below the key $5,000 mark per troy ounce as the new week gets underway. Modest gains in the US Dollar are keeping the metal in check, while thin trading conditions, due to the Presidents Day holiday in the US, are adding to the choppy and hesitant tone across markets.

Bitcoin consolidates as on-chain data show mixed signals

Bitcoin price has consolidated between $65,700 and $72,000 over the past nine days, with no clear directional bias. US-listed spot ETFs recorded a $359.91 million weekly outflow, marking the fourth consecutive week of withdrawals.

The week ahead: Key inflation readings and why the AI trade could be overdone

It is likely to be a quiet start to the week, with US markets closed on Monday for Presidents Day. European markets are higher across the board and gold is clinging to the $5,000 level after the tamer than expected CPI report in the US reduced haven flows to precious metals.

FedEx (FDX) outpaces stock market gains: What you should know

FedEx (FDX) ended the recent trading session at $374.72, demonstrating a +1.42% change from the preceding day's closing price. The stock outpaced the S&P 500's daily gain of 0.05%. On the other hand, the Dow registered a gain of 0.1%, and the technology-centric Nasdaq decreased by 0.22%.