Amid an electric political climate in Washington, US Bond markets are showing surprising stability. As US President Donald Trump stepped up the pressure on the Federal Reserve (Fed) and investors tried to decipher the implications of this institutional offensive, Treasury yields did not panic. A performance that both questions and reassures.

A market under stress, but not in crisis

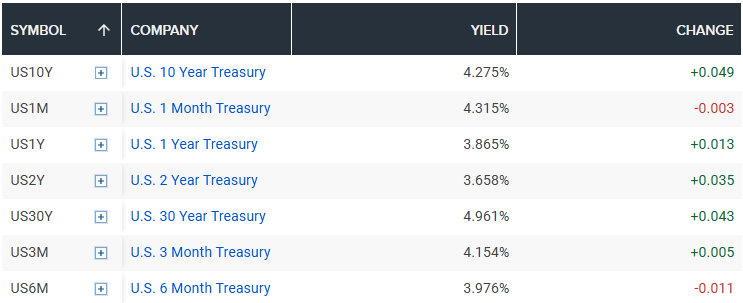

On Tuesday, the 30-year Treasury yield briefly approached 5%, before easing back to 4.96%. The 10-year, the global benchmark, hovers around 4.27%, down from 4.3% earlier today. The 2-year points to 3.65%, widening the gap with the 10-year to its widest since April, noted CNBC.

Source: CNBC

These adjustments show that volatility is under control. Investors are reacting to political events, but without triggering a mass exodus.

Trump and the Fed: A high-risk showdown

The tension stems from a spectacular gesture, US President Donald Trump announcing that he was sacking Lisa Cook, Fed Governor and respected figure on the Federal Open Market Committee (FOMC).

Legally questionable, this decision could trigger a legal battle, as Cook has already announced her intention to sue.

For the markets, the stakes are broader. President Trump wants to place a majority of his allies on the Board of Governors in order to steer short-term interest rates.

The idea of a Federal Reserve under political influence raises fears of a forced cut in key interest rates, to the detriment of the fight against inflation. In this scenario, long yields would rise, reflecting an increased risk premium on US debt.

An intriguing resilience

Despite these threats, the US Bond market remains resilient. Several factors explain this resilience:

- Treasury Bonds remain the ultimate safe-haven asset, even when domestic politics become tense.

- Global investors are still anticipating gradual disinflation, which is holding back the rise in yields.

- Finally, the prospect of an economic slowdown in the United States encourages investors to secure their portfolios by favouring sovereign debt.

The paradox is therefore as follows: The more uncertain the political situation, the stronger the demand for US debt, supporting prices and keeping Treasury yields under control.

The spectre of September

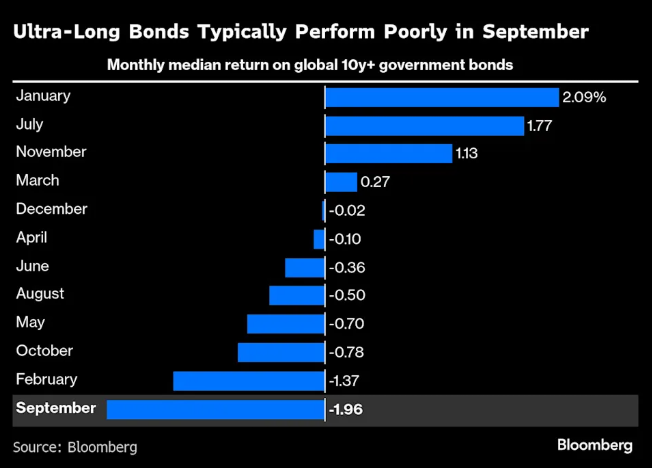

However, history reminds us that the current serenity may only be temporary. September is traditionally a difficult month for long-dated Bonds, notes Bloomberg, due to a surge in issuance and a repositioning of investors.

This year, the equation is even more complex. Rising budget deficits, stubborn inflation, international tensions and uncertainty over the next Federal Reserve meeting scheduled for mid-September.

If all these elements come together, the stability seen in recent days could be shattered. Some strategists see a risk of a "vicious circle": Rising public debt would push yields higher, exacerbating the fiscal burden and reinforcing investors' doubts.

Cautious vigilance

For the time being, the official line remains that of Treasury Secretary Scott Bessent: "The Bond market is calm", he asserted.

But behind this façade, operators know that the balance is fragile. The confrontation between Donald Trump and the Federal Reserve could permanently alter the perception of American risk, the beating heart of the global financial system.

In the meantime, Treasury yields remain the markets' compass, oscillating steadily but under constant tension. A deceptive lull that could, at the slightest political or economic misstep, give way to a new phase of turbulence.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD: Yes, the US economy is resilient – No, that won’t save the US Dollar Premium

Some impressive US data should have resulted in a much stronger USD. Well, it didn’t happen. The EUR/USD pair closed a third consecutive week little changed, a handful of pips above the 1.1800 mark.

Gold: Metals remain vulnerable to broad market mood Premium

Gold (XAU/USD) started the week on a bullish note and climbed above $5,000 before declining sharply and erasing its weekly gains on Thursday, only to recover heading into the weekend.

GBP/USD: Pound Sterling remains below 1.3700 ahead of UK inflation test Premium

The Pound Sterling (GBP) failed to resist at higher levels against the US Dollar (USD), but buyers held their ground amid a US data-busy blockbuster week.

Bitcoin: BTC bears aren’t done yet

Bitcoin (BTC) price slips below $67,000 at the time of writing on Friday, remaining under pressure and extending losses of nearly 5% so far this week.

US Dollar: Big in Japan Premium

The US Dollar (USD) resumed its yearly downtrend this week, slipping back to two-week troughs just to bounce back a tad in the second half of the week.

Vertiv Holdings explodes higher, but can bulls break through this resistance ceiling?

Vertiv Holdings, LLC (VRT) is a provider of critical digital infrastructure and continuity solutions. The stock just delivered one of those rare trading days that gets everyone's attention. VRT rocketed 24.49% higher yesterday, closing at $248.5, so what's the technical picture telling us here?