As markets eagerly await Friday's release of the latest Personal Consumption Expenditures (PCE) Price Index figure, the US Federal Reserve's (Fed) preferred indicator for gauging inflation, investors know that this report will weigh heavily in September's interest rate decision.

But why is this figure, less well known than the Consumer Price Index (CPI), so central to US monetary policy?

PCE vs CPI: Two measures, two rationales

For most Americans, and even international observers, inflation is measured by the CPI.

The CPI, published by the Bureau of Labor Statistics, measures changes in the prices of a fixed basket of goods and services that represent urban household spending.

It's the most widely publicized inflation measure, and the one that hits the headlines when talking about the price of rent, food or gasoline.

The PCE, on the other hand, is less well known to the general public, but is preferred by the Fed.

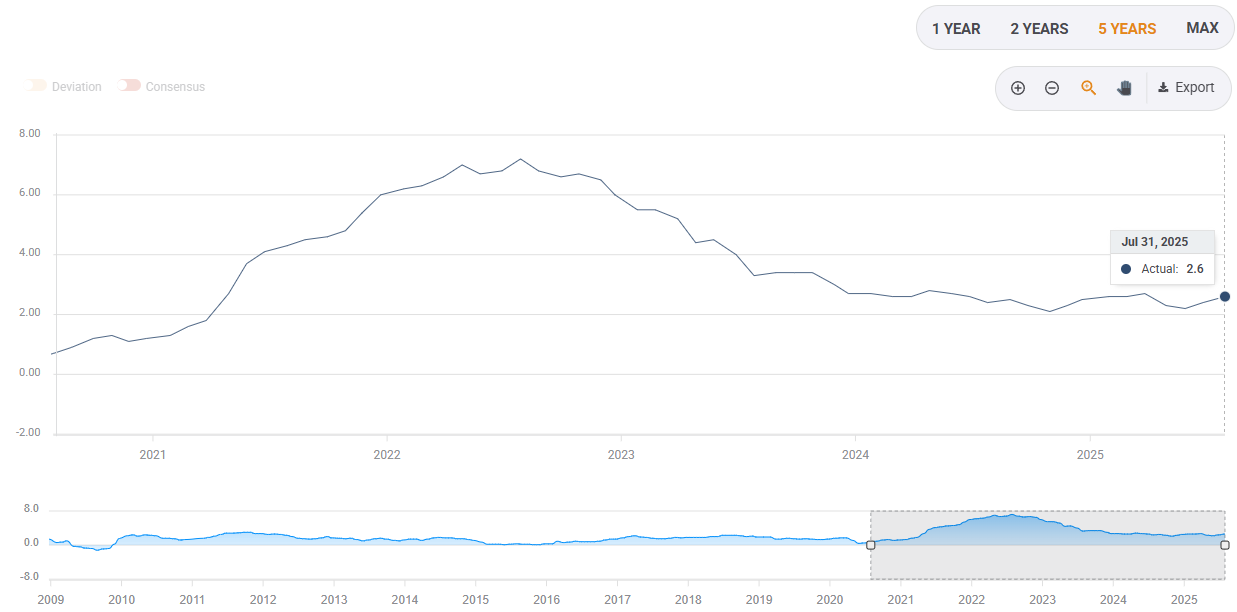

Personal Consumption Expenditures. Source: FXStreet

Calculated by the Bureau of Economic Analysis, it covers a broader field. Not only expenses paid directly by households, but also those paid on their behalf, such as healthcare financed by employers or public programs.

Its more flexible methodology better incorporates changes in consumer behavior. For example, switching from beef to chicken if red meat prices soar. In other words, the PCE more accurately reflects the reality of American consumption.

Finally, the PCE is adjusted to consumer habits or changes more frequently and draws on a wider range of administrative sources, making it a more accurate and stable barometer than the CPI.

It is for these reasons that, since the early 2000s, the Fed has adopted it as its main tool for assessing whether or not inflation is close to its 2% target.

A decisive indicator for the September meeting

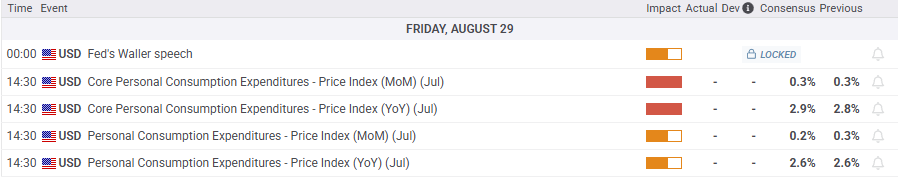

Friday's report is of particular importance. It will be the last PCE inflation release before the September 16-17 Federal Open Market Committee (FOMC) meeting.

The analysts' consensus expects headline PCE to have risen by 2.6% year-on-year in July, a pace still above the Fed's target.

More worryingly, the core PCE, which excludes the more volatile food and energy prices, is expected to have accelerated to 2.9%, after 2.8% in June.

Economic calendar. Source: FXStreet.

These figures complicate the Fed's task. On the one hand, keeping key interest rates high, currently in the 4.25% to 4.5% range, would make it possible to contain inflationary pressures fuelled in particular by the US President Donald Trump administration's tariff hikes.

On the other hand, the marked slowdown in the labor market argues in favor of easing policy to support activity.

Powell between inflation and employment

During his speech at the Jackson Hole symposium, Fed Chair Jerome Powell underlined this dilemma: "The labor market appears to be in equilibrium, but it is a curious equilibrium, marked by a joint slowdown in the supply and demand for workers", he declared.

Job creation has slowed sharply to an average of just 35,000 new jobs per month over the past three months, according to the Nonfarm Payrolls report, while statistical revisions have removed hundreds of thousands of previously announced jobs.

This context is prompting the Fed to reconsider the weighting of its dual mandate: price stability and full employment.

After a long-standing focus on inflation, Powell hinted that employment risks could now weigh more heavily on the central bank's decisions.

"If these risks materialize, they can do so quickly, in the form of a sharp rise in layoffs and unemployment," he warned.

A risky bet for the markets

Financial markets are betting heavily on a rate cut as early as September, which would give the economy some breathing space.

However, too rapid monetary policy easing could rekindle inflation at a time when tariffs continue to push up the prices of consumer goods.

In other words, Friday's PCE report could well tip the balance: confirm that inflation remains too high to justify monetary easing, or, on the contrary, allow the Fed to begin a cycle of interest rate cuts.

Either way, the equation is more complex than ever. Chair Powell will have to arbitrate between persistent inflation and an increasingly fragile labor market.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds lower ground near 1.1850 ahead of EU/ US data

EUR/USD remains in the negative territory for the fourth successive session, trading around 1.1850 in European trading on Friday. A broadly cautious market environment paired with modest US Dollar demand undermines the pair ahead of the Eurozone GDP second estimate and the critical US CPI data.

GBP/USD keeps losses around 1.3600, awaits US CPI for fresh impetus

GBP/USD holds moderate losses at around 1.3600 in the European session on Friday, though it lacks bearish conviction. The US Dollar remains supported amid softer risk tone and ahead of the US consumer inflation figures due later in the NA session on Friday.

Gold trims intraday gains to $5,000 as US inflation data loom

Gold retreats from the vicinity of the $5,000 psychological mark, though sticks to its modest intraday gains heading into the European session. Traders now look forward to the release of the US consumer inflation figures for more cues about the Fed policy path. The outlook will play a key role in influencing the near-term US Dollar price dynamics and provide some meaningful impetus to the non-yielding bullion.

US CPI data set to show modest inflation cooling as markets price in a more hawkish Fed

The US Bureau of Labor Statistics will publish January’s Consumer Price Index data on Friday, delayed by the brief and partial United States government shutdown. The report is expected to show that inflationary pressures eased modestly but also remained above the Federal Reserve’s 2% target.

A tale of two labour markets: Headline strength masks underlying weakness

Undoubtedly, yesterday’s delayed US January jobs report delivered a strong headline – one that surpassed most estimates. However, optimism quickly faded amid sobering benchmark revisions.

Vertiv Holdings explodes higher, but can bulls break through this resistance ceiling?

Vertiv Holdings, LLC (VRT) is a provider of critical digital infrastructure and continuity solutions. The stock just delivered one of those rare trading days that gets everyone's attention. VRT rocketed 24.49% higher yesterday, closing at $248.5, so what's the technical picture telling us here?