Forex trading has quickly become one of the most lucrative markets across the globe. As we lean further into a decentralised future, the Foreign Exchange market has become popular amongst international traders.

As a market that was once reserved for large-scale organisations, forex Trading has increased by 300% in just the last 15 years and is now open to just about anyone who hopes to make a profit when trading currencies.

However, as FX trading becomes popular in a volatile online market, how can traders ensure that their exchanges are secure and reliable?

This is where virtual private servers (VPS) come into play. For FX traders and brokers that are regularly interacting with the Foreign Exchange market, investing in a VPS provider could be the difference between a profit and a loss.

Why choose VPS for forex trading?

Forex is constantly evolving. Both traders and brokers are searching for new ways to maximise productivity in a fast-moving market.

Trading on a VPS server does just that. As an isolated environment that runs on a cloud server, VPS hosting provides traders with greater levels of security, scalability and minimises latency.

“In order to maximize their productivity, forex traders need a VPS. No matter where you are, you can consistently perform exchanges without much hassle,” says Priti Mujumdar, marketing manager at MilesWeb. “In comparison with PC usage, a VPS offers maximum security and fewer restrictions.”

Essentially, forex VPS is a cloud version of your computer. This cloud version can be remotely operated from pretty much any device from anywhere in the world. VPS allows traders to run automated trading and execute trades 24/7 with minimal latency, giving you the safety and security needed.

From security to scalability, VPS hosting is the future of forex trading. With this in mind, let’s have a closer look into why it is an essential component for success.

Trade anywhere, at any time

Investing in a VPS server opens up your avenues for forex trading. No matter whether you’re sitting beside your own PC or on a holiday far away from home, you can log into a VPS server from anywhere.

Not only does this give you the power to trade anywhere at any time, but also provides you with more control over the market.

Better still, VPS servers support automated trading too. If you invest in a secure forex VPS, your bots can execute trades during the middle of the night, when your computer is turned off and even when the power goes out. Automating your trading in a secure and reliable system opens you up to more opportunities for profitable exchange and means that you are not confined to a certain pace.

Increased defence against cyber attacks

Did you know that more than 800,000 people experience a cyber attack every year?

If you’re concerned about the security of your trading efforts, a VPS provides a secure and reliable system for the safe transfer of currency. In fact, most VPS servers are also equipped with built-in firewalls, antivirus software and up-to-date security frameworks that aim to mitigate any potential threats.

Say goodbye to slippage

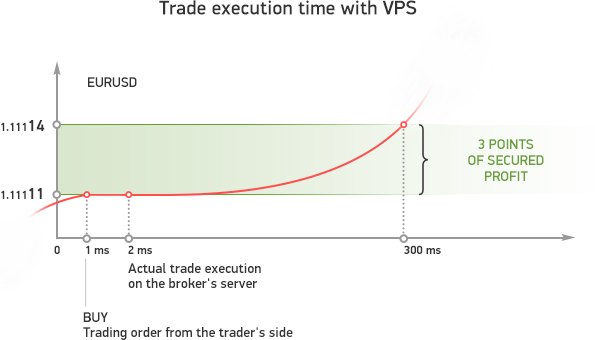

Trade execution delays could be the difference between a profit and a loss. Without a secure VPS network, the distance between your PC and the broker's server could cause unnecessary transaction delays, which in turn affect your trading profits.

Investing in a forex VPS server could reduce slippage time and ensure that your trades are executed promptly. With a current network latency of fewer than 5 milliseconds for connections to over 82% of brokerage servers, MetaTrader’s VPS feature offers traders the ability to execute trades with minimal delay.

As automated trading grows in popularity, MetaTrader’s 99.99% uptime guarantee also ensures that all trades, no matter where or when they are executed, reach their destination at optimum speed, regardless of a lack of internet connection or a potential power cut.

How to get started

Before you invest in a forex VPS, there are a few things to consider when choosing the perfect server for you.

You should make sure that your forex broker offers a VPS service, as some charge a monthly fee for this service.

After implementing a major service update based on valuable feedback from loyal brokers and traders, the popular forex VPS platform MetaTrader is offering free access to their traders under predefined terms and conditions.

"Free specialized hosting for automated trading is a valuable asset and a significant advantage over competitors,” comments Renat Fatkhullin, CEO of MetaQuotes. “In a highly saturated and aggressive market, any compelling argument can tip the scales. We believe that the updated service will assist brokers in improving their business performance."

The forex trading landscape may be evolving, but those who step into a VPS-powered future will find themselves ahead of the market curve. From reliability to security, VPS hosting is essential for any trader hoping to see success.

All views and opinions expressed in this article are the opinions of the author and not FXStreet. Trading cryptocurrencies or related products involves risk. This is not an endorsement to invest in or trade any of the cryptocurrencies, stocks or companies mentioned in this article.

Editors’ Picks

AUD/USD taps three-year highs on broad US Dollar weakness

AUD/USD is trading near three-year highs after a strong break above the 0.7000 psychological level for the first time since February 2023, supported by the Reserve Bank of Australia's surprise 25 basis point rate hike to 3.85% at its February meeting. The daily chart shows the pair in a well-defined uptrend, holding above both the 50-day Exponential Moving Average near 0.6970 and the 200-day EMA around 0.6700.

Gold pushes back above $5,000

The daily chart shows spot Gold in a parabolic uptrend that accelerated sharply from the $4,600 area in late January, printing a record high at $5,598.25 before a violent reversal erased nearly $1,000 in value during the final days of the month.

USD/JPY slumps below 156.00 as Japanese Yen strengthens after Takaichi's landslide victory

The USD/JPY pair tumbles to near 155.90 during the early Asian session on Tuesday. The Japanese Yen strengthens against the US Dollar after Japanese Prime Minister Sanae Takaichi led the ruling Liberal Democratic Party to a historic landslide win. Traders braced for key US economic data that could offer more clues on the Federal Reserve's monetary policy.

Litecoin eyes $50 as heavy losses weigh on investors

Following a strong downtrend across the crypto market over the past week, Litecoin holders are under immense pressure. The Bitcoin fork has trimmed about $1.81 billion from its market capitalization since the beginning of the year, sending it below the top 20 cryptos by market cap.

Japanese PM Takaichi nabs unprecedented victory – US data eyed this week

I do not think I would be exaggerating to say that Japanese Prime Minister Sanae Takaichi’s snap general election gamble paid off over the weekend – and then some. This secured the Liberal Democratic Party (LDP) an unprecedented mandate just three months into her tenure.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.