Why New York Charts...

Why any serious trader should use the New York Close chart? Learning to trade the forex market can be a tough experience. You have probably read a lot of articles about trading strategies, registered to various online forex forums, and you are practicing whenever you have time to look at the charts. But, there is probably one thing that you've missed, that can have an enormous difference in your trading performance and learning efforts.

It's the type of charts that you use. To make the right trading decisions based on price-action, you need a simple and clean chart which shows you the real market sentiment, is compact and not cluttered with unnecessary information. You may ask, "Wait, but all charts are the same, aren't they?" -No, they are not. There is actually a big difference in the price feeds that forex brokers are using, with two main probably one thing that you’ve missed, that can have an enormous difference in your trading performance charts which we will discuss below: the GMT chart, and the New York Close chart.

The FOREX Market and New York Charts

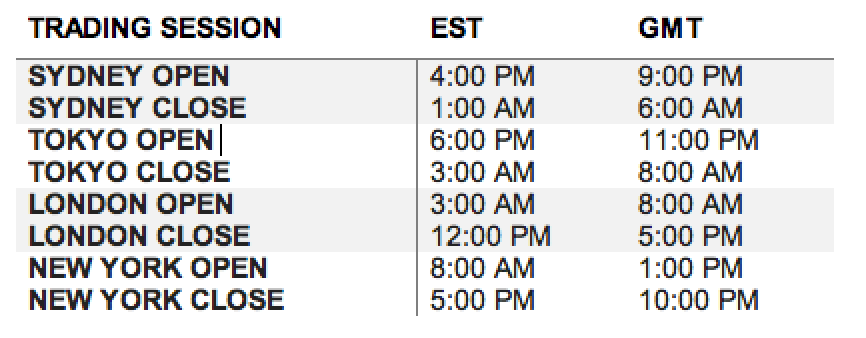

Let me explain. The forex market is open six days per week, 24 hours a day. The New York session, London session, and Asia-Pacific trading session are all open at a different time, which makes the forex market open around the clock. The following table shows when the trading sessions open according to EST and GMT time zones.

Not all trading sessions have the same daily trading volume. You probably already know, that most of the market volatility takes place with the overlap between the London and New York session, which is from 8:00 AM to 12:00 PM EST. After that, the only session which has a significant market impact is the New York session, which ends each day at 5:00 PM from Monday to Friday. A more thorough explanation of why I am using the Daily timeframe can be found HERE.

What you want to look at is the closing price of the New York session. Unfortunately, the majority of brokers use chart types that are based on GMT time. This means, each candle opens at exactly 00:00 AM GMT, which creates a total of six daily candles per week. This type of charting creates unnecessary confusion and fake signals, as it usually has a small "Sunday" candle which opens at Sunday 11:00 PM GMT and closes at 00:00 AM GMT.

Be Careful: GMT charts are cluttered with redundant, unnecessary information (candles) which can also be confused with doji candles. Doji candles have a small body and usually mean a possible trend reversal, but as they are not true daily candles they are not relevant!

New York Close charts, on the other hand, have a total of five candles during a week and equal the closing price of each New York session. The closing prices are the most important number for price-action trading, as they truly represent the fight between bulls and bears and show who won the battle in the previous trading session.

In a nutshell, charts that don't rely on the New York Close are not suitable for any type of professional trading and analysis and I can't recommend them at all. Beside the small "Sunday" candles that clutter the chart and create fake signals, the particular closing prices of GMT charts are not showing the real picture of the market sentiment. In the end, if you are not using New York Close FOREX Charts, you will not see the same results. That's why I encourage you to try them, especially if you are serious about price-action trading.

What Is The Difference Between GMT and New York Close Charts On The Screens?

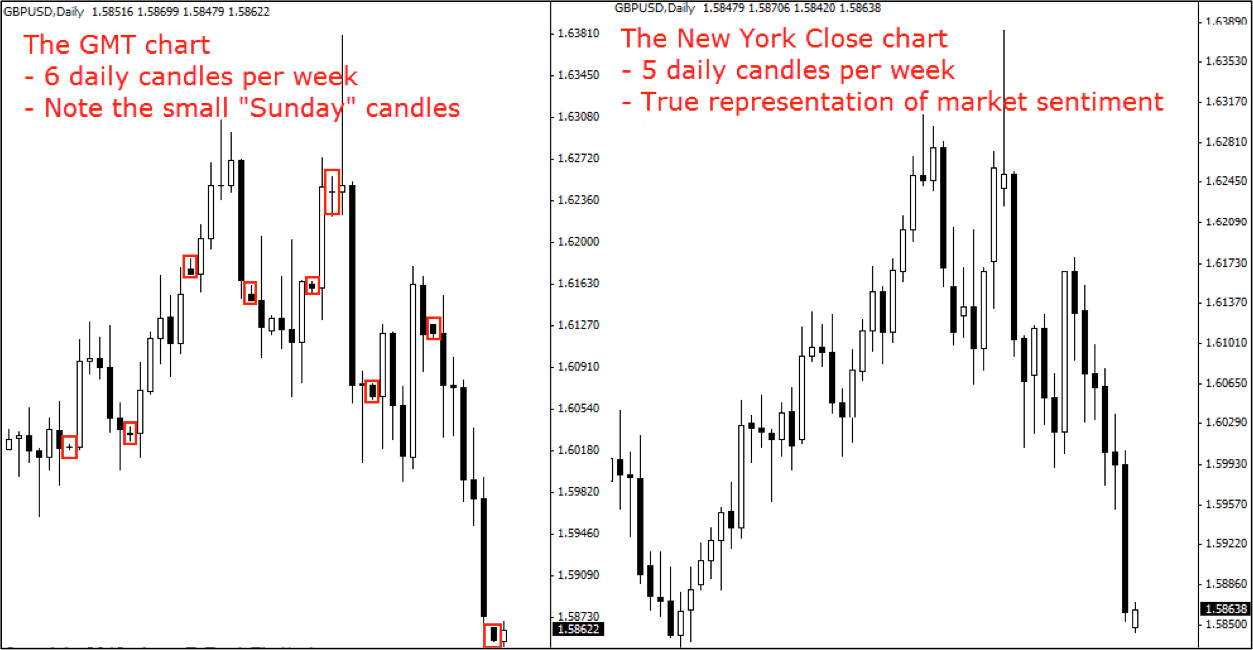

Let's take a look at the difference between a GMT chart and a New York Close chart.

As you can see, the New York Close chart has no unnecessary "Sunday" candles which can confuse traders. Notice the small candles in red on the left GMT chart.

Be careful: If you rely on candlestick patterns in your trading, GMT charts would generate a lot of fake signals which could ultimately cost you a lot of money.

There are a lot of dojis and other candlesticks with small bodies, due to the small time-frame that they represent (only one hour after the Tokyo session opens). The New York Close chart, on the other hand, represents exactly the New York session trading day, which is extremely important for price-action trading. Closing prices are the most important prices for any market, not just forex. To make the right trading decisions, you need to make sure that you have the right price feed.

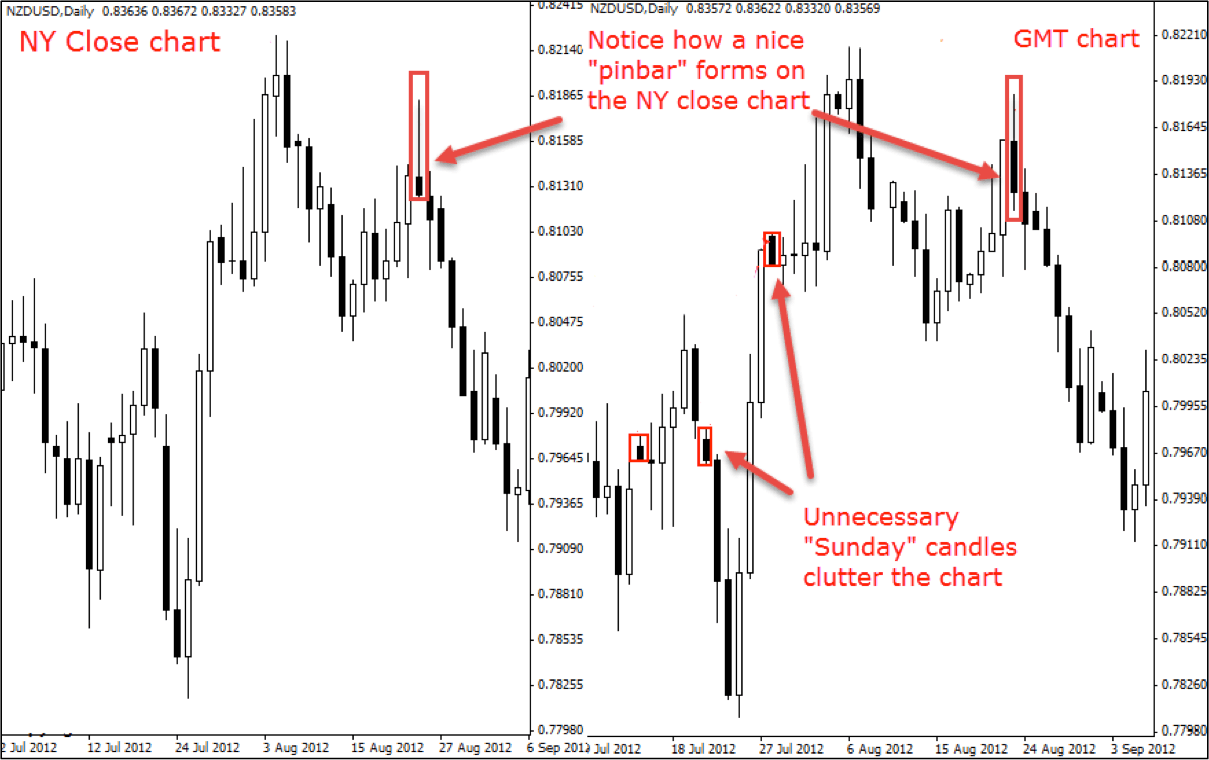

Look at the real-life difference between the NY Close chart (left) and GMT chart (right). While a nice pinbar candlestick forms on the NY Close chart, which triggers a profitable short position afterwards, there is nothing similar on the GMT chart. Even more, the "Sunday" candles dilute traders' attention and can give costly "fake signals", i.e. if the irrelevant "Sunday" candles form a doji or shooting star.

If you don't know which charts your broker uses, the easiest way to find out is by watching when the daily candle closes.

Tip: If the time is different from 5:00 PM EST, your broker uses another chart feed than the New York Close, most probably the GMT type of chart.

Final Words

am not saying that you can't be a profitable trader with GMT charts. I have traded myself on GMT charts before I discovered the New York Close charts. Once you switch to New York Close charts, you will immediately feel the difference while just looking at the chart – it's more compact, has 5 daily candles during a week, and you know that each candle's closing price represents the close of the New York session at 5:00 PM EST. I find it now much easier to discover profitable trading patterns while looking at the New York Close charts.

If you want to become a professional price-action trader, one of the most important things is to start from the foundation – which are the charts. You want compact and clean charts, which truly represent the fight between the bulls and the bears.

Happy Trading,

This material is written for educational purposes only. By no means do any of its contents recommend, advocate or urge the buying, selling or holding of any financial instrument whatsoever. Trading and Investing involves high levels of risk. The author expresses personal opinions and will not assume any responsibility whatsoever for the actions of the reader. The author may or may not have positions in Financial Instruments discussed in this newsletter. Future results can be dramatically different from the opinions expressed herein. Past performance does not guarantee future results.

Editors’ Picks

EUR/USD tests nine-day EMA support near 1.1850

EUR/USD remains in the negative territory for the fourth successive session, trading around 1.1870 during the Asian hours on Friday. The 14-day Relative Strength Index momentum indicator at 56 stays above the midline, confirming steady momentum. RSI has eased but remains above 50, indicating momentum remains constructive for the bulls.

Gold recovers swiftly from weekly low, climbs back closer to $5,000 ahead of US CPI

Gold regains positive traction during the Asian session on Friday and recovers a part of the previous day's heavy losses to the $4,878-4,877 region, or the weekly low. The commodity has now moved back closer to the $5,000 psychological mark as traders keenly await the release of the US consumer inflation figures for more cues about the Federal Reserve's policy path.

GBP/USD consolidates around 1.3600 vs. USD; looks to US CPI for fresh impetus

The GBP/USD pair remains on the defensive through the Asian session on Friday, though it lacks bearish conviction and holds above the 1.3600 mark as traders await the release of the US consumer inflation figures before placing directional bets.

Solana: Mixed market sentiment caps recovery

Solana is trading at $79 as of Friday, following a correction of over 9% so far this week. On-chain and derivatives data indicates mixed sentiment among traders, further limiting the chances of a price recovery.

A tale of two labour markets: Headline strength masks underlying weakness

Undoubtedly, yesterday’s delayed US January jobs report delivered a strong headline – one that surpassed most estimates. However, optimism quickly faded amid sobering benchmark revisions.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.