Dear Trader

The blogosphere is full of the impending collapse of the Dow with some pundits talking of 14,000 in 2019, a modest 10,000 points lower. Right or wrong, the fuel that has kept stock markets forever bubbling, an endless wall of money and a strong economy, will eventually end. Is the yield curve telling us the economy is about to fall of a cliff?

Normality

Government and corporate bonds are issued with different maturities. The standard US bond is the 30 year, but there are many different maturities, typically 3, 5 and 10 year, etc. Some run for just a few months to maturity, whilst some whacky corporate bonds have been issued with maturities way out at 100 years!

As the economy ebbs and flows the yield, interest rate, on bonds moves up and down as the bond price also moves. Now, the interest rate on long term bonds is usually higher than that of the shorter dates.

This is how the banking system works. Banks borrow short term at lower rates, then lend out over longer periods at higher rates and pocket the difference. Understandably, banks and investors want a greater interest rate of return the longer the money is tied up.

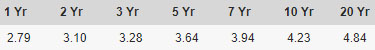

A typical yield curve tracks the difference between the bonds maturities. This shows the curve increasing back in the, relatively, normal times of 2005:

When the economy is expecting a recession, Central Banks reduce expectations of rate rises. Interest rates fall, starting at the longer maturities, and when the Yield curve turns negative, or inverts, a recession often follows along.

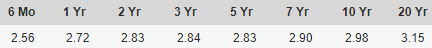

This is what preceded the 2007/8 stock market tumble:

The curve went upside down. Short term rates were higher than long term and down the economy tumbled with the banking sector's shenanigans. When the curve inverts, the usual banking cycle of borrow short lend long, goes into reverse and with it, their profits.

Right now, the curve has gone flat with the 3-5 year inverting:

That's why the talking heads and pundits are predicting a recession is on the way and interest rate rises are most likely to stop or even fall.

This year next year when?

Looking back to 2007, the inversion started early in 2006 which gave a lead time of 18 months+ before recession hit. As we've seen, the US Federal Reserve has been increasing rates and is still expected to do so one more time this year on 19th December.

Powell, the Fed Chairman, at his last statement suggested that US rates were 'just below the neutral rate'. Taking that to mean the neutral rate for the economy is 1/4% higher than the current 2.25% gives us the last rate increase this year.

Most likely that's it, nothing more - no more rises in 2019 as the yield curve inversion signals recession by 2020.

And the markets?

Stock markets have loved QE, stock buy backs and tax cuts. The effects of all these are likely to dissipate through 2019. QE is tapering down. The error of stock buybacks, using debt as growth falters, is hammering the likes of General Electric and General Motors, etc., and the tax cuts feel good factor can't happen every year.

These are all headwinds, but if the market does take fright from an impending recession will the Fed step in again and chop rates back to zero in an attempt to save the stock market? They've got form on this and are unlikely to allow the market to tank when it’s in almost everyone’s interest to keep it bubbling.

The Dollar

Right now it's looking as though it has more upside as rising rates have created a worldwide dollar shortage. That shortage has been squeezing emerging economies as they struggle to pay rising rates on their massive dollar loans.

If the dollar has no more momentum after what could be it's last rate rise on 19th December, then look for an end year top and load up on the Euro for 2019. Assuming Italian debt doesn't default!

Gold and Silver

If the US Dollar does peak, Gold will get a shove upwards as the Dollar falls. The next newsletter will look at how the two interact now the Gold/Silver ratio has reached an all time high.

The information included in these contents is not and should not be construed as investment or financial advice and is not an invitation to buy or sell currency pairs or any other financial instrument. The contents do not have any contractual effect. Trading carries a high level of risk to your capital. Only speculate with money you can afford to lose. Trading may not be suitable for all investors therefore ensure you fully understand the risks involved. Do not trade or invest in derivatives with money you cannot afford to lose. Any investment carries a high degree of risk to the investor and due to fluctuations in value the investor may not get back the amount invested. With certain transactions clients might not only lose their initial investment but may incur a liability to pay further unspecified amounts at a later date. George Hallmey and Clickevents Ltd will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Editors’ Picks

When are the China’s CPI, PPI and how could they affect AUD/USD?

The National Bureau of Statistics of China will publish its data for January at 01.30 GMT. The Consumer Price Index is expected to show a rise of 0.4% YoY in January, compared to 0.8% in December. The Producer Price Index is projected to show a decline of 1.5% in January versus a fall of 1.9% prior.

USD/JPY extends backslide as election fallout bolsters Yen

USD/JPY is trading in a choppy, range-bound structure on the daily chart, oscillating between the January high near 159.450 and the late-January swing low at 152.100. Price closed Monday at 154.410, dropping sharply by 1.47 yen (0.94%) after an initial gap higher following Prime Minister Takaichi's landslide election victory was met with verbal intervention from Finance Minister Katayama and Japan's top currency official Mimura, both signaling readiness to act on yen volatility.

Gold declines to near $5,050, focus shifts to US jobs data

Gold price falls to near $5,045 during the early Asian session on Wednesday. Traders assess whether prices have found a floor following a historic sell-off. The delayed US employment report for January, which was pushed back due to the recently ended four-day government shutdown, will take center stage later on Wednesday.

Ethereum: Whales buy the dip amid rising short bets

Following one of Ethereum's largest weekly drawdowns, whales are slowly returning to action alongside a drop in retail selling pressure. After slightly selling into the decline at the start of the month, whales or wallets with a balance of 10K-100K ETH began buying the dip last Wednesday as prices crashed further.

Dollar drops and stocks rally: The week of reckoning for US economic data

Following a sizeable move lower in US technology Stocks last week, we have witnessed a meaningful recovery unfold. The USD Index is in a concerning position; the monthly price continues to hold the south channel support.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.