The evolution of money has always mirrored the great challenges of history. Gold anchored trust through scarcity. Paper currencies extended the authority of the state. Banking systems scaled trust across nations. Each transformation emerged from necessity — crises that forced societies to rethink the architecture of money.

Today, the next chapter is unfolding. The Great Challenge of our time is to preserve stability and access in an increasingly volatile and fragmented world.

USD stablecoins have emerged as both the risk and the opportunity within this reality. They are not speculative tokens on the fringe of finance. They are digital instruments that extend the trust of the U.S. dollar into global, instant, programmable form.

This is why I call stablecoins the digital operating system of the dollar. They are not a new currency but the reconfiguration of an old one, adapted to the demands of a new normality.

A global demand for stability

When a currency loses its credibility, people instinctively seek a safer ground of value. This is the pattern I describe in my framework of Great Challenges: When beliefs in the system falter, new knowledge and activities emerge to restore balance. Stablecoins are the embodiment of this response.

In Argentina, Carlos struggles with inflation that dissolves his savings: “My paycheck arrives in pesos, but my bills rise in dollars. Last year, I lost a third of my wealth. With stablecoins, I finally hold digital dollars without begging a bank teller.”

In Kenya, Amina sees access where banking has failed: “Everyone here has a smartphone, but not everyone has a bank. Stablecoins let me get paid from abroad, save in dollars, and convert locally when I need to, no middlemen taking a cut.”

In China, Mei views them as a gateway: “Domestic payments are seamless, but crossing borders is hard. With digital dollars, I can move value globally in minutes and participate in opportunities abroad.”

And in Europe, David emphasizes efficiency: “Our treasury used to juggle cut-offs and correspondent banks. Now we settle customer payouts in seconds with programmable dollars, and reconcile in real time.”

Four different realities, one common story: When currencies weaken or systems slow, the demand for stability and efficiency accelerates adoption of digital dollars.

Adoption across continents

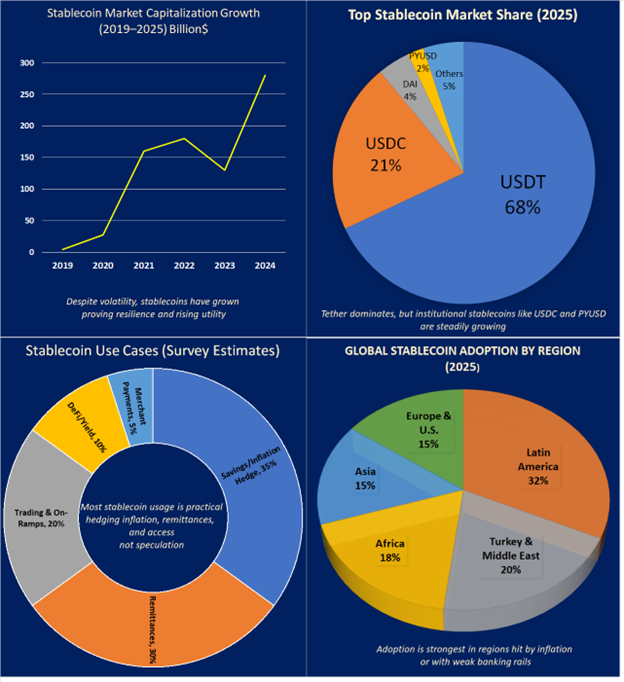

The evidence is clear. In Latin America, where inflation repeatedly destroys wealth, stablecoins are becoming the de facto store of value. More than a third of crypto users in Argentina hold stablecoins rather than speculative tokens, and remittances now flow in digital dollars with far lower costs.

In Turkey, where inflation has exceeded 60 percent, USDT dominates peer-to-peer markets, functioning as a digital mattress dollar. In Nigeria, where access to dollars is tightly controlled, stablecoins bypass both devaluation and restrictions, serving as a practical currency for households and businesses.

In Asia, merchants rely on stablecoins for trade settlements, and overseas workers in the Philippines increasingly use them to send remittances back home, cutting fees and delays. Meanwhile, in Europe and the United States, the integration is institutional. PayPal’s PYUSD has introduced stablecoins to millions of users, while tokenized securities and repo transactions already depend on them for settlement.

By 2024, international flows in stablecoins had surpassed $2 trillion, according to the IMF, with a global market capitalization of approximately $280 billion. This is no longer marginal activity; it is systemic adoption.

Charts and visuals

Regulation between control and necessity

The rapid rise of stablecoins is also a Great Challenge for policymakers. It forces them to confront the balance between innovation and sovereignty.

In the United States, Congress continues to debate frameworks that would impose full reserve backing, transparency, and federal oversight. Yet progress is slow, and the reality is that global adoption moves faster than legislation.

The European Union has advanced further. The Markets in Crypto-Assets (MiCA) regulation, effective in 2025, sets the world’s first comprehensive framework for stablecoins. Issuers must hold reserves in cash or Treasuries, publish disclosures, and submit to European Banking Authority supervision. MiCA, much like GDPR in data privacy, may set the global benchmark.

In emerging markets, regulators face their own paradox. Citizens adopt stablecoins because local currencies collapse, yet central banks fear losing control of monetary policy through “digital dollarization.” Some experiment with sandboxes, others impose restrictions, but none can stop the organic demand for stable value.

Global institutions such as the IMF and BIS now recognize the inevitability of stablecoins. They warn of risks, but also acknowledge their contribution to inclusion and efficiency. The global consensus is shifting: bans are not realistic. The only path forward is coordinated regulation that manages risks without destroying the opportunity.

Risks that must be managed

Every Great Opportunity contains the seeds of risk. Stablecoins are no exception.

Depegging events, such as the collapse of TerraUSD in 2022 or the temporary dislocation of USDC in 2023, reveal how fragile trust can be if reserves and governance are weak. Concerns about illicit finance persist, though blockchain transparency provides regulators with tools unavailable in the world of cash. And systemic risk cannot be ignored: with nearly $300 billion in circulation, a failure of a major issuer could ripple into banking and bond markets.

Yet these are not existential flaws. They are engineering challenges: solvable through stronger reserve quality, diversified custodianship, independent audits, and regulatory oversight. Just as banks evolved into trusted institutions over centuries, stablecoin issuers are now being reshaped into digital banks of the future.

From use case to infrastructure

What began as a tool for savers and remittance senders is now becoming global infrastructure.

-

Fintech companies build stablecoins into their wallets and cross-border rails.

-

Merchants, especially in emerging markets, accept them for faster settlement and reduced costs.

-

Traders treat them as the backbone of liquidity in crypto markets.

-

Corporates and institutions experiment with invoicing, treasury management, and tokenized securities settled in digital dollars.

Stablecoins are no longer a peripheral tool. They are quietly emerging as the settlement layer of tokenized capital markets, a role that places them at the very core of the next financial architecture.

Stablecoins and the global order - Macroeconomic implications

Stablecoins are not just a financial innovation; they are becoming a geopolitical force. The dominance of the U.S. dollar in global trade, finance, and reserves is being redefined through a digital channel that operates outside traditional banking. This shift carries profound implications for governments, central banks, and global institutions.

At one level, USD stablecoins strengthen the role of the dollar. They extend its reach to regions and populations historically excluded from access to the reserve currency. In countries suffering from chronic inflation, dollar-denominated stablecoins are now functioning as parallel monetary systems, allowing households and businesses to preserve value and transact in dollars without touching the traditional banking system. This accelerates a trend that economists once described as “dollarization,” but today it is not imposed from above, it is adopted organically, from the ground up.

At another level, stablecoins challenge the monopoly of central banks in monetary sovereignty. When citizens choose digital dollars over local money, they reveal the fragility of national currencies and expose the inability of domestic institutions to safeguard stability. For some policymakers, this is a threat. For others, it is an opportunity to integrate stablecoins into their financial systems and attract investment.

Globally, stablecoins also intersect with the contest over reserve currencies. While debates continue over the rise of the Chinese yuan or the euro as challengers to the dollar, the reality is that the dollar is already reinventing itself in digital form. Stablecoins effectively upgrade the dollar for the digital age programmable, borderless, and accessible on a smartphone. In this sense, they reinforce U.S. monetary influence even as they operate outside Washington’s direct control.

This is where the Great Challenge lies: the world is entering a phase where financial power is no longer only measured by central bank balance sheets or foreign reserves but by the digital rails that carry everyday transactions. If stablecoins become the standard medium for global trade and savings, the dollar’s primacy will not only survive, it will deepen, but in a new form.

For emerging markets, this dual reality, empowerment through access, loss of control through dollarization, represents both a Great Risk and a Great Opportunity. For advanced economies, it represents the challenge of adapting regulation quickly enough to avoid losing influence over a transformation that is already underway.

A new normality rooted in trust

In my framework of Great Challenges, what defines a turning point is its power to create a new reality and establish a new normality. USD stablecoins embody this process. They respond to the erosion of trust in local currencies by anchoring value in the dollar, while reconfiguring activities and beliefs around money into a digital, borderless form.

-

For the saver in Argentina, they preserve wealth.

-

For the worker in Kenya, they provide access to financial life.

-

For the investor in China, they offer cross-border freedom.

-

For the fintech in Europe, they deliver efficiency and programmability.

The lesson is clear: The future of finance will not be local, fragmented, and inflation-prone. It will be global, instant, and dollar-denominated.

Stablecoins are not the side story of crypto, they are the central story of money’s transformation.

They are the proof that a Great Challenge, inflation, exclusion, inefficiency, can generate both Great Risks and Great Opportunities.

- The risk lies in mismanagement or regulatory paralysis.

- The opportunity lies in embracing stablecoins as the digital operating system of the dollar.

And that future is not distant. It is already here, one saver, one merchant, and one transaction at a time.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. The Article/Information available on this website is for informational purposes only, you should not construe any such information or other material as investment advice or any other research recommendation. Nothing contained on this Article/ Information in this website constitutes a solicitation, recommendation, endorsement, or offer by LegacyFX and A.N. ALLNEW INVESTMENTS LIMITED in Cyprus or any affiliate Company, XE PRIME VENTURES LTD in Cayman Islands, AN All New Investments BY LLC in Belarus and AN All New Investments (VA) Ltd in Vanuatu to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. LegacyFX and A.N. ALLNEW INVESTMENTS LIMITED in Cyprus or any affiliate Company, XE PRIME VENTURES LTD in Cayman Islands, AN All New Investments BY LLC in Belarus and AN All New Investments (VA) Ltd in Vanuatu are not liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the website, but investors themselves assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Article/ Information on the website before making any decisions based on such information or other Article.

Editors’ Picks

AUD/USD retargets 0.7100 ahead of RBA Minutes

AUD/USD keeps the slightly bid bias around 0.7070 ahead of the opening bell in Asia. Indeed, the pair reverses two daily pullbacks in a row, meeting some initial contention around 0.7050 while investors gear up for the release of the RBA Minutes early on Tuesday.

EUR/USD keeps the rangebound trade near 1.1850

EUR/USD is still under pressure, drifting back towards the 1.1850 area as Monday’s session draws to a close. The modest decline in spot comes as the US Dollar picks up a bit of support, while thin liquidity and muted volatility, thanks to the US market holiday, are exaggerating price swings and keeping trading conditions choppy.

Gold battle around $5,000 continues

Gold is giving back part of Friday’s sharp rebound, deflating below the key $5,000 mark per troy ounce as the new week gets underway. Modest gains in the US Dollar are keeping the metal in check, while thin trading conditions, due to the Presidents Day holiday in the US, are adding to the choppy and hesitant tone across markets.

AI Crypto Update: Bittensor eyes breakout as AI tokens falter

The artificial intelligence (AI) cryptocurrency segment is witnessing heightened volatility, with top tokens such as Near Protocol (NEAR) struggling to gain traction amid the persistent decline in January and February.

The week ahead: Key inflation readings and why the AI trade could be overdone

It is likely to be a quiet start to the week, with US markets closed on Monday for Presidents Day. European markets are higher across the board and gold is clinging to the $5,000 level after the tamer than expected CPI report in the US reduced haven flows to precious metals.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.