When individuals set out to initiate their trading endeavor they have three aspects of trading they have to hone-in on. The first is risk, which is the easiest to figure out. Most new traders quickly grasp this concept.

How to Calculate Risk on a Trade

Measuring the risk on a trade is simply a measure of the amount of money exposed between the entry and the stop loss. A simple example would be in a trade of WTI (West Texas Intermediate) Crude Oil for the March Expiration (CLH20). In this particular contract, every one dollar move is worth $1000. This value is derived by the fact that every contract in CL controls 1000 barrels of West Texas Intermediate Crude Oil. The smallest incremental price move (called a tick) is .01, thus there are 100 ticks in a point. Since there 100 ticks in a point ($1000/100) every tick has a value of $10. If a trader buys 1 contract of CLH20 at a price of 52.30, with a stop market order of 52.10 her risk would 20 ticks (20 x $10 ) would equal $200 of risk per contract.

How to Calculate Reward on a Trade

The next facet of trading is the reward. Since trading is about risking money, the reward should compensate a trader at a favorable ratio, at least three times the risk. In this oil trade example, the market should allow for at least a $600 profit potential. This can be projected by understanding where price is likely to turn against the trade after it starts to move in a favorable direction. In the long oil trade example, a trader must objectively find where the sellers are found on a price chart to know where price might turn against the long trade. This would look like a fresh quality supply zone opposite the buy zone from which the buy was executed.

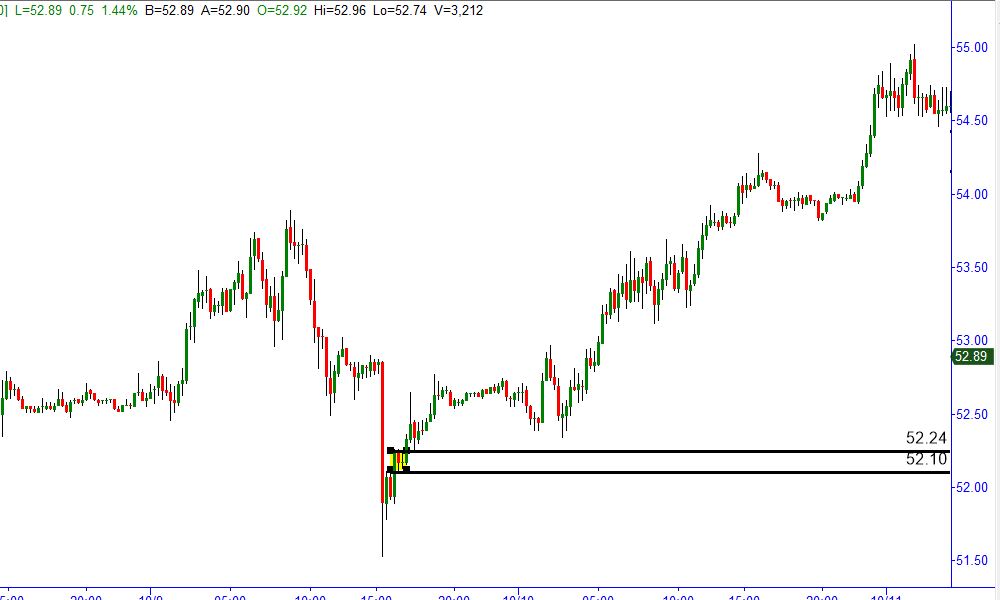

In the two charts below, we see a recent setup in CLH20 the fit these two parameters.

In this first chart we see a quality demand zone that would likely produce a turn in price because price hadn’t returned to the price level after producing a strong rally.

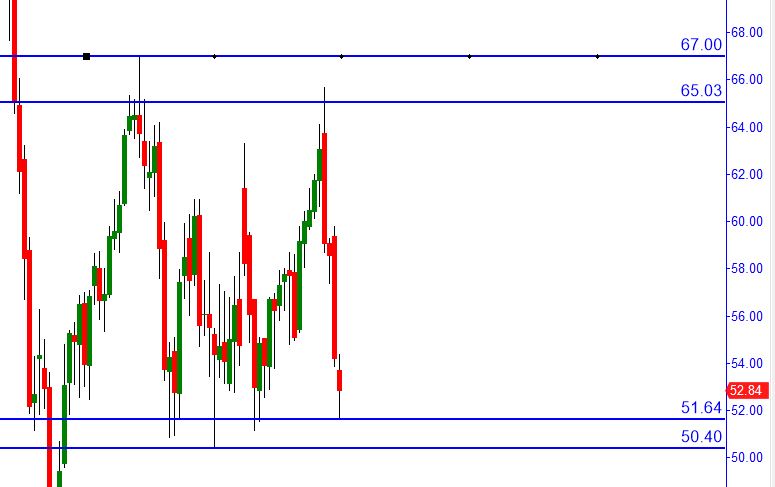

In the second chart below, we see that there is a gap in price which insinuates that there are plenty of sellers at that level, as the sell orders were so overwhelming that the price gapped lower. This is where a trader can objectively seek to take profits. In fact, a better chance of hitting the target would be to place the target 20% before the selling zone.

We can see the outcome in the chart below as price rallied into the supply zone and immediately turned lower. If the trader had not looked at this information objectively, she may have let her emotions take hold and may have not taken her profits.

Probabilities

Probabilities are, in my experience, the most challenging aspect for traders to quantify. One way to think about probability is to look at it as the location where the odds would favor buying, or selling.

In the oil example, buying was a more favorable opportunity as the price of oil had fallen more than $12 and was approaching a longer term area where buyers had stepped in and purchased lots of contracts in the past year. This, coupled with the fact that Oil had been in a well-defined range and had fallen from the top extremity to the lower boundary of the range, made this a higher probability setup. This is seen in the chart below.

In conclusion, in order for a trader to experience consistent results, the first step is to formulate a process that can clearly assess risk, reward and probability. Those that fall short of doing that are not likely to see favorable results.

Until next time, I hope every has a great week.

This content is intended to provide educational information only. This information should not be construed as individual or customized legal, tax, financial or investment services. As each individual's situation is unique, a qualified professional should be consulted before making legal, tax, financial and investment decisions. The educational information provided in this article does not comprise any course or a part of any course that may be used as an educational credit for any certification purpose and will not prepare any User to be accredited for any licenses in any industry and will not prepare any User to get a job. Reproduced by permission from OTAcademy.com click here for Terms of Use: https://www.otacademy.com/about/terms

Editors’ Picks

Gold plunges on sudden US Dollar demand

Gold drops markedly on Thursday, challenging the $4,900 mark per troy ounce following a firm bounce in the US Dollar and amid a steep sell-off on Wall Street, with losses led by the tech and housing sectors.

EUR/USD turns negative near 1.1850

EUR/USD has given up its earlier intraday gains on Thursday and is now struggling to hold above the 1.1850 area. The US Dollar is finding renewed support from a pick-up in risk aversion, while fresh market chatter suggesting Russia could be considering a return to the US Dollar system is also lending the Greenback an extra boost.

GBP/USD change course, nears 1.3600

GBP/USD gives away its daily gains and recedes toward the low-1.3600s on Thursday. Indeed, Cable now struggles to regain some upside traction on the back of the sudden bout of buying interest in the Greenback. In the meantime, investors continue to assess a string of underwhelming UK data releases released earlier in the day.

LayerZero Price Forecast: ZRO steadies as markets digest Zero blockchain announcement

LayerZero (ZRO) trades above $2.00 at press time on Thursday, holding steady after a 17% rebound the previous day, which aligned with the public announcement of the Zero blockchain and Cathie Wood joining the advisory board.

A tale of two labour markets: Headline strength masks underlying weakness

Undoubtedly, yesterday’s delayed US January jobs report delivered a strong headline – one that surpassed most estimates. However, optimism quickly faded amid sobering benchmark revisions.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.