Even with the benefit of a night's rest, NFL fans are still flabbergasted by the New England Patriots shocking Super Bowl comeback to beat the Atlanta Falcons 34-28 in overtime. For my money, it was the best Super Bowl in history and it cements Tom Brady's status as the greatest quarterback of all time (Go Blue!).

Not surprisingly, all the sports talk shows and corner bars across the country are filled with "Monday Morning Quarterbacks" criticizing the Falcons' self-destructive play calling, which was admittedly atrocious. But one other group is getting just as much condemnation: the burgeoning sports analytics community.

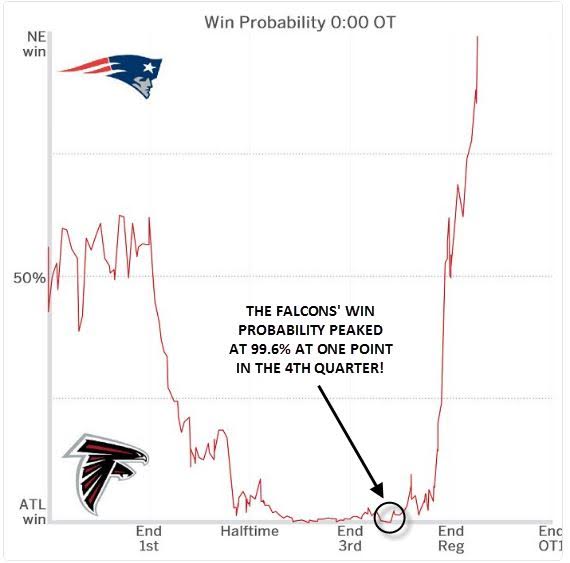

All the newfangled "live win probability trackers" unanimously had the Falcons as overwhelming favorites to win late in the game. The below chart, courtesy of ESPN.com, had the Falcons as high as 99.6% likely to win at one point in the fourth quarter. No doubt many Atlanta residents were already planning on requesting a day off from work to attend the victory parade:

Source: ESPN.com

Surely, some fans argue, the ex post fact that the Patriots won (to say nothing of other recent long short bets including Brexit, the Cleveland Cavaliers comeback from 3-1 down in the NBA finals, and Trump's run to the White House) invalidates the use of such statistical models?

While I'll be the first to argue that perhaps some of the models were too confident in their conclusions, especially around the US election, the fact remains that such models can only give probability-based forecasts, not guarantees. 99.6% is not 100.00%.

Even if better programmers and more advanced statistical programming in the future determines that the Falcons' hypothetical win probability was "only" 99% or 95%, the fact remains that it's overwhelmingly difficult to come back from down 19 points with less than ten minutes left in a football game. The closest historical statistic that I could find was that teams that were down at least 17 points after the third quarter were 0-133 in NFL playoff history before last night, and the Patriots situations was even more dire than that.

So what does this mean for investors? There are two big lessons for market participants to draw from the Patriots historic comeback:

Lesson #1: History can provide perspective on future outcomes, but never certainty.

It's often said the most dangerous words in investing are "this time is different," but the truth is that every time is different. Even if situation A has led to result B the last 133 times it appeared, that doesn't mean that it will on the 134th time (especially when you have mitigating factors, such as the best coach-quarterback pairing of all time on one side).

Speaking of greatest-of-all-time experts in their field, Warren Buffett once said that "diversification is a hedge for ignorance." Even if we judge a certain outcome is 99.6% likely (an investing impossibility given the pseudo-random nature of markets), we're still ignorant of whether any given trial will fall into the 99.6% "bucket" or the 0.4% "bucket." That's why diversification and proper position sizing are absolutely essential.

Lesson #2: Evidence-based thinking is still the only strategy with any hope of long-term success

Today's Monday Morning Quarterbacks are all denigrating live win probability models, but uniformly discarding such tools is "throwing out the proverbial baby with the bath water." Rather than scrapping an evidenced-based forecasting method after an unlikely event occurs, such occurrences provide an opportunity to review the model and determine if its analysis is still valid.

As far as I know, there haven't been any major changes to the rules or structure of the game of football that would render models based on historical NFL games invalid. Similarly, even if we see another "six-sigma flash crash" in the markets, that doesn't mean you should immediately abandon a previously profitable strategy or investment plan.

After all, there is at least one certainty for investors: the fly-by-the-seat-of-your-pants alternative to an evidence-based process is the only guaranteed way to lose money in markets.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Editors’ Picks

EUR/USD: US Dollar comeback in the makes? Premium

The US Dollar (USD) stands victorious at the end of another week, with the EUR/USD pair trading near a four-week low of 1.1742, while the USD retains its strength despite some discouraging American data released at the end of the week.

Gold: Escalating geopolitical tensions help limit losses Premium

Gold (XAU/USD) struggled to make a decisive move in either direction this week as it quickly recovered above $5,000 after posting losses on Monday and Tuesday.

GBP/USD: Pound Sterling braces for more pain, as 200-day SMA tested Premium

The Pound Sterling (GBP) crashed to its lowest level in a month against the US Dollar (USD), as critical support levels were breached in a data-packed week.

Bitcoin: No recovery in sight

Bitcoin (BTC) price continues to trade within a range-bound zone, hovering around $67,000 at the time of writing on Friday, and falling slightly so far this week, with no signs of recovery.

US Dollar: Tariffed. Now What? Premium

The US Dollar (USD) reversed its previous week’s decline, managing to stage a meaningful rebound and retesting the area just above the 98.00 barrier when tracked by the US Dollar Index (DXY).

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.