Professional traders always are in search of key levels that either repel price or, after trading through it, accelerate price action in a predictable direction. The Camarilla pivot point trading strategy is a technique that has an astounding accuracy in both regards, with particularly reliable performance for day-trading equities. Camarilla pivot points were discovered in 1989 by Nick Scott, a successful bond trader. The basic thesis for this strategy is a common one: That price, as most time series, has a tendency to revert to its mean, right up until the point it doesn’t.

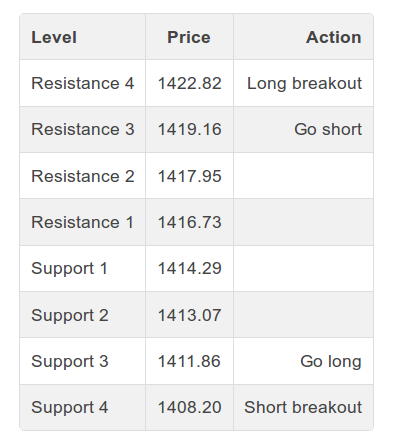

As compared to classic pivots where traders look for Resistance 1 and Support 1 levels, the most important levels for the Camarilla pivot point variation are the third and fourth levels. Examples of each level, along with what might be considered an appropriate trade action, are shown here:

Camarilla pivot point calculations are rather straightforward. We need to input the previous day’s open, high, low and close. The formulas for each resistance and support level are:

- R4 = Close + (High – Low) * 1.1/2

- R3 = Close + (High – Low) * 1.1/4

- R2 = Close + (High – Low) * 1.1/6

- R1 = Close + (High – Low) * 1.1/12

- S1 = Close – (High – Low) * 1.1/12

- S2 = Close – (High – Low) * 1.1/6

- S3 = Close – (High – Low) * 1.1/4

- S4 = Close – (High – Low) * 1.1/2

The calculation for further resistance and support levels varies from this norm. These levels can come into play during strong trend moves, so it’s important to understand how to identify them. For example, R5, R6, S5 and S6 are calculated as follows:

- R5 = R4 + 1.168 * (R4 – R3)

- R6 = (High/Low) * Close

- S5 = S4 – 1.168 * (S3 – S4)

- S6 = Close – (R6 – Close)

Trading strategies

Camarilla pivot points are interesting in that they offer guidance for both sideways and trending markets. Depending on the price levels in play, the indicator can suggest a trade that would exploit a reversion to the mean or a breakout to new highs or lows. Let’s walk through various hypothetical trading scenarios to demonstrate the utility of this approach.

Scenario 1: Price opens at or between Support 3 and Resistance 3

When price opens between S3 and R3, we will use the following rules to guide our trade execution:

- Long trades: Let the price move to S3. At S3, go long with a stop loss placed five ticks below S4. Profit targets for this trade are R1, R2 and R3.

- Short trades: Let the price move to R3. At R3, go short with a stop loss placed five ticks above R4. Profit targets for this trade are S1, S2 and S3.

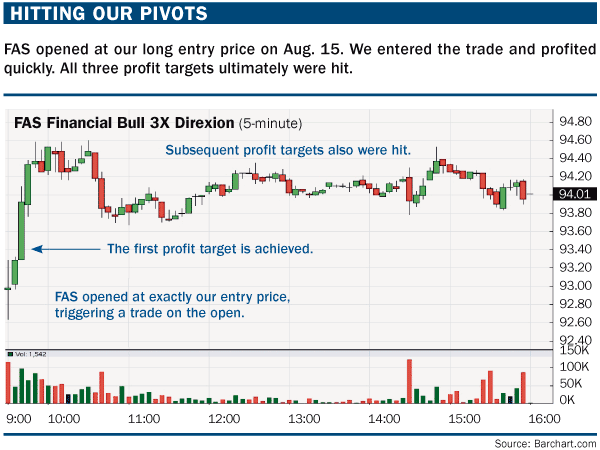

The Financial Bull 3X Direxion (FAS) exchange-traded fund (ETF) tracks the value of financial sector stocks and provides roughly three times the leverage of cash positions in these stocks.

On Aug. 14, FAS had the following: Open, 94.50; high, 95.14; low, 92.55; close, 93.35. Based on these values, our Camarilla pivot point resistance and support levels are:

- R1 = 93.59; R2 = 93.82; R3 = 94.06; R4 = 94.77

- S1 = 93.11; S2 = 92.88; S3 = 92.64; S4 = 91.93

Thus, the trading strategy for Aug. 15 is:

- Buy at 92.64. Stop loss: 91.88; Profit targets: 93.59, 93.82, 94.06

- Sell at 94.06. Stop loss: 94.82; Profit targets: 93.11, 92.88, 92.64

The trade worked out. On Aug. 15 FAS opened at the lower end of the range and our long trade at S3 (92.64) was triggered immediately. Price quickly reached our price targets, and we scaled out of the trade (see “Hitting our pivots,” below). Another helpful risk-control guideline is to manage the stop loss actively. In this case, we moved the stop loss to the entry price when the first profit target was hit.

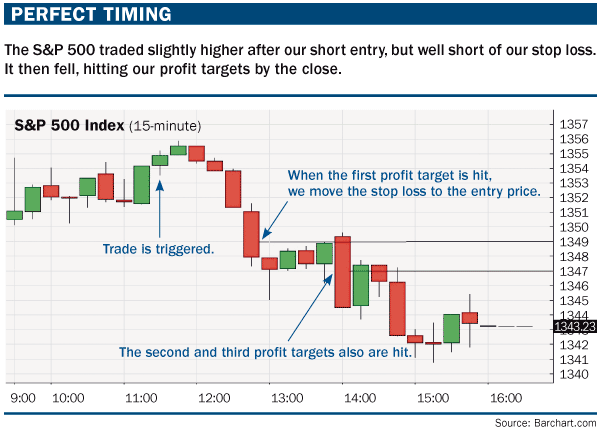

Now consider another example of the same technique using the S&P 500. On Feb. 14, the S&P 500 had the following: Open, 1351.30; high, 1351.30; low, 1340.83; close, 1350.50. Inputting these prices into the formulas, we find that our Camarilla pivot point resistance and support levels are:

- R1 = 1351.46; R2 = 1352.42; R3 = 1353.38;

- R4 = 1356.26 S1 = 1349.54; S2 = 1348.58; S3 = 1347.62; S4 = 1344.74

Thus, the trading strategy for Feb. 15 is:

- Buy at 1347.62. Stop loss: 1344.69; Profit targets: 1351.46, 1352.42, 1353.38

- Sell at 1353.38. Stop loss: 1356.31; Profit targets: 1349.54, 1348.58, 1347.62

On Feb. 15, the S&P 500 opened at 1350.52, which is between S3 and R3. A short trade was triggered, per our plan, at 11:15 a.m. Subsequently, the S&P 500 made a high of 1355.87, below our stop loss. The market reversed lower and all profit targets were hit by 2 p.m. (see “Perfect timing,” below).

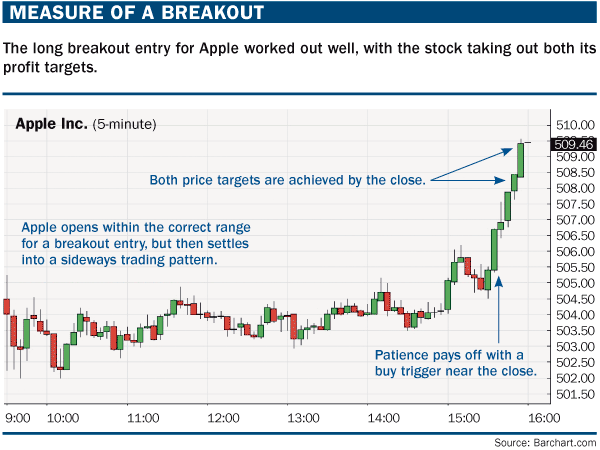

Scenario 2: Camarilla pivot points also are useful in identifying breakout trades. If price breaks beyond Resistance 4 or Support 4, a trade with the trend rather than a reversion trade is signaled. For example, a long trade is set up when price opens between Resistance 3 and Resistance 4. We will buy if price continues above Resistance 4, with profit targets at Resistance 5 and Resistance 6 and a stop loss placed five ticks below Resistance 3.

We can demonstrate with Apple. On Feb. 13, Apple had the following: Open, 499.74; high, 503.83; low, 497.09; close, 502.60. Given these values, our Camarilla pivot point resistance levels are:

- R3 = 504.45; R4 = 506.31; R5 = 508.47; R6 = 509.41

So, our breakout strategy for Feb. 14 is to buy at 506.31 with profit targets at 508.47 and 509.41. Our initial stop loss will be five ticks below R3, or 504.40. It played out, as Apple opened at 504.5 — between R3 and R4 — with the trade triggered at 3:35 p.m., after which Apple achieved the first profit target at 508.47 three (five-minute) bars later and the second profit target immediately after that (see “Measure of a breakout,” below).

Now, let’s look at an example of a short breakout trade. Our logic is the mirror image of the long breakout entry. A short trade is set up when price opens between Support 3 and Support 4. We will sell if price continues below Support 4, with profit targets at Support 5 and Support 6 and a stop loss placed five ticks above Support 3.

Our example will be based on Exxon Mobil. On March 27, Exxon had the following: Open, 87.13; high, 87.25; low, 86.54; close, 86.62. Given these values, our Camarilla pivot point support levels are:

- S3 = 86.42; S4 = 86.23; S5 = 86.00; S6 = 85.91

This means our strategy for March 28 is to sell at 86.23 if the market opens below 86.42 but above 86.23. Our profit targets will be 86.00 and 85.91. The stop loss is five ticks above 86.42, or 86.37. On March 28, Exxon opened at 86.30 and our short breakout entry was triggered at 9:40 a.m. Both profit targets were hit at 10:30 a.m. (see “Short profits,” below).

Camarilla pivot points are simple but versatile trading tools. They help to find the upper and lower trading ranges for a stock on any particular day. Patience and discipline are key. Traders must wait for the prices to be hit before taking action. Once a trader is comfortable with the core technique, further refinement is possible by combining this strategy with the relative strength index and moving averages.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Editors’ Picks

Gold plunges on sudden US Dollar demand

Gold drops markedly on Thursday, challenging the $4,900 mark per troy ounce following a firm bounce in the US Dollar and amid a steep sell-off on Wall Street, with losses led by the tech and housing sectors.

EUR/USD turns negative near 1.1850

EUR/USD has given up its earlier intraday gains on Thursday and is now struggling to hold above the 1.1850 area. The US Dollar is finding renewed support from a pick-up in risk aversion, while fresh market chatter suggesting Russia could be considering a return to the US Dollar system is also lending the Greenback an extra boost.

GBP/USD change course, nears 1.3600

GBP/USD gives away its daily gains and recedes toward the low-1.3600s on Thursday. Indeed, Cable now struggles to regain some upside traction on the back of the sudden bout of buying interest in the Greenback. In the meantime, investors continue to assess a string of underwhelming UK data releases released earlier in the day.

LayerZero Price Forecast: ZRO steadies as markets digest Zero blockchain announcement

LayerZero (ZRO) trades above $2.00 at press time on Thursday, holding steady after a 17% rebound the previous day, which aligned with the public announcement of the Zero blockchain and Cathie Wood joining the advisory board.

A tale of two labour markets: Headline strength masks underlying weakness

Undoubtedly, yesterday’s delayed US January jobs report delivered a strong headline – one that surpassed most estimates. However, optimism quickly faded amid sobering benchmark revisions.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.