A different topic for us to look at today as we await the outcome of the US elections. Around 15% of daily spot FX trading is executed by algorithms. So, what is an algorithm? It is an automated trading program that places a trade according to a pre-defined set of instructions. These algorithms have developed from very simple rule based mechanisms to more advanced strategies that respond to different market conditions.

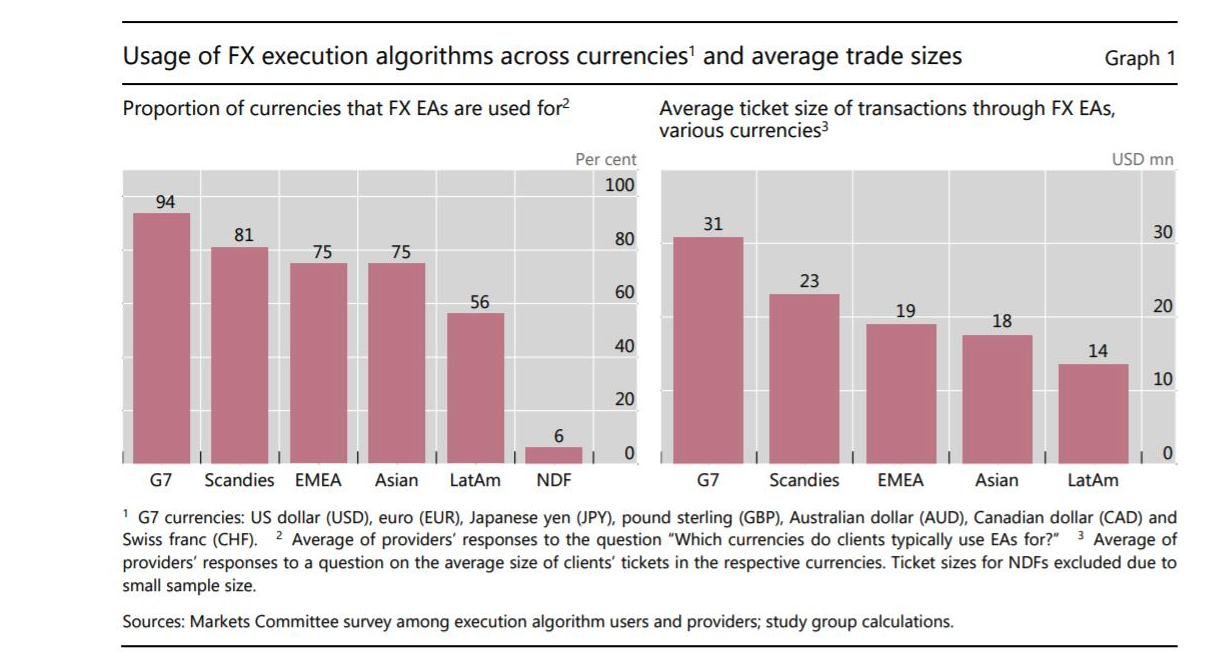

So, which are the main currencies are using EA’s?

In a Markets Committee survey where algorithm providers where asked which currencies EA’s were used with and what the size of the ticket was the following answered were given. Look at the results of the survey below. It is no surprise that around 94% of G7 currencies have clients using EA’s. This is for the major currencies like the USD, the EUR and the GBP etc. The average ticket size is around 31 million for this G7 block.

So, what are the consequences of using algorithms?

One hidden impact of their use has been a move towards market makers, often the bank, trying to match orders internally without passing them on to external venues. This trend has now raised some concerns with the Bank of International Settlements as if too much internal order sorting takes place then the quality of prices reported may be undermined. You could envisage a situation where the reported prices is not reflecting the true price. This could also cause the trading volumes on primary venues to drop. This matters because prices from primary trading venues such as Refinitiv and EBS are used as reference prices for other currency trading platforms and for bilateral trading.

Another impact to be aware of is the rise of ‘flash crashes’. These are sudden violent moves in markets and they appear to be accented by algorithmic trading. The most likely time for a flash crash is after the close of the US session and before the open of the Asian session, so this is something to be aware of if you are holding trades over that time.

Our products and commentary provides general advice that do not take into account your personal objectives, financial situation or needs. The content of this website must not be construed as personal advice.

Editors’ Picks

AUD/USD retargets 0.7100 ahead of RBA Minutes

AUD/USD keeps the slightly bid bias around 0.7070 ahead of the opening bell in Asia. Indeed, the pair reverses two daily pullbacks in a row, meeting some initial contention around 0.7050 while investors gear up for the release of the RBA Minutes early on Tuesday.

EUR/USD keeps the rangebound trade near 1.1850

EUR/USD is still under pressure, drifting back towards the 1.1850 area as Monday’s session draws to a close. The modest decline in spot comes as the US Dollar picks up a bit of support, while thin liquidity and muted volatility, thanks to the US market holiday, are exaggerating price swings and keeping trading conditions choppy.

Gold battle around $5,000 continues

Gold is giving back part of Friday’s sharp rebound, deflating below the key $5,000 mark per troy ounce as the new week gets underway. Modest gains in the US Dollar are keeping the metal in check, while thin trading conditions, due to the Presidents Day holiday in the US, are adding to the choppy and hesitant tone across markets.

AI Crypto Update: Bittensor eyes breakout as AI tokens falter

The artificial intelligence (AI) cryptocurrency segment is witnessing heightened volatility, with top tokens such as Near Protocol (NEAR) struggling to gain traction amid the persistent decline in January and February.

The week ahead: Key inflation readings and why the AI trade could be overdone

It is likely to be a quiet start to the week, with US markets closed on Monday for Presidents Day. European markets are higher across the board and gold is clinging to the $5,000 level after the tamer than expected CPI report in the US reduced haven flows to precious metals.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.