I think that we would all agree on the fact that this has been an eventful year in the world of politics and has most definitely had an impact on the global financial markets as such. What started with a Brexit, swiftly led on to a shock election for Donald Trump, rounding off nicely with a snap general election in my home country of Great Britain. Huge moves in the financial markets fueled by political surprises have now become the norm and incorporating tactics to deal with this has become more necessary than ever before. I said it once and I’ll say it again however, if you are looking at the markets through the eyes of an institution instead of the eyes of a retail investor, you are more likely to be able to approach your speculative activities from a point of safety rather than regret.

As I engage with students and prospective students alike, the questions arise frequently about how we teach our graduates of Online Trading Academy to work around times of such uncertainty. If you have read one of my articles before, you will know that the number one decision-making factor which all traders and market speculators must be aware of is the behavior of price, and more importantly what moves prices up and down. Supply and demand created by major banks and institutions is the fuel which drives the markets, and by recognizing and understanding the footprints of these big market players we too can spot the imbalances which create major demand and supply zones and in turn give us low risk and high reward trading opportunities on a frequent basis. Once you understand the nature of price, you then factor the news around it.

What better example to use from recent events than the UK election which took place on June 8, 2017? This is not the first example I’ve shown you through one of these articles of how price and economic news can work in harmony, and how the discipline to trade, armed with a solid risk management plan around all outcomes produces positive results. Too many people attempt to read the news and then decide on which trade to take after. This retail thinking is what always gets them late to the action and forces them to chase price. The professional simply looks for what the big banks and institutions are doing and follows along. Let’s face it, the biggest orders will create the biggest imbalances, which in turn create great levels of demand and supply and I think we all know who has deep enough pockets to create orders of that size, don’t we?

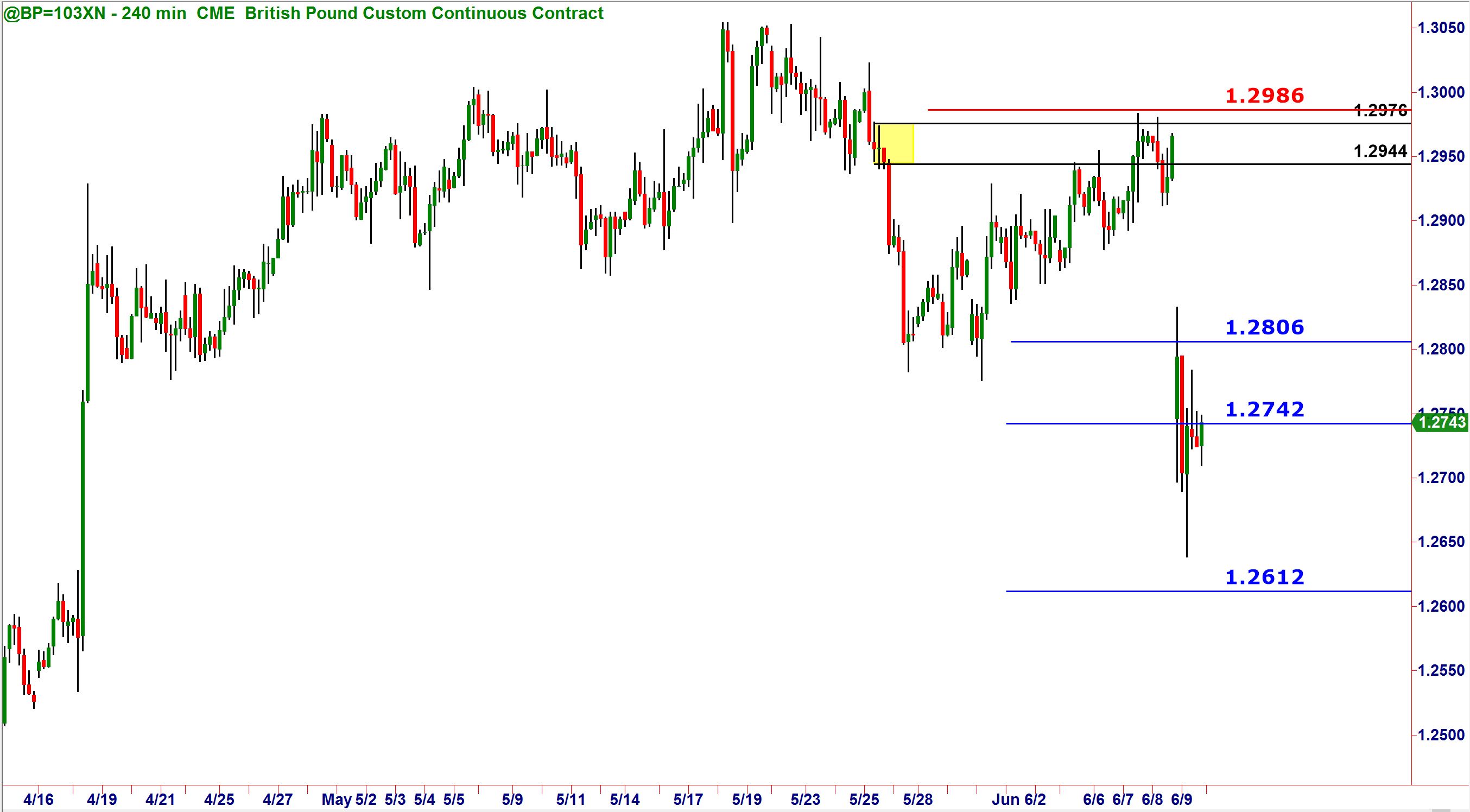

News will come and news will go but our job is to trade the plan and the zones consistently, regardless of what we may think or hear in the press. Let’s look at a recent XLT session I did last week on the British Pound Futures, over a week before the UK Election:

In this session from May 31st, 2017, I identified a clean level of supply for a nice short on the GBPUSD Futures. As we can see, price was still nowhere near the entry, thus allowing us to set and forget the trade ahead of time. As with all XLT sessions, the instructor will share with the class the entry, stop and targets clearly for all to see, via the prep screen and by drawing on the chart itself. We went to do this as necessary:

You will see that the prep screen on the left of the screenshot gives us the numbers for the trade and I then drew these in on the chart, with red for the stop loss and the 2 targets in blue below. I also looked much lower still for a third target as well, which can be seen here:

With these factors all planned, this gives all 520 students in the room the opportunity to consider this trade for themselves and do their own position sizing around the numbers and trade given to them. Once this is done, we put the orders in for a “Set and Forget” approach and let the markets do their thing.

Now as this trade was planned on May 31st, we did know that the UK election was happening just over a week later but with the orders set and the trade planned we just stick to the rules and don’t get caught up in the emotions. As you may or may not know, the result of the election saw the Conservative Party win more seats than any others but not enough to have a majority representation in the Houses of Parliament. This is known as a “Hung Parliament” scenario and is never a good thing. The Prime Minister, Theresa May, has managed to cling to power by forming a fragile alliance with the Northern Irish Democratic Unionist Party to get her majority, but it has really shaken political confidence across the markets as a result. No big surprises therefore, when the British Pound sold off sharply in reaction to the news. Interestingly though, look where the sell-off originated from:

Notice how the downside move started from our supply zone we marked off 1 week prior to the election? Our students were already in short, before the bad news where most would have been selling afterwards. All this was simply achieved by following the footprints of the banks as our primary decision-making tool, not second-hand news. You will also see why it is important to factor in a decent buffer for our stop loss order too (which should also be rules-based) otherwise trade would have taken us out painfully, only to see the market drop in our direction.

So, the lesson of the day: don’t let the news be your primary decision-making tool. Don’t worry about what you may hear or read as it will always influence your choices and, more importantly, will be far too late to the game. The last thing you want to do is chase the action when you should be letting it come directly to you. I hope you found this useful.

The information provided is for informational purposes only. It does not constitute any form of advice or recommendation to buy or sell any securities or adopt any investment strategy mentioned. It is intended only to provide observations and views of the author(s) or hosts at the time of writing or presenting, both of which are subject to change at any time without prior notice. The information provided does not have regard to specific investment objectives, financial situation, or specific needs of any specific person who may read it. Investors should determine for themselves whether a particular service or product is suitable for their investment needs or should seek such professional advice for their particular situation. Please see our website for more information: https://bustamanteco.com/privacy-policy/

Editors’ Picks

EUR/USD recedes to daily lows near 1.1850

EUR/USD keeps its bearish momentum well in place, slipping back to the area of 1.1850 to hit daily lows on Monday. The pair’s continuation of the leg lower comes amid decent gains in the US Dollar in a context of scarce volatility and thin trade conditions due to the inactivity in the US markets.

GBP/USD resumes the downtrend, back to the low-1.3600s

GBP/USD rapidly leaves behind Friday’s decent advance, refocusing on the downside and retreating to the 1.3630 region at the beginning of the week. In the meantime, the British Pound is expected to remain under the microscope ahead of the release of the key UK labour market report on Tuesday.

Gold looks inconclusive around $5,000

Gold partially fades Friday’s strong recovery, orbiting around the key $5,000 region per troy ounce in a context of humble gains in the Greenback on Monday. Additing to the vacillating mood, trade conditions remain thin amid the observance of the Presidents Day holiday in the US.

Bitcoin consolidates as on-chain data show mixed signals

Bitcoin price has consolidated between $65,700 and $72,000 over the past nine days, with no clear directional bias. US-listed spot ETFs recorded a $359.91 million weekly outflow, marking the fourth consecutive week of withdrawals.

The week ahead: Key inflation readings and why the AI trade could be overdone

It is likely to be a quiet start to the week, with US markets closed on Monday for Presidents Day. European markets are higher across the board and gold is clinging to the $5,000 level after the tamer than expected CPI report in the US reduced haven flows to precious metals.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.