Trade is not nuclear science, but neither is it a simple process in which everyone can easily participate. There is a long way to go to understand the needs of traders and the type of tools they actually use in order for a trader to successfully participate in the trading process. Five are the fundamental tools a trader needs in order to participate successfully and systematically upgrade his skills in trading:

Selection of financial instruments

There are dozens of models that a trader uses in trading. Depending on the market conditions and the estimates that they make, traders select simple or complex models to take advantage of the market movements.

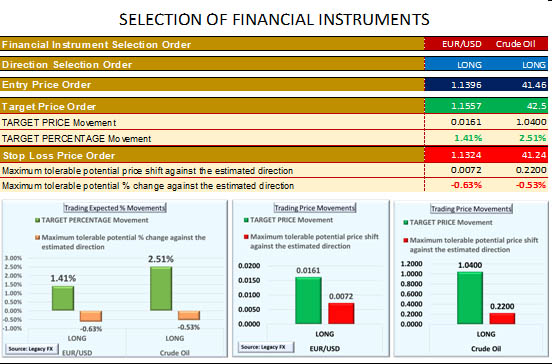

Whether it is the models that make a profit when there is a trend in the market or the models that make a profit from the horizontal movement of the market, the crucial issue is that all these models in each case must clearly define the following three values: the entry price, target price and stop-loss price as a trader select to trade a financial instrument.

No financial instrument should be selected if these prices cannot be accurately determined by the model.Instead, each financial instrument (commodity, currency, index, or stock) can be selected for trading if the above prices can be set.

For example, a trader may take a long position for example in the following financial instruments: EUR / USD and Crude Oil, provided that entry prices, target prices and Stop loss prices can be set, as follows:

Why are these prices important?

Because they are used in the calculation of the optimal size and the calculation of the profitability of a trade.

Risk limitation

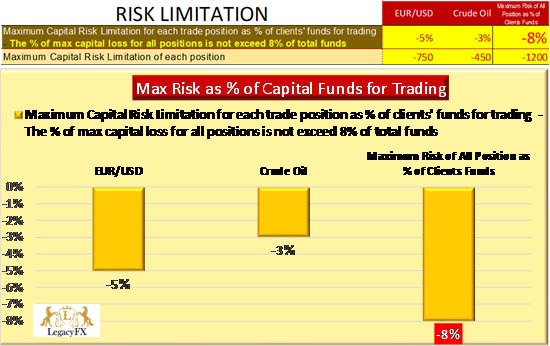

The risk limitation of trading positions is defined as the percentage of maximum acceptable potential loss with respect to the total funds intended for trade.

Suppose an investor has 15,000 capitalfor trading in CFD Market.

The risk limitation for all investment or trading positions must not exceed 8% of the total funds for trading. The limit of 8% has not been determined by chance. In fact, it has been found that for most traders, 8% of a potential loss on total capital funds for trading, is the greatest limit of loss that if happens a trader can tolerate and manage it in a rational way.

Suppose a trader holds the two positions as shown in the exampleabove.As the maximum loss of all positions held by a trader cannot exceed -8%, we assume that the trader sets for the pair of EUR/USD a maximum loss in terms of total funds -5% and for the Crude Oil maximum loss in terms of total funds -3%. In terms of capital for trading that represents total loss of 15,000*8%=1,200.

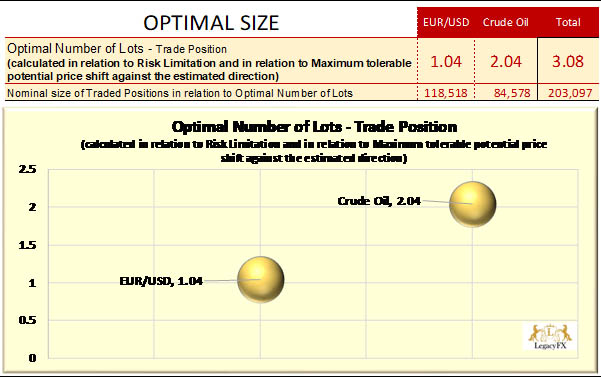

Optimal size

Once tradersare able to set entry and stop-loss rates, and since they can set the risk limitation for each position, they are also able to set the optimal size for each trading or investment position.

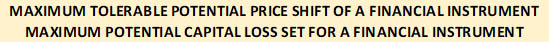

The Optimal Number of Lots, Contracts or Shares for a Trade or investment Position is calculated by dividing, the Maximum tolerable potential price shift of a financial instrument (entry price minus stop loss price), with the maximum potential capital loss -Risk Limitation- set for that financial instrument.

Thus, based on the previous example and making the appropriate calculations, the following results are obtained where the number of lots and the nominal value of the positions in relation to the optimal number of lots are:

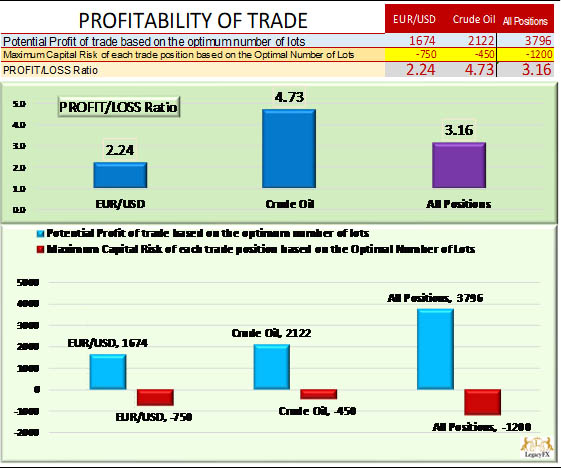

Profitability of trade

Based on the optimal size for each trading or investment position can be calculated the potential Profit and the Maxim Capital Loss for each trade position.

By dividing Potential Profit with Maxim Capital Loss for a trade position we get Profit/Loss Ratio:

A trade position is assumed as profitable when the Profit/Loss ratio is much higher than 1. The higher it is, the more profitable the trading position is judged.

Regarding the previous example, the profitability with the profit and loss ratio is calculated as follows:

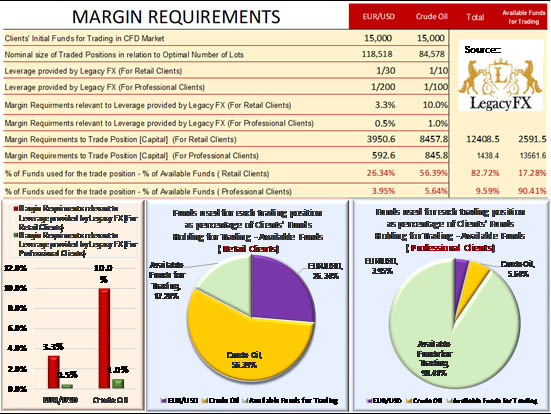

Margin requirements

The trading positions have a nominal size calculated in relation to the characteristics of the financial instrument and the optimal number of lots.

A trader in the CFD market uses only a certain percentage of capital from his funds, compared to the nominal size of the financial instrument, to maintain a trading position on the optimal number of lots.

The Margin requirements for each investment or trading position depends on the characteristics of the financial instruments and the leverage provided by a trading platform.

Professional Clients need much lower margin requirements from retail customers, which means that they always have more available funds. Thus, they are in a better position as they get the trading positions they need while diversifying their portfolios making them more efficient.

In the table below you can see the margin requirements and how they are distributed comparatively between the retail and professional clients.

Once a trader understands the above issues, he can significantly improve his trading capacity in all markets and in all financial instruments.

In other words, the main questions on which traders need to address are:

-

What do they really need so that they can be able to SELECT FINANCIAL INSTRUMENTS?

-

How do they LIMIT their exposure to RISK to a certain level?

-

How do they calculate the OPTIMUM POSITION to be taken when trade in a financial instrument?

-

How do they evaluate if a trade can be PROFITABLE?

-

How capital MARGINS for each trade are calculated?

The answers are given in this article. By having understood the value of these answers and having the appropriate tools to address them, a trader will be able to really upgrade his trading skills.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. The Article/Information available on this website is for informational purposes only, you should not construe any such information or other material as investment advice or any other research recommendation. Nothing contained on this Article/ Information in this website constitutes a solicitation, recommendation, endorsement, or offer by LegacyFX and A.N. ALLNEW INVESTMENTS LIMITED in Cyprus or any affiliate Company, XE PRIME VENTURES LTD in Cayman Islands, AN All New Investments BY LLC in Belarus and AN All New Investments (VA) Ltd in Vanuatu to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. LegacyFX and A.N. ALLNEW INVESTMENTS LIMITED in Cyprus or any affiliate Company, XE PRIME VENTURES LTD in Cayman Islands, AN All New Investments BY LLC in Belarus and AN All New Investments (VA) Ltd in Vanuatu are not liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the website, but investors themselves assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Article/ Information on the website before making any decisions based on such information or other Article.

Editors’ Picks

EUR/USD treads water around 1.1900

EUR/USD edges a tad lower around the 1.1900 area, coming under mild pressure despite the US Dollar keeps the offered stance on turnaround Tuesday. On the US data front, December Retail Sales fell short of expectations, while the ADP four week average printed at 6.5K.

GBP/USD looks weak near 1.3670

GBP/USD trades on the back foot around the 1.3670 region on Tuesday. Cable’s modest retracement also comes in tandem with the decent decline in the Greenback. Moving forward, the US NFP and CPI data in combination with key UK releases should kee the quid under scrutiny in the next few days.

Gold the battle of wills continues with bulls not ready to give up

Gold comes under marked selling pressure on Tuesday, giving back part of its recent two day advance and threatening to challenge the key $5,000 mark per troy ounce. The yellow metal’s correction follows a better tone in the risk complex, a lower Greenback and shrinking US Treasuty yields.

AI Crypto Update: BankrCoin, Pippin surge as sector market cap steadies above $12B

The Artificial Intelligence (AI) segment is largely on the back foot with major coins such as Bittensor (TAO) and Internet Computer (ICP) extending losses amid a sticky risk-off sentiment.

Dollar drops and stocks rally: The week of reckoning for US economic data

Following a sizeable move lower in US technology Stocks last week, we have witnessed a meaningful recovery unfold. The USD Index is in a concerning position; the monthly price continues to hold the south channel support.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.