"I had a buddy who picked a perfect bracket two years in a row! He went back and looked at the players' high school stats and everything!"

I was on a college trip with our investing club with that guy. You know the kind, the dreaded "One-Upper":

...If you had a friend who got a perfect score on a college entrance exam, Mr. One-Upper had done it himself...in middle school.

...If you went on a helicopter ride on a family trip to Hawaii, his uncle had invented the helicopter...and then used it to discover Hawaii.

...And as I had just found out, if you had once correctly picked 15 of the first 16 games of the NCAA basketball tournament, he had a buddy who put your "accomplishment" to shame.

He was, of course, either lying or badly misinformed. But his assertion gets at the most fundamental reason that its possible, though far from easy, for some traders and investors to earn market-beating returns.

For those who are not familiar, the NCAA college basketball tournament, colloquially dubbed "March Madness," has resumed its annual tradition of taking over the computer screens and attentions spans of Americans. According to a study by consultancy Challenger, Gray & Christmas, the act of filling out the brackets, checking scores, at outright watching the games at work costs US employers upwards of $4 Billion in lost productivity each year.

And if you've ever created your own bracket, you know that there's one emotion that quickly comes to dominate all others: regret. If only you had done a bit more research into the free throw shooting percentages of that team or the propensity for this team to struggle against zone defense, then you would have seen that upset coming.

And it's a fool's errand. At some point, the relationship between the sophistication of your analysis and the likelihood of success breaks down. The role of lucky and randomness takes over.

The world's most renowned investor, Warren Buffett, famously offered a cool $1B to anyone who filled out a perfect bracket. The oft-cited odds of correctly picking 63 consecutive games is 1 in 9,200,000,000,000,000,000, though the experts at FiveThirtyEight suggest that the actual odds are "only" 1 in about 1,500,000,000 most years. The point is that, even if you deeply researched the players' high school stats, as Mr. One Upper's friend ostensibly did, there are too many random variables to correctly predict every game...much less to do it consecutively!

The best you can hope for is a bracket that identifies potentially vulnerable favorites, underseeded upsets and correctly selects the champion. This is the same exact type of attitude that you should adopt with your trading. With all the economic, political, and technical crosscurrents that buffet the market every day, it's impossible to design a trading or investing strategy that wins 100% of its trades...even if you research the CEO's high school math grades!

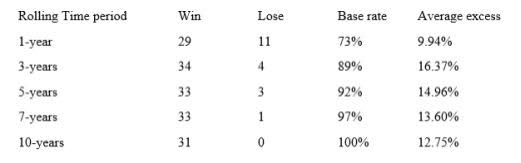

James O'Shaughnessy, who quite literally wrote the book on investing strategy (What Works on Wall Street), recently opined on a similar topic. He studied the historic probability of Warren Buffett's Berkshire Hathaway (BRK.B), which we know in hindsight has been one of the greatest stocks of all-time, outperforming the overall stock market over different time periods:

Obviously, Buffett's track record is stellar, but even "The Oracle of Omaha" has had a greater than 1 in four shot of underperforming the overall stock market in any given year. Indeed, BRK.B has trailed the stock market over a five-year basis nearly 10% of the time.

Imagine where you were five years ago. Now imagine that your favorite investment had underperformed a simple, stupid S&P 500 index fund over those last five years. Would you have the confidence and temerity to stick with that investment? Chances are many of Buffett's "long-term" investors jumped ship during these periods of underperformance, which was in hindsight, one of the worst things they could do.

Don't fall into Mr. One-Upper's trap of thinking you can pick the perfect bracket or the perfect trading/investing strategy. The best you can hope for is a consistent process that identifies higher-probability outcomes for your timeframe, limits risk in the (inevitable) event that the market moves against you, and the discipline to stick to your strategy even when it temporarily underperforms.

We might not have quite as long of a track record as Warren Buffett, but that's exactly what we at Faraday Research have been doing for years...just don't ask us for help with your bracket!

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Editors’ Picks

EUR/USD faces some resistance near 100-SMA on H4, around 1.1830 zone

The EUR/USD pair gains some follow-through positive traction for the second consecutive day and climbs to the 1.1830 region during the Asian session on Thursday. The US Dollar remains on the back foot amid concerns about the economic fallout from US President Donald Trump's erratic trade policies and acts as a tailwind for spot prices.

USD/JPY tumbles below 156.00 on hawkish BoJ-speak, risk-off mood

USD/JPY holds lower ground below 156.00 in the Asian session on Thursday, deep in the red amid hawkish BoJ commentary, looming intervention fears and risk-off mood, which lend support to the Japanese Yen. The US Dollar remains on the back foot amid concerns about the fallout from Trump's trade policies, adding to the pair's downside.

Gold struggle with $5,200 extends ahead of more US-Iran talks

Gold is replicating the recovery moves seen in Wednesday’s Asian trading early Thursday, as buyers continue to flirt with the $5,200 level. Sustained US Dollar weakness and looming US-Iran talks aid the bright metal’s rebound.

Stellar: Relief bounce fades as bearish undertone persists

Stellar is trading around $0.16 at the time of writing on Thursday after rebounding more than 8% in the previous day. Derivatives data paints a negative picture as XLM’s short bets hit a monthly high while Open Interest continues to decline.

Nvidia delivers another monster earnings report, and forecasts big things to come

It was another monster earnings report from Nvidia for fiscal Q4. Revenues were $68.1bn, smashing estimates of $65bn. Gross profit margin was a healthy 75%, up from 73.5% in the prior quarter, and the outlook for this quarter was monstrous.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.