Learning to understand and effectively use support and resistance was a major turning point in my own trading. It is essential when trading that you find something that make sense to you, that you understand and believe in and that you are able to build a solid trading plan around. Support and resistance levels can at first seem quite difficult to engage as the levels may seem tricky to identify and this is why it is crucial that you firstly learn to properly identify support and resistance levels in the market and begin to understand how price reacts around them so that you are able to then move on to trading them.

If you aren’t already familiar with support and resistance levels then check out this brief video and for a more in-depth look check out this webinar recording.

The most basic way that we look to use support and resistance levels is to fade them, whereby we look to buy into support and sell into resistance. This type of strategy can work well initially with clearly defined levels as price moves into them for the first few times. However, as we build our Forex knowledge and start to learn more about how the market works we can start to take advantage of further dynamics at play around these important levels.

Understanding Order Flow

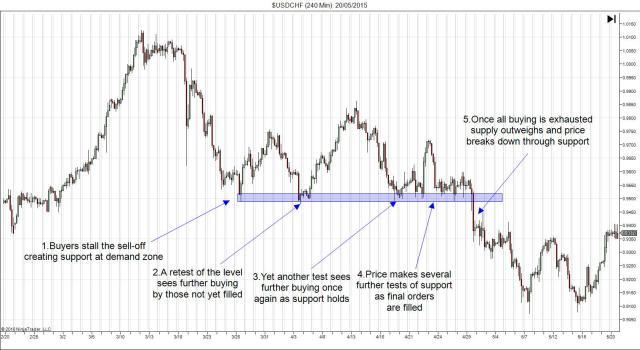

As we know, the reason that support and resistance levels exist is due to the underlying order flow in the market. A build up of buy orders creates support and a build up of sell orders creates resistance. Each subsequent time these levels are tested, the order at the level are eroded as more participants enter the market. Eventually, upon enough probing these orders giver way and the supply/demand balance shifts.

For example, as a surge in buying creates a support area, we see price bounce as buy orders are filled. If price then returns to that area we see further reactions higher as those buy orders not filled first time around are filled along with fresh buying. Subsequent returns to the level may similarly be met with further buying but eventually as all original buy orders are filled and fresh buying dries up to due to the lack of momentum we see a shift in the supply/demand scale and supply outweighs demand to take price lower.

Trading The Retest

The typical guidelines espoused for trading support and resistance suggest that the more times a specifics level or area is tested the stronger it becomes. Whilst it is true that levels displaying many tests are indeed strong, the idea that these levels become stronger with each touch is actually the opposite of what is happening due to the order flow dynamic we just discussed. An understanding of this dynamic paves the way for new trading opportunities in the market.

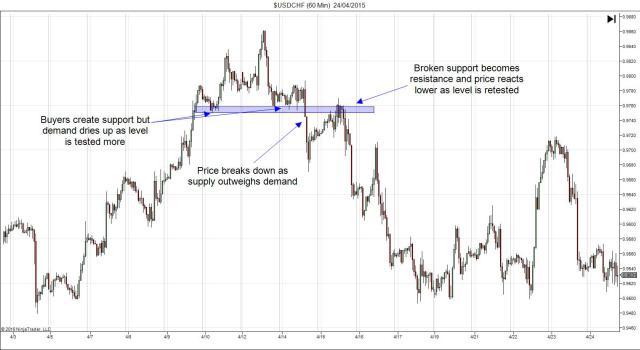

As broken support indicates the dominance of supply over demand in the market we need to adapt our view. The area that was once support, created by strong demand, now becomes resistance, created by supply. Where we previously might have looked to buy at that area, anticipating a reaction higher we can now look to sell, anticipating that as price returns to that level sell-orders previously unfilled will be filled along with potentially fresh selling interest.

Trading the retest of key levels in the market can be an extremely simple yet powerfully effective trading strategy. The beauty of the idea is that due to the underlying order flow creating the setup, you can really trade this on all time-frames as the same dynamic plays our over and over again on different scales. Even within the large example we are looking at I can clearly identify setups that would have been fantastic lower time-frame trading opportunities.

Lets zoom in further on the rectangular area highlighted in the chart above.

Can you see how exactly the same setup occurs on the lower time-frame? The very order flow dynamic that we were looking at in our larger 4hour chart setup is seen here working in precisely the same way on the 1hour charts.

Creating A Trading Plan

Once you have a raw trading idea in place such as we have here, you then need to think about really firming the idea up and shaping a solid trading plan that you can construct rules for, allowing you to consistently engage the market based on your plan.

Things to think about:

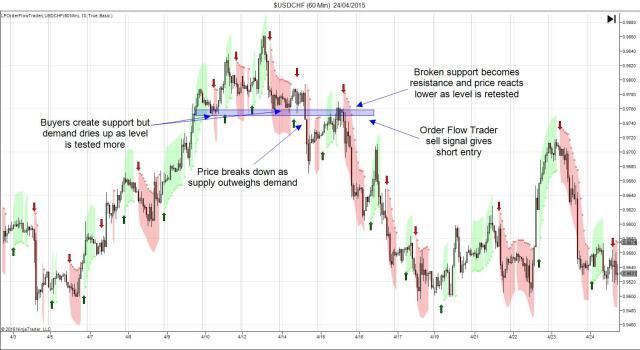

Will you simply trade a retest of the level or will you look for further confirmation such as identifying key price action signals? Alternatively, will you look to combine an indicator to act as a filter for your trades?

If you are looking to build indicators in to you system, Order Flow Trader can be a fantastic tool to use in these scenarios whereby you look to enter on an Order Flow Trader signal given as price reacts to the level retest.

Furthermore, you must consider your stop loss placement. Will you use structural levels such as recent key highs or lows, or will you use an ATR based stop considering the volatility of the instrument in your placement. If you use ATR based stops you should definitely check out our ATR Boundaries indicator which is an incredibly effective upgrade of the classic ATR indicator and can be really helpful in stop placement.

Finally you need to consider your targets. Will you run a simple risk:reward based system where you look to target x times your initial risk or will you consider market structure, targeting the next key level?

In considering your targets, one final point to note is that in terms of taking the very best setups and really looking to give yourself as good a shot as possible at placing a winning trade you should always be looking to trade with the trend and infact this simple setup can be a really effective way of gaining entry to trending markets. Simply establish the dominant trend on the higher time-frames and then drop down down onto the lower time-frames seeking to identify the retest of key broken support and resistance levels to give you entry in line with the dominant trend. This will give more weight to your trade and you may find that momentum affords you bigger winners, allowing you to trail stops rather than playing for a specific target.

All comments, charts and analysis on this website are purely provided to demonstrate our own personal thoughts and views of the market and should in no way be treated as recommendations or advice. Please do not trade based solely on any information provided within this site, always do your own analysis.

Editors’ Picks

EUR/USD: US Dollar to remain pressured until uncertainty fog dissipates Premium

The EUR/USD pair lost additional ground in the first week of February, settling at around 1.1820. The reversal lost momentum after the pair peaked at 1.2082 in January, its highest since mid-2021.

Gold: Volatility persists in commodity space Premium

After losing more than 8% to end the previous week, Gold (XAU/USD) remained under heavy selling pressure on Monday and dropped toward $4,400. Although XAU/USD staged a decisive rebound afterward, it failed to stabilize above $5,000.

GBP/USD: Pound Sterling tests key support ahead of a big week Premium

The Pound Sterling (GBP) changed course against the US Dollar (USD), with GBP/USD giving up nearly 200 pips in a dramatic correction.

Bitcoin: The worst may be behind us

Bitcoin (BTC) price recovers slightly, trading at $65,000 at the time of writing on Friday, after reaching a low of $60,000 during the early Asian trading session. The Crypto King remained under pressure so far this week, posting three consecutive weeks of losses exceeding 30%.

Three scenarios for Japanese Yen ahead of snap election Premium

The latest polls point to a dominant win for the ruling bloc at the upcoming Japanese snap election. The larger Sanae Takaichi’s mandate, the more investors fear faster implementation of tax cuts and spending plans.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.