Making major financial decisions that are truly best for you requires non–conventional thinking. There is a reason why the gap between Wall Street’s annual profits and the average investor’s is so wide. There is a reason why Wall Street revenues break records almost every year and the average investor hardly ever achieves their financial goals. It’s simply a matter of how both groups think which leads to the action that drives the results.

I started my career years ago on the Wall Street side of the business during my time on the trading floor of the Chicago Mercantile Exchange. What I saw first-hand was how vastly different the Wall Street professional “thinks the markets” vs. the average investor, for whom Wall Street serves. Wall Street returns may be a big stretch for the average investor, but if you even want to get close you had better start thinking and acting like Wall Street.

Price: the one word Wall Street doesn’t want you to think or ask about. The reason for this is because just about every financial decision you’re going to make requires you to buy something: Stocks from your broker or financial advisor, Annuities, Mutual Funds, Life Insurance Policies and more. In all cases, you are essentially buying something from someone which means they are trying to profit from your decision. With stocks for example, Wall Street owns the stock at a certain price and sells it to you at a higher price; your purchase of the stock is one of the many ways they profit. Don’t blame Wall Street, this is how the system is setup. Instead, realize that the responsibility to make the right decision is on one person, you. The goal is to first become aware of this issue, then understand how to make the right decision and, lastly, feel comfortable and confident doing it.

The average investor almost never asks what “price” they are buying a stock at. Make sure you do and that you buy on sale, just like Wall Street does. Wall Street professionals suggest buying and holding, but are they doing that? Wall Street focuses on “price” more than anything else when buying stocks, bonds and any financial instrument. The problem with buy and hold is it really means Buy at Any Price in the Market and Hold with No Plan for Risk or Profit. Does this make any sense to you? Do you think this is the strategy financial institutions use for their capital? Wall Street isn’t doing anything wrong, the average investor is and it is simply because of a lack of understanding. To really change your financial trajectory, there is only one answer in my opinion: Stop thinking and acting like an average investor and start thinking and acting like the big banks and financial institutions.

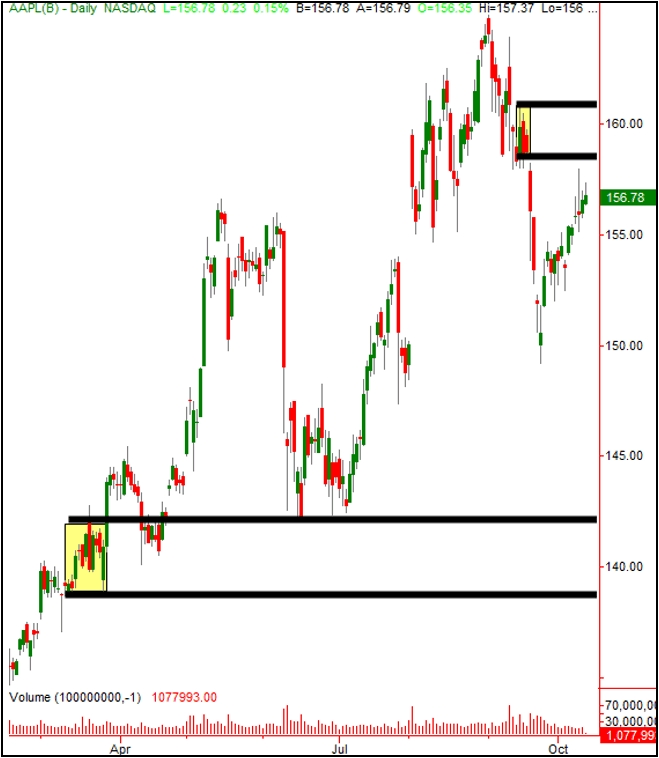

Take Apple as a great example. In the chart below, you can see It is very close to supply (retail price) where the current rally in price will likely stall and turn lower. Yet investors will pour hard earned fortunes into the stock at and near current levels. Do you buy everything else in life with no regard to price? If your answer is no, why would you do this with your hard-earned investment capital? How do you think Warren Buffet has made his fortune? His strategy is simple. Along with his insurance business, find strong companies and buy them cheap, just like Wall Street and opposite of the average investor.

Apple Daily Chart

What if we start thinking and acting like Wall Street professionals? It’s not as hard as you may think. To start with, understand that how you make money in the financial markets is exactly how you make money buying and selling anything in life. When buying a stock, think and act the same way you do at the store, try and buy something really good on sale. The next time you make a key financial decision, make sure you’re asking yourself this simple question: Is this decision benefiting you, or the person selling it to you?

Hope this was helpful, have a great day.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Editors’ Picks

EUR/USD clings to strong gains above 1.1850 on USD weakness

EUR/USD preserves its bullish momentum to start the week and trades above 1.1850. The US Dollar struggles to find demand ahead of Wednesday's critical January employment report and helps the pair continue to push higher.

USD/JPY slumps below 157.00 on intervention risks

The Japanese Yen outperforms the US Dollar to start the week on the back of speculations that authorities will step in to stem JPY weakness in the domestic currency following Prime Minister Sanae Takaichi's landslide win in Sunday's election.

Gold holds steady above $5,000

Gold builds on the gains it posted to end the previous week and holds steady above $5,000 on Monday. Data released over the weekend showed that the People's Bank of China extended its Gold buying spree for a 15th month in January. Moreover, dovish US Fed expectations and concerns about the central bank's independence drag the US Dollar lower for the second straight day, providing an additional boost to the non-yielding yellow metal.

Crypto Today: Bitcoin steadies around $70,000, Ethereum and XRP remain under pressure

Bitcoin hovers around $70,000, up near 15% from last week's low of $60,000 despite low retail demand. Ethereum delicately holds $2,000 support as weak technicals weigh amid declining futures Open Interest. XRP seeks support above $1.40 after facing rejection at $1.54 during the previous week's sharp rebound.

Japanese PM Takaichi nabs unprecedented victory – US data eyed this week

I do not think I would be exaggerating to say that Japanese Prime Minister Sanae Takaichi’s snap general election gamble paid off over the weekend – and then some. This secured the Liberal Democratic Party (LDP) an unprecedented mandate just three months into her tenure.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.