As many of my students know, I am an avid motorcyclist. What you may not know is that I also hold a certificate in motorcycle repair. As with my trading, I feel it is important to be able to fix things when they do not go well. If there is a problem with my bike, or it needs routine maintenance, I can fix it. When there is something wrong with my trading, I can diagnose the problem and adjust my plan to improve my trading. This can only happen with the proper education and practice.

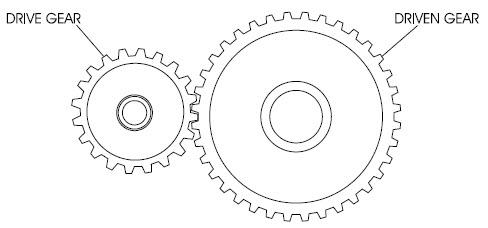

In a motorcycle, power is transferred from the engine to the rear wheel. This is done through a set of gears. To make the smaller movements of the engine gears generate more power to move the wheel, smaller gears are linked up to larger ones. This is known as gearing.

There is a way to get more power from your money in the markets as well. This is also sometimes referred to as gearing. It is trading through the use of leverage. Leverage is additional buying power given to a trader or investor in order to increase their trading exposure. Simply put, it is extra buying power.

Do not confuse leverage with margin. Margin is a good faith deposit placed with your brokerage or clearing house in order to cover any losses that may occur in a trade. Margin is the money you commit to the broker in order to be able to use leverage. Just because you place a certain amount of margin with the broker for a trade, this does not mean that you can only lose that amount in the trade. You can lose more than that amount and even more than what is in your account if you do not manage your risk properly.

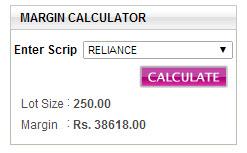

An example of margin and leverage would be selecting to trade Reliance futures instead of trading Reliance Industries stock. The current price as of this writing was Rs. 976.30. If you wanted to buy 500 shares of the stock, you would have to pay Rs 4,88,150. However, when looking at the Sharekhan website, you could buy one Reliance futures contract that has the same value and price movement as the shares for a margin of Rs 77,236.

In this example, you are using margin of Rs 77,236 to receive leverage of 6:1. Your buying power is increased six times what you are placing as a deposit!

Margin and leverage can be a great thing. You can increase your returns. If Reliance Industries moved in your favor by Rs 10 per share, you would profit Rs 5000. On the stock trade, this is a gain of about 1% (5000 / 4,88,150). But on the futures trade with leverage, this is a gain of 6.4% (5000 / 77,236).

There is also increased danger when trading with leverage. Your rewards increase but also so do your risks! If the trade had gone against you, you could have lost 6% of your capital very quickly. So treat leverage with respect.

To learn how to manage leverage and other risks in the market, become fully educated in how to trade those markets. Joining a course at Online Trading Academy is a great way to start.

Neither Freedom Management Partners nor any of its personnel are registered broker-dealers or investment advisers. I will mention that I consider certain securities or positions to be good candidates for the types of strategies we are discussing or illustrating. Because I consider the securities or positions appropriate to the discussion or for illustration purposes does not mean that I am telling you to trade the strategies or securities. Keep in mind that we are not providing you with recommendations or personalized advice about your trading activities. The information we are providing is not tailored to any individual. Any mention of a particular security is not a recommendation to buy, sell, or hold that or any other security or a suggestion that it is suitable for any specific person. Keep in mind that all trading involves a risk of loss, and this will always be the situation, regardless of whether we are discussing strategies that are intended to limit risk. Also, Freedom Management Partners’ personnel are not subject to trading restrictions. I and others at Freedom Management Partners could have a position in a security or initiate a position in a security at any time.

Editors’ Picks

EUR/USD holds firm above 1.1900 as US NFP looms

EUR/USD holds its upbeat momentum above 1.1900 in the European trading hours on Wednesday, helped by a broadly weaker US Dollar. Markets could turn cautious later in the day as the delayed US employment report for January will takes center stage.

USD/JPY remains heavy around 153.00 on firmer Japanese Yen

USD/JPY is sustaining its three-day rout at around 153.00 in the European session on Wednesday, awaiting the closely-watched US NFP report. Rising bets on Fed rate cuts keep the US Dollar depressed. In contrast, expectations that PM Takaichi's policies will boost the economy and allow the BoJ to stick to its hawkish stance bolster the Japanese Yen, weighing on the pair amid intervention fears.

Gold sticks to gains near $5,050 as focus shifts to US NFP

Gold holds moderate gains near the $5,050 level in the European session on Wednesday, reversing a part of the previous day's modest losses amid dovish US Federal Reserve-inspired US Dollar weakness. This, in turn, is seen as a key factor acting as a tailwind for the non-yielding yellow metal ahead of the critical US NFP release.

US Nonfarm Payrolls expected to show modest job gains in January

The United States Bureau of Labor Statistics will release the delayed Nonfarm Payrolls data for January on Wednesday at 13:30 GMT. Investors expect NFP to rise by 70K following the 50K increase recorded in December.

S&P 500 at 7,000 is a valuation test, not a liquidity problem

The rebound from last week’s drawdown never quite shook the sense that it was being supported by borrowed conviction. The S&P 500 once again tested near the 7,000 level (6,986 as the high watermark) and failed, despite a macro backdrop that would normally be interpreted as supportive of risk.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.