When technicians chart using point & figure charts, they are doing so to identify and stay in longer trends. We do not want to be shaken out too early on a trade that could have yielded much more profit. Therefore we would want to make our signals less sensitive so we have fewer of them or we need to use some sort of filter so that we do not take every trade we happen to see.

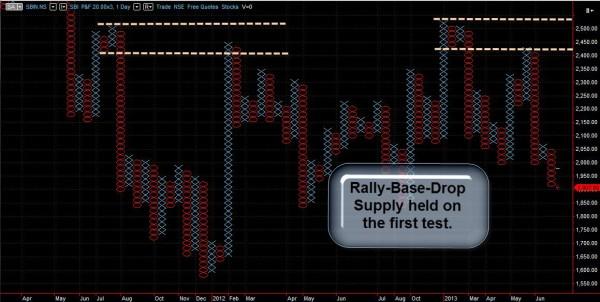

We must have a trading plan or system designed around the use of our technical tools. In my previous articles on Point & Figure charting, I told you the need for identifying your entry, stop, and even projected target for the trade before entering it. Supply and demand levels work the same in point and figure as they do in other styles of charts. Look for an area where trend reversed strongly. Your typical rally-base-drop or drop-base-rally would do just fine. You should look to buy or sell when you receive entry signals in those areas only.

One of the simplest filters is to make sure the trades we take meet the standard 3:1 reward to risk ratio we always follow in our classes. Since we know our entry, our stop, and can use supply and demand or even the horizontal or vertical projections for our targets, there is no reason why you cannot take only the trades that offer the greatest potential for success and the lowest risk in relation to it.

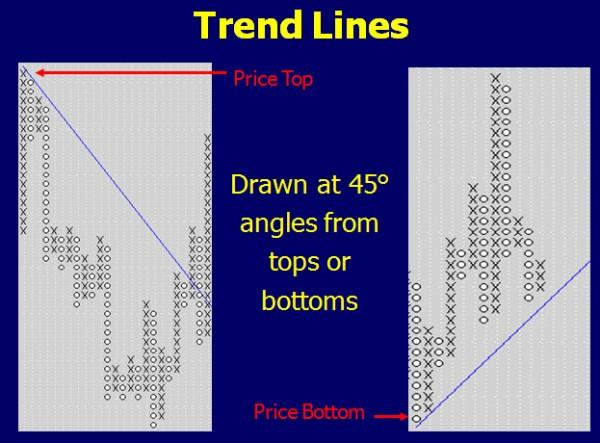

The overall trend of price is something we look at to determine whether we should be a buyer or a seller of a stock. Why should it be any different with P&F charts? The difference in drawing the trend lines is that they are traditionally only drawn at 45 degree angles from a low or from a top. You would not connect multiple lows for an uptrend or multiple tops for a downtrend as you would with candles.

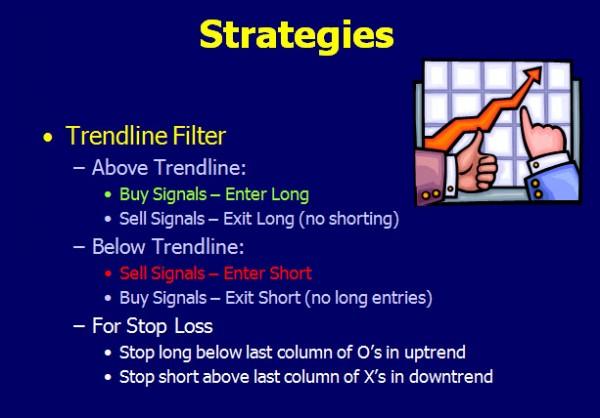

We can also limit our risk in trading by only trading with the trend. If you are above an uptrend from a low, you would only look to enter trades when you receive a buy signal. Use the selling signals to exit those longs only. You would not take a sell signal as an invitation to enter a short as it is counter trend and has a lower probability of working. The short positions should only be entered when you have a sell signal when you are trading below a trend line drawn from a high. You would use a buy signal to exit those shorts but not to enter longs.

Breaking a previous column of X’s is a simple signal. So is breaking a previous column of O’s. I showed you some patterns that can be used as more advanced entry signals. There are many others. Some technicians will only enter trades on a complex signal and then exit upon receiving a simple signal. This will also serve to filter out a lot of unnecessary trades.

There are a lot of choices to screen out trades that are marginal. We want to trade smarter, not more. No matter what system you create, be sure that it manages your risk properly and offers you the opportunity to identify and take high probability, low risk trades. There are plenty of them in the markets waiting for you.

Neither Freedom Management Partners nor any of its personnel are registered broker-dealers or investment advisers. I will mention that I consider certain securities or positions to be good candidates for the types of strategies we are discussing or illustrating. Because I consider the securities or positions appropriate to the discussion or for illustration purposes does not mean that I am telling you to trade the strategies or securities. Keep in mind that we are not providing you with recommendations or personalized advice about your trading activities. The information we are providing is not tailored to any individual. Any mention of a particular security is not a recommendation to buy, sell, or hold that or any other security or a suggestion that it is suitable for any specific person. Keep in mind that all trading involves a risk of loss, and this will always be the situation, regardless of whether we are discussing strategies that are intended to limit risk. Also, Freedom Management Partners’ personnel are not subject to trading restrictions. I and others at Freedom Management Partners could have a position in a security or initiate a position in a security at any time.

Editors’ Picks

EUR/USD treads water around 1.1900

EUR/USD edges a tad lower around the 1.1900 area, coming under mild pressure despite the US Dollar keeps the offered stance on turnaround Tuesday. On the US data front, December Retail Sales fell short of expectations, while the ADP four week average printed at 6.5K.

GBP/USD looks weak near 1.3670

GBP/USD trades on the back foot around the 1.3670 region on Tuesday. Cable’s modest retracement also comes in tandem with the decent decline in the Greenback. Moving forward, the US NFP and CPI data in combination with key UK releases should kee the quid under scrutiny in the next few days.

Gold the battle of wills continues with bulls not ready to give up

Gold comes under marked selling pressure on Tuesday, giving back part of its recent two day advance and threatening to challenge the key $5,000 mark per troy ounce. The yellow metal’s correction follows a better tone in the risk complex, a lower Greenback and shrinking US Treasuty yields.

AI Crypto Update: BankrCoin, Pippin surge as sector market cap steadies above $12B

The Artificial Intelligence (AI) segment is largely on the back foot with major coins such as Bittensor (TAO) and Internet Computer (ICP) extending losses amid a sticky risk-off sentiment.

Dollar drops and stocks rally: The week of reckoning for US economic data

Following a sizeable move lower in US technology Stocks last week, we have witnessed a meaningful recovery unfold. The USD Index is in a concerning position; the monthly price continues to hold the south channel support.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.