And This Little Piggy Went to the Market. But on the way he stopped at your house and took your money because he wanted to buy a new large screen television for his new brick home he had built recently to protect him from the big bad wolf. Don’t you love fairy tales?

This article is about an event that happened in the Lean Hog Futures market a couple of months ago that I thought our readers should be aware of. It’s a rare event in today’s Futures markets. The event is a Limit Move in Commodity prices.

A Limit Move is a price restriction that Futures Exchanges put on some Commodity markets and not others. Each day the Exchange will take the previous day’s settlement price and add and subtract a fixed price. Thereby creating a high and low maximum price band the market may trade out to the next trading session.

For example the Lean Hog market has a daily Limit Move of .03 above and below the previous trading session’s settlement price.

Once price trades to one of these Limit prices the market is not allowed to trade beyond that price. If price trades to Limit Up market participants are permitted to sell at that price, but they cannot buy any higher than the Limit Up price. I will explain later why it is not smart to sell when markets are Limit up or buy when markets are Limit Down.

A trader should be aware of Limit Moves in the particular Futures markets they are trading. This is the individual trader’s responsibility, not your brokers. Once your broker contacts you about a Limit Move it is usually because you are getting a margin call (requesting you send more money to fund your trading account because you just lost a lot of money). Each Futures contract has specific contract specifications and these can be found on the Exchange’s website where the market trades. This is where you will find if your market has a daily price limit. If there is no daily price limit for your market the Exchange will just omit that line from the specifications.

Many markets have Limit Moves on a regular basis and during the next session the market begins to freely trade in both directions again normally after a gap opening. The rare event I was mentioning earlier is a day when the market goes Limit Up or Limit Down and when the next session opens, it gaps up or down the next day’s daily limit and does not trade for the entire session, for both Extended and Regular Trading hours. This traps many traders in the market and they cannot liquidate their losing positions until the market begins trading again. The Lean Hog market did exactly this and I would like to show you some charts of what it looks like and what the risk was to traders on the wrong side of the market.

Figure 1 is a 45 minute Regular Trading Hours (RTH) chart of the October Lean Hog market.

The blue box represents where the Lean Hog contract gapped into a Limit Up price and never traded all day. If you look at an Extended Trading Hours (ETH) chart you will see the market was Limit Up during that entire session as well. If a trader were short prior to this Limit Up Gap they could not get out of their position until somebody was willing to sell at the Limit Up price. Unfortunately it is very rare that anybody will sell to you when markets are Limit Up. They are well aware that what made price go Limit Up was a huge imbalance of buyers to sellers. Therefore when the market resumes trading the next session the odds are the market will gap up and that is when the traders with short positions can attempt to exit the market

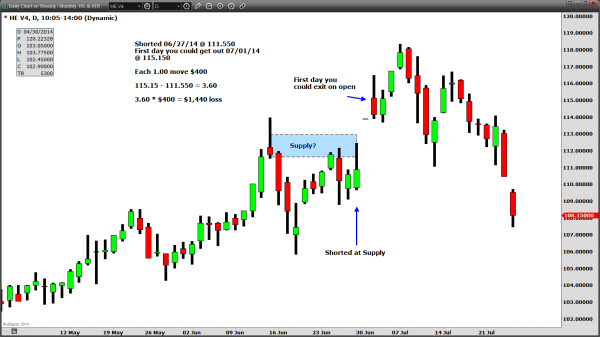

Figure 2 will show a daily chart of the same market.

The dangers of these Limit Moves is that sometimes a Supply/Demand level may have you enter the market for a swing trade. Then as in this example the market gaps past your stop and is immediately Limit Up. Meaning you’re trapped in your short position.

The chart above shows what could have happened to a trader if they were short (for any style of trader) on June 27, 2014 @ 111.550. The lower blue arrow shows the day a trader may have gone short. The next session the market gapped Limit Up and stayed there for the entire session. The stop the trader may have had in the market was gapped through and could not be filled the next trading session. Then on July 1, 2014 the market gapped up and began trading. At this point any stops that were trapped in the Limit Up will be filled at or near the opening price of 115.150.

Each $1.00 move in the Lean Hog market is worth $400. If the trader was filled on the open of this candle the math would look like this:

115.15 (Stop Fill) – 111.550 (Short from) = 3.60

3.60 * $400 = $1,440 loss

Perhaps the trader entered the position with the assumption their stop was only risking a couple of hundred dollars, but after the Limit Up move against them they actually lost $1,440 per contract.

While these types of Limit Moves are rare today, they can still happen. For a small trader this could actually result in them losing more money than they have in their trading account and they would be responsible for the extra loss beyond their cash balance.

Understanding the Futures markets you choose to trade is very important. Technical analysis is only a small part of becoming a successful trader. To be a complete trader you must understand contract specifications and the risk you are facing in certain markets.

“What you get by achieving your goals is not as important as what you become by achieving your goals.” Wolfgang Goethe

This content is intended to provide educational information only. This information should not be construed as individual or customized legal, tax, financial or investment services. As each individual's situation is unique, a qualified professional should be consulted before making legal, tax, financial and investment decisions. The educational information provided in this article does not comprise any course or a part of any course that may be used as an educational credit for any certification purpose and will not prepare any User to be accredited for any licenses in any industry and will not prepare any User to get a job. Reproduced by permission from OTAcademy.com click here for Terms of Use: https://www.otacademy.com/about/terms

Editors’ Picks

AUD/USD taps three-year highs on broad US Dollar weakness

AUD/USD is trading near three-year highs after a strong break above the 0.7000 psychological level for the first time since February 2023, supported by the Reserve Bank of Australia's surprise 25 basis point rate hike to 3.85% at its February meeting. The daily chart shows the pair in a well-defined uptrend, holding above both the 50-day Exponential Moving Average near 0.6970 and the 200-day EMA around 0.6700.

Gold falls below $5,050 as traders await US jobs data

Gold price attracts some sellers near $5,035 during the early Asian session on Tuesday. The precious metal edges lower amid improved risk sentiment and some profit-taking. Traders brace for key US economic data later this week, including delayed employment and inflation reports.

USD/JPY slumps below 156.00 as Japanese Yen strengthens after Takaichi's landslide victory

The USD/JPY pair tumbles to near 155.90 during the early Asian session on Tuesday. The Japanese Yen strengthens against the US Dollar after Japanese Prime Minister Sanae Takaichi led the ruling Liberal Democratic Party to a historic landslide win. Traders braced for key US economic data that could offer more clues on the Federal Reserve's monetary policy.

Litecoin eyes $50 as heavy losses weigh on investors

Following a strong downtrend across the crypto market over the past week, Litecoin holders are under immense pressure. The Bitcoin fork has trimmed about $1.81 billion from its market capitalization since the beginning of the year, sending it below the top 20 cryptos by market cap.

Japanese PM Takaichi nabs unprecedented victory – US data eyed this week

I do not think I would be exaggerating to say that Japanese Prime Minister Sanae Takaichi’s snap general election gamble paid off over the weekend – and then some. This secured the Liberal Democratic Party (LDP) an unprecedented mandate just three months into her tenure.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.