George Santayana is popularly known for aphorisms such as, “Those who cannot remember the past are condemned to repeat it.” When it comes to the markets, this is often the rule more than the exception. In fact, Online Trading Academy’s core strategy is based on locating repeatable patterns that demonstrate where the institutional traders are placing their orders.

When you look at charts, you are looking at the historical picture of price action. This price action is caused by the thoughts and perceptions of the market participants. During various economic and political conditions these thoughts and perceptions influence traders and investors in predictable manners. By viewing similar patterns, we can often predict future behavior of the financial markets.

Purely by accident, I was viewing charts of the S&P 500 from the past with one of my classes when I noticed a period of time where the markets looked eerily similar to the price patterns we are currently experiencing. Looking at the following chart, you can see the top chart is a weekly picture of the S&P 500 index. The bottom chart is also a weekly chart of the S&P 500, but from 1968 to 1969.

While not exact, the price patterns are extremely similar. The dips and rallies occurred in nearly the same pattern in 2015 and 2016 as they did in the late 1960’s.

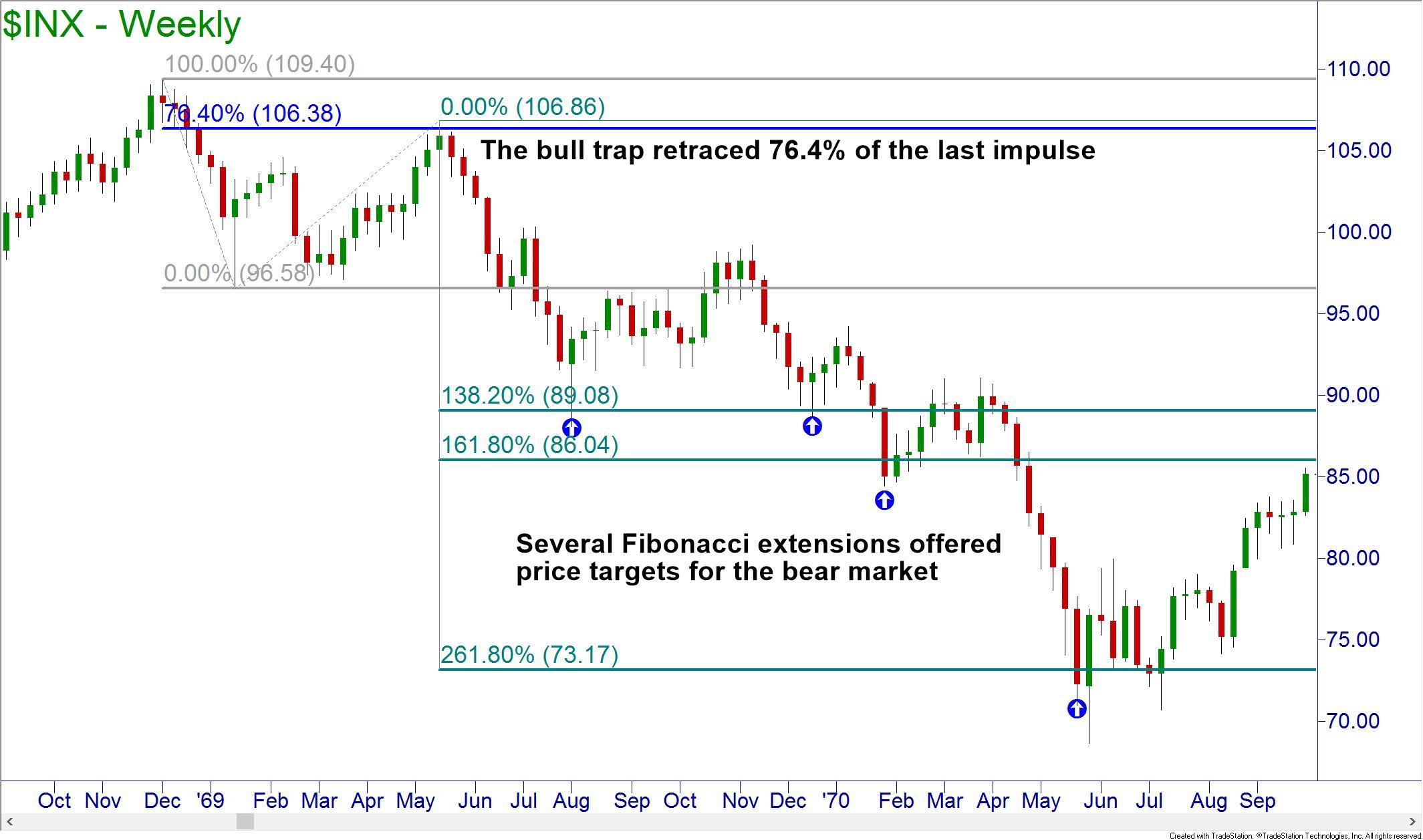

Applying some advanced technical analysis techniques, such as Fibonaccis, to the price action of the 1960s, you can see that there was a bull trap just before the bear market that extended from 1969 through 1970. A bull trap is when prices rise after a sharp decline from a major price peak. This rapid rise leads investors to believe that the drop was only a small correction and that the bull market will shortly resume. This is a pattern that has repeated itself for every bubble burst and bear market.

There was a sharp rise in early 1969 that retraced 76.4% of the drop from the peak in prices. Once the decline began, the Fibonacci Extensions offered potential targets for shorting opportunities, including the bottom of the bear market.

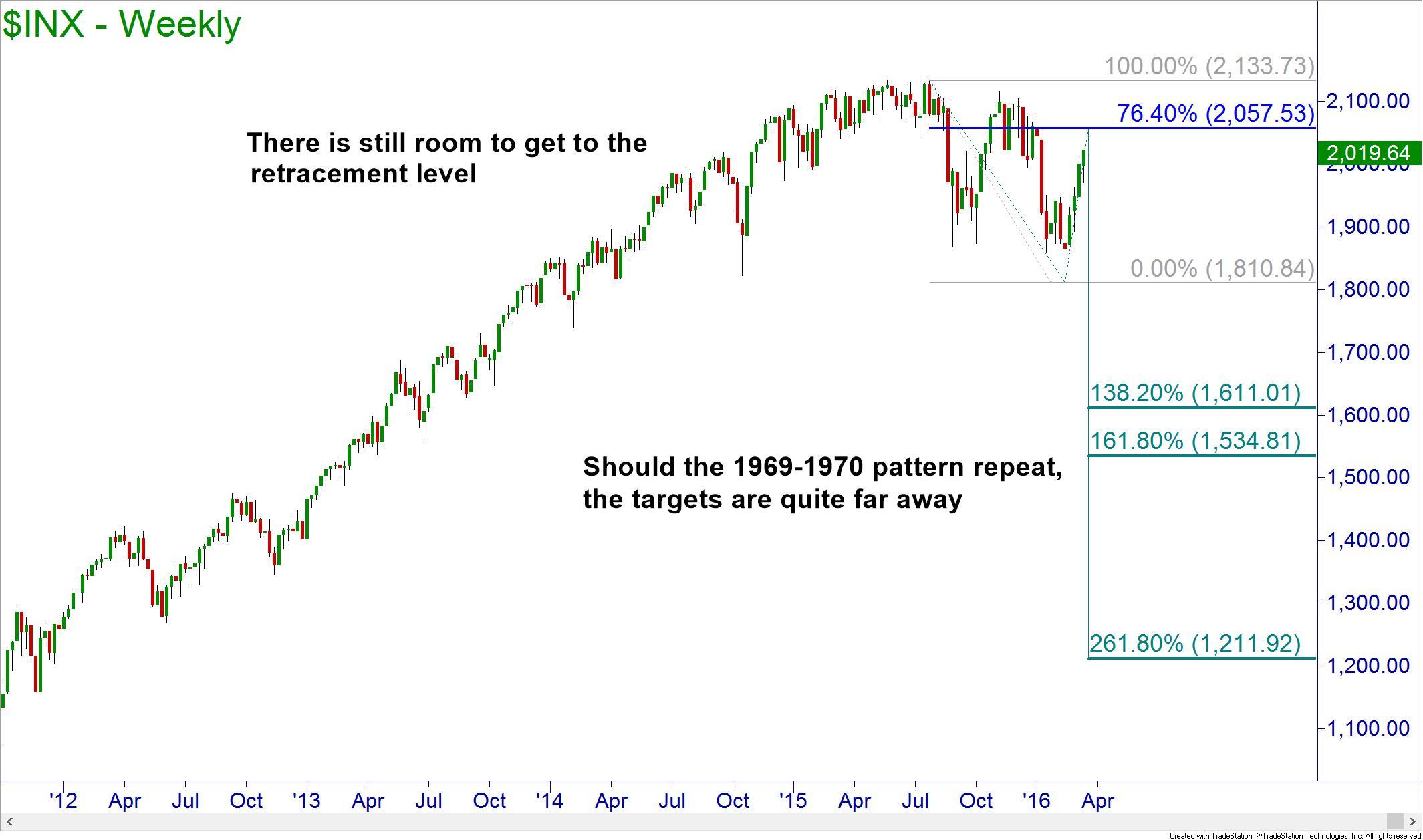

Applying the same Fibonacci techniques to the current S&P 500 price chart, the bull trap appears to be in place and ready to spring on unsuspecting traders and investors. Should we follow the same pattern as the 1960s, the index will continue to climb until approximately 2057. Once there the bear market should begin with prices targeting a few points along the way.

The first major target for bearish price action would be in the low 1600s. Once there, price would likely see a small bounce. The bear market would definitely be in full swing as that would be a price drop from the highs of about 25%. Further price targets are 1530 and the potential bottom of the market at the low 1200s. There is a strong weekly demand at 1440 that could be the bottom instead of the Fibonacci projection.

That brings up an important point. Supply and demand zones are the primary driving force of price. The Fibonacci tools are just to be used as a supporting tool, not the decision maker itself. The retracement to 2057 also corresponds to a supply zone which makes the level stronger. Trust your levels when navigating the markets in order to increase your chances for success.

To learn how to identify the proper zones, visit your local Online Trading Academy Education Center and enroll in a course today!

Neither Freedom Management Partners nor any of its personnel are registered broker-dealers or investment advisers. I will mention that I consider certain securities or positions to be good candidates for the types of strategies we are discussing or illustrating. Because I consider the securities or positions appropriate to the discussion or for illustration purposes does not mean that I am telling you to trade the strategies or securities. Keep in mind that we are not providing you with recommendations or personalized advice about your trading activities. The information we are providing is not tailored to any individual. Any mention of a particular security is not a recommendation to buy, sell, or hold that or any other security or a suggestion that it is suitable for any specific person. Keep in mind that all trading involves a risk of loss, and this will always be the situation, regardless of whether we are discussing strategies that are intended to limit risk. Also, Freedom Management Partners’ personnel are not subject to trading restrictions. I and others at Freedom Management Partners could have a position in a security or initiate a position in a security at any time.

Editors’ Picks

AUD/USD gets ready to punch through 0.7100

The intense sell-off in the Greenback underpins the solid performance of the Aussie Dollar on Monday, motivating AUD/USD to add to recent gains while challenging the key 0.7100 barrier, or fresh YTD highs, at the same time.

EUR/USD extends its optimism past 1.1900

EUR/USD retains a firm underlying bid, surpassing the 1.1900 mark as the NA session draws to a close on Monday. The pair’s persistent uptrend comes as the US Dollar remains on the defensive, with traders staying cautious ahead of upcoming US NFP prints and CPI data.

Gold picks up pace, retargets $5,100

Gold gathers fresh steam, challenging daily highs en route to the $5,100 mark per troy ounce in the latter part of Monday’s session. The precious metal finds support from fresh signs of continued buying by the PBoC, while expectations that the Fed could lean more dovish also collaborate with the uptick.

XRP struggles around $1.40 despite institutional inflows

Ripple (XRP) is extending its intraday decline to around $1.40 at the time of writing on Monday amid growing pressure from the retail market and risk-off sentiment that continues to keep investors on the sidelines.

Japanese PM Takaichi nabs unprecedented victory – US data eyed this week

I do not think I would be exaggerating to say that Japanese Prime Minister Sanae Takaichi’s snap general election gamble paid off over the weekend – and then some. This secured the Liberal Democratic Party (LDP) an unprecedented mandate just three months into her tenure.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.