Last week we learned about the basic tenants of Elliott Wave Theory including the wave structure and patterns. This week we will learn how to measure the waves and even some trading strategies that can be used for trading with the waves.

If you recall from the previous article, the waves form in distinct patterns and follow certain rules. In addition to these rules, there are guidelines that allow a trader to estimate the length and time of the waves. These guidelines then offer a trader or investor opportunities to enter positions with a higher probability of success.

Remember that guidelines are not as strong as rules, and prices can and will deviate from these guidelines. The best entries and exits to positions are found with Online Trading Academy’s Core Strategy. The Elliott Wave Theory can be applied as an odds enhancer to your core strategy of identifying strong supply and demand zones.

Last year I discussed the use of Fibonacci retracements and extensions as a means to estimate turning points of both retracements and corrections. These tools can be applied to measuring the impulse and corrective waves and, when they align with a supply or demand zone, can offer the trader the high quality entry and exit points I mentioned.

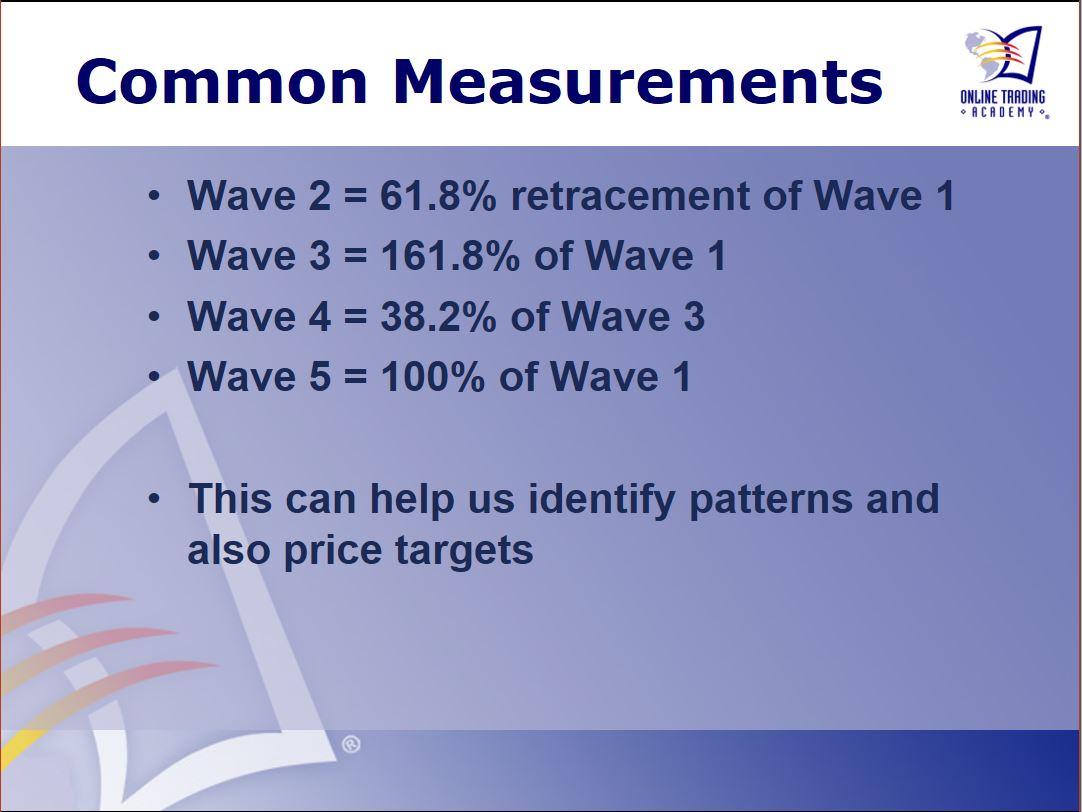

When analyzing the impulsive five wave movements, the most common measurements are:

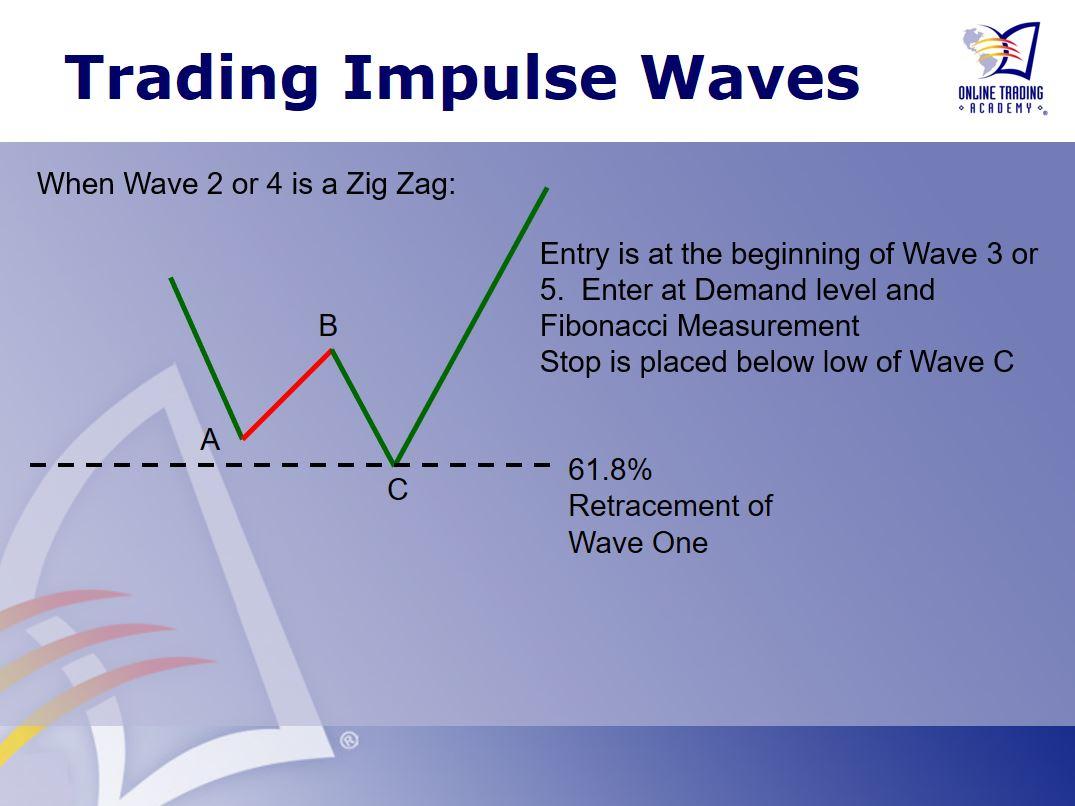

Wave one can be difficult to identify and trade, so when attempting to trade impulses in the larger trend you may have a better chance for success when trading Waves Three or Five. The entry for the position would be at the beginning of Wave Three or Five. This should only be done when there is a strong supply or demand zone that corresponds with the Fibonacci retracement level usually associated with the end of the corrective wave.

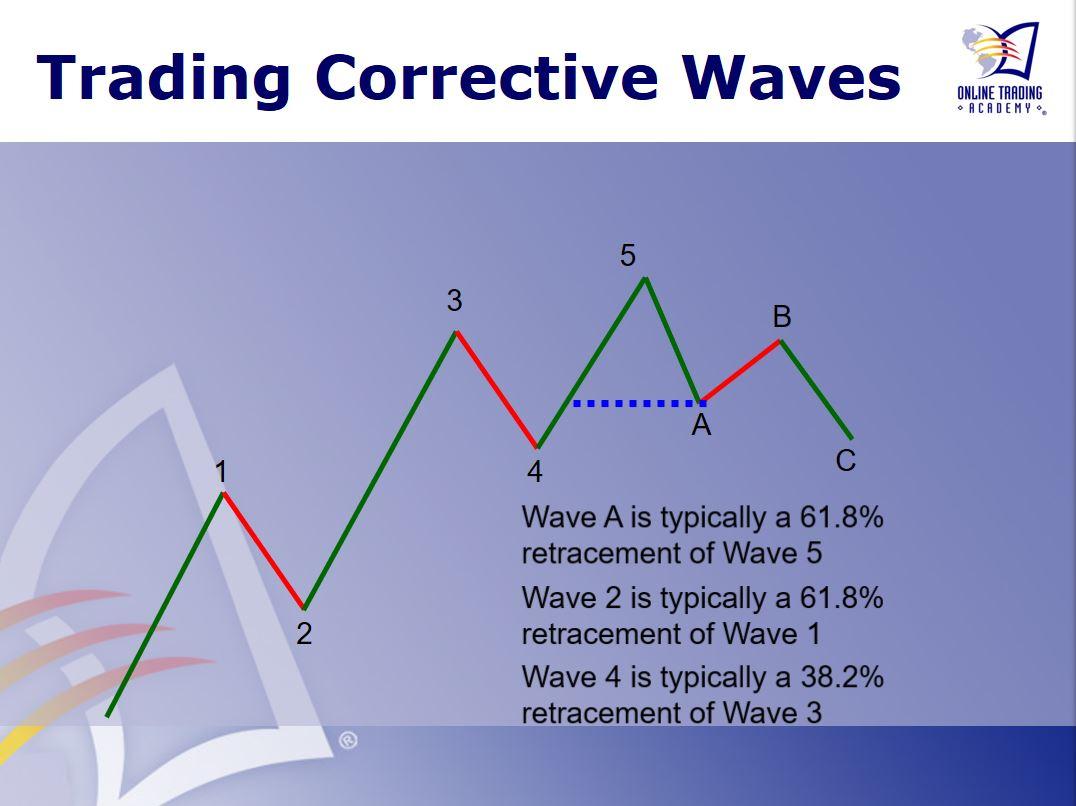

When the corrective Wave Two is a zig zag, you would want to enter into the beginning of Wave Three at a demand or supply zone that is at a 61.8% retracement of Wave One. The entry for trading Wave Five would be at a 38.2% retracement of Wave Three.

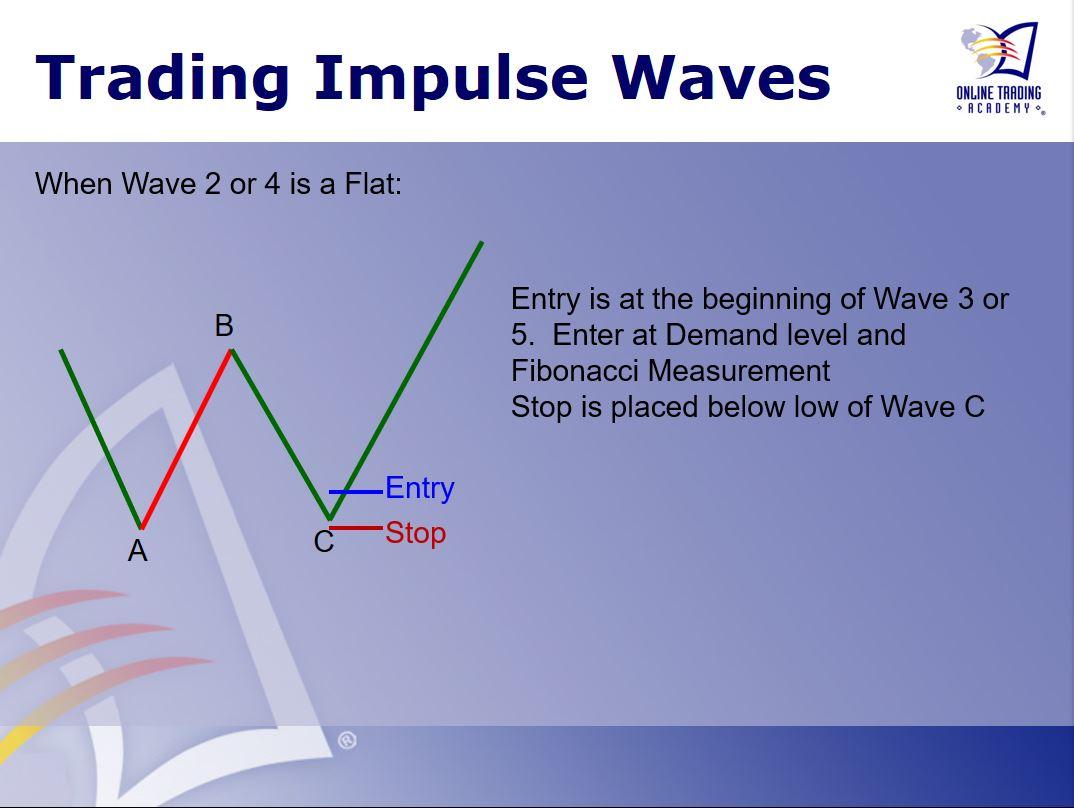

Trading an impulse wave after a flat corrective wave may be easier as the end of Wave A often forms demand or supply for Wave C.

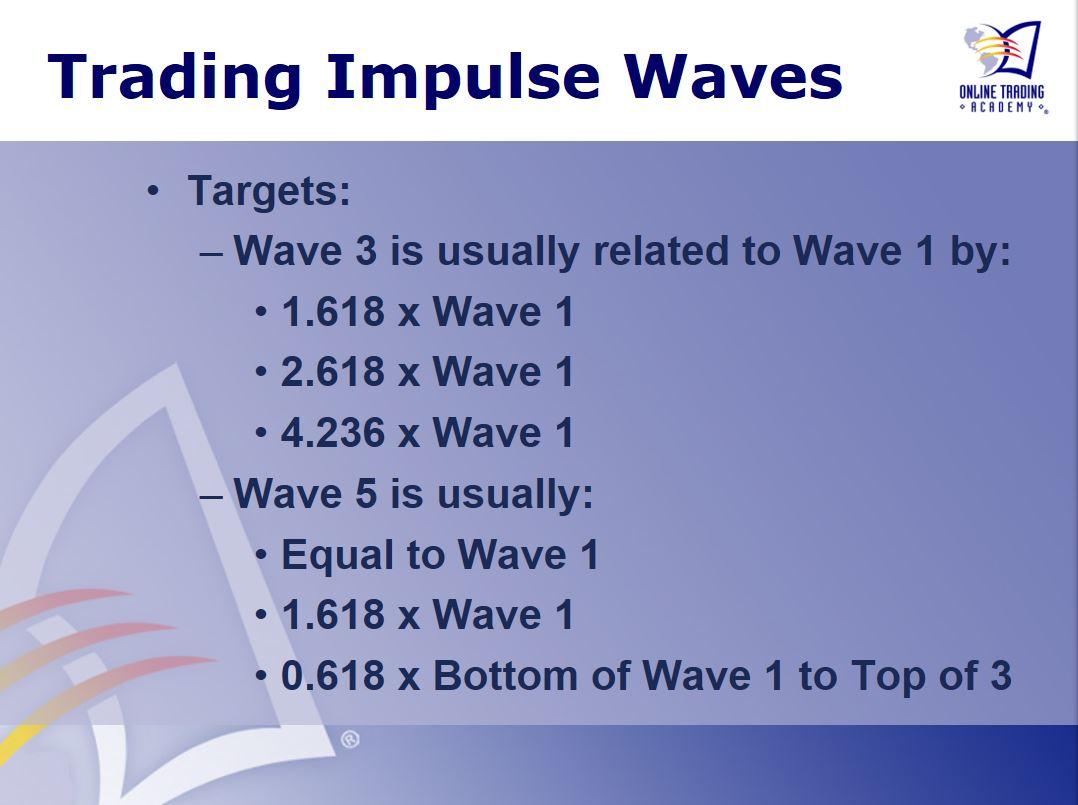

Of course, before you enter a position in the markets you should have also identified your targets. You would target the next opposing supply or demand zone which is where the Fibonacci extensions can help. You can measure the previous impulse waves and see which supply or demand zones line up with the measurements. The most common measurements are below.

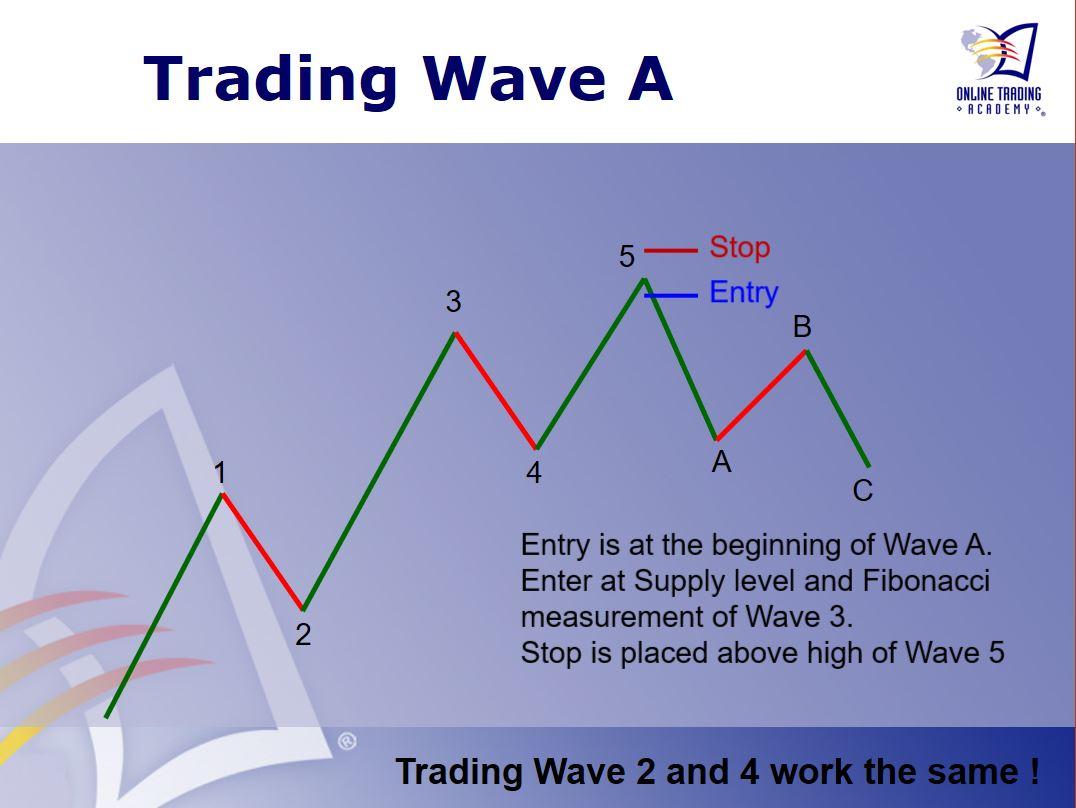

You can also trade the corrective waves. These waves will be smaller and offer lower profits than the impulses but give additional opportunities while waiting for the large impulse moves. Since we know that the impulses are likely to end at a supply or demand level that matches with a Fibonacci measurement, we know our entry for the correction trade. We can enter right at the beginning of those corrections.

The targets would be the opposing supply or demand zone that corresponds to a Fibonacci retracement level. The most common targets are below.

Now that we have an idea of how the entries and exits are identified, let’s look at the markets and see how we can put Elliott Wave Theory to use.

In the 60-minute chart of SPY, you can see wave one, wave two and the start of wave three. The sub waves have also been marked. A trader looking for a long opportunity was able to enter at the point where price pulled back in wave two, to a point where it had both retraced 38.2% of wave one and also a fresh demand zone.

The target for the trade would need to be identified prior to entry into the position. Potential targets for the long trade would be where Fibonacci Extensions line up with supply zones. Note that this will only mark the end of wave three, not the end of the trend. The trader could lock in profits at the beginning of the wave four correction and then re-enter for wave five.

Elliott Wave Theory can be useful in order to increase your chances for success in your trading. Notice that it can only help increase chances; in order to know where the best entry and exit points are in any market you should apply Online Trading Academy’s core strategy. To learn these valuable tools, visit your local center today.

Neither Freedom Management Partners nor any of its personnel are registered broker-dealers or investment advisers. I will mention that I consider certain securities or positions to be good candidates for the types of strategies we are discussing or illustrating. Because I consider the securities or positions appropriate to the discussion or for illustration purposes does not mean that I am telling you to trade the strategies or securities. Keep in mind that we are not providing you with recommendations or personalized advice about your trading activities. The information we are providing is not tailored to any individual. Any mention of a particular security is not a recommendation to buy, sell, or hold that or any other security or a suggestion that it is suitable for any specific person. Keep in mind that all trading involves a risk of loss, and this will always be the situation, regardless of whether we are discussing strategies that are intended to limit risk. Also, Freedom Management Partners’ personnel are not subject to trading restrictions. I and others at Freedom Management Partners could have a position in a security or initiate a position in a security at any time.

Editors’ Picks

EUR/USD climbs to two-week highs beyond 1.1900

EUR/USD is keeping its foot on the gas at the start of the week, reclaiming the 1.1900 barrier and above on Monday. The US Dollar remains on the back foot, with traders reluctant to step in ahead of Wednesday’s key January jobs report, allowing the pair to extend its upward grind for now.

USD/JPY recedes to multi-day lows near 155.50

USD/JPY is pulling back sharply at the start of the week, slipping back toward the 155.50 area as speculation mounts that authorities could step in to rein in further Yen weakness. That narrative gained traction after PM S. Takaichi secured a landslide victory in Sunday’s election, stoking expectations of a tougher line in defence of the domestic currency.

Gold treads water around $5,000

Gold is trading in an inconclusive fashion around the key $5,000 mark on Monday week. Support is coming from fresh signs of further buying from the PBoC, while expectations that the Fed could turn more dovish, alongside concerns over its independence, keep the demand for the precious metal running.

Crypto Today: Bitcoin steadies around $70,000, Ethereum and XRP remain under pressure

Bitcoin hovers around $70,000, up near 15% from last week's low of $60,000 despite low retail demand. Ethereum delicately holds $2,000 support as weak technicals weigh amid declining futures Open Interest. XRP seeks support above $1.40 after facing rejection at $1.54 during the previous week's sharp rebound.

Japanese PM Takaichi nabs unprecedented victory – US data eyed this week

I do not think I would be exaggerating to say that Japanese Prime Minister Sanae Takaichi’s snap general election gamble paid off over the weekend – and then some. This secured the Liberal Democratic Party (LDP) an unprecedented mandate just three months into her tenure.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.