Most people who view my income and wealth trading workspace in one of the many live trading sessions I deliver eventually ask me the same question… “Why is the US Dollar chart always on your screen no matter what market you’re looking at?” There is a reason, and it is the focus of this piece.

Let’s go over a trading opportunity from the other day using our Supply / Demand Grid in the GBPUSD, Euro Futures, and EURUSD and walk through all the deciding factors that led to these quality trading opportunities.

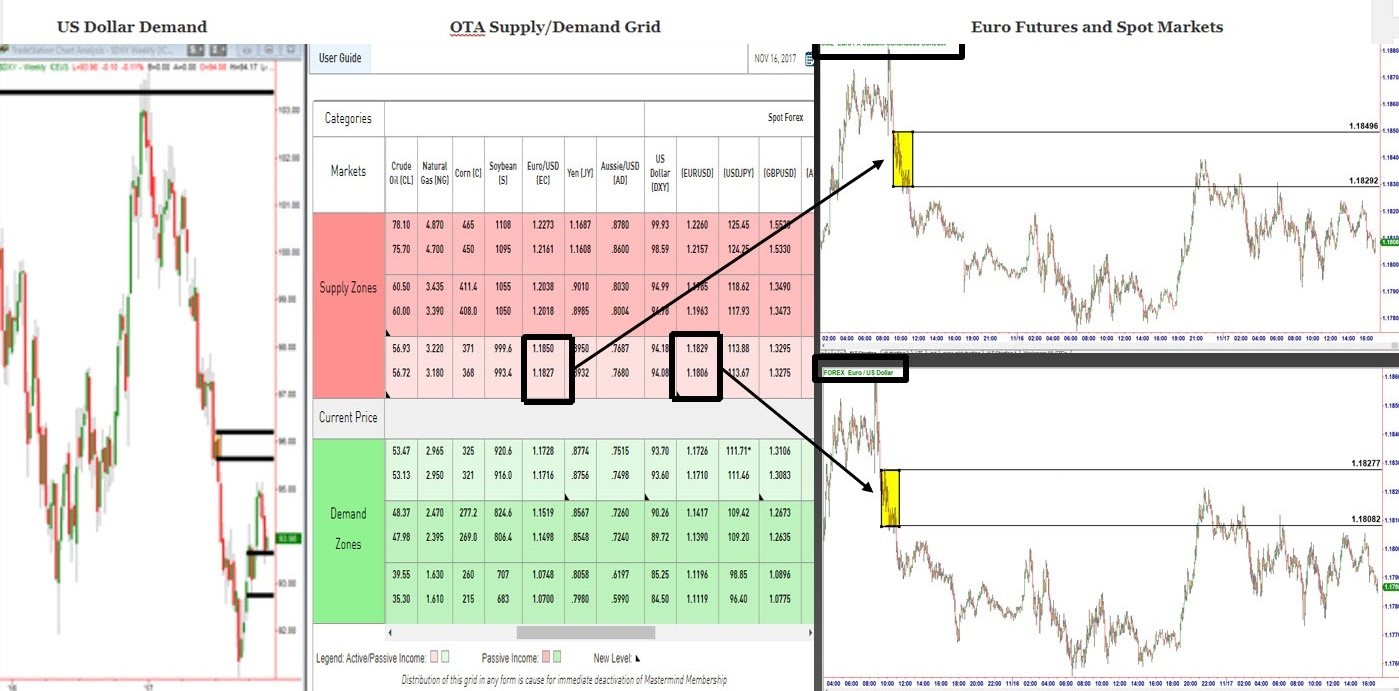

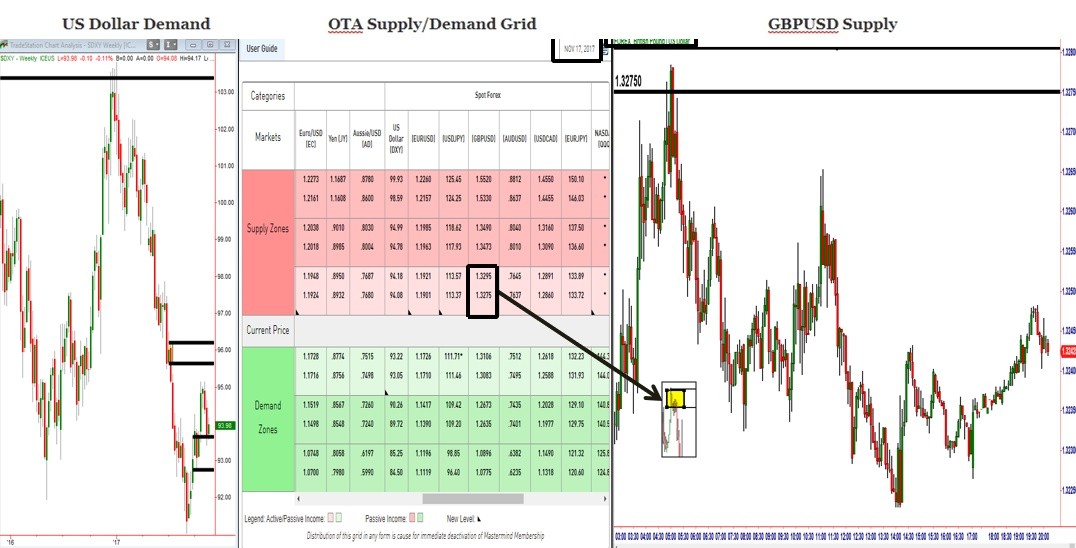

First, notice the charts on the right. These are charts with supply zones in the GBP and Euro futures and spot markets. On the charts, you will see that price has rallied to an area of supply that the arrows are pointed at. When price is at or near supply and there is a significant profit zone below, we only want to think about shorting. This offered our student members a low risk, high reward and high probability trading opportunity but not just because of the quality supply zones found using our grid.

Next, look at the chart of the US Dollar on the left in both cases. Notice that while there was supply above, current price was at demand, and this is a weekly chart which is significant. That US Dollar demand information was a strong hint that FX markets against the Dollar were likely to decline. What we had in front of us and in advance was clear vision as to where major global banks where buying and selling. Quantifying financial institution supply and demand is the key to getting this right and accurately predicting price movement in any and all markets.

11/16/17 – OTA Supply/Demand Grid FX Opportunity

11/17/17 – OTA Supply/Demand Grid FX Opportunity

Setting up these trading opportunities in advance based on objective information is also very important, it takes all the emotion out of the decision-making process and also means we don’t have to sit in front of the computer screen all day, which no one wants to do.

During that trading session and over the next couple days, the Dollar rallied off demand and EURUSD and GBPUSD declined, as they should. Identifying fresh institution demand and supply, properly correlating the US Dollar market, and then executing our rule based strategy is the key to making this work.

Hope this was helpful, have a great day.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Editors’ Picks

AUD/USD tests 0.7100 after China inflation and RBA Hauser's comments

AUD/USD flirts with three-year highs at 0.7100 in Wednesday's Asian trading. The pair remains undeterred by the mixed Chinese inflation data for January, which showed the growth in the Consumer Price Index slowing more than expected, while the Producer Price Index beat estimates. RBA official Hauser's hawkish commentary provides an extra boost to Aussie bulls.

USD/JPY extends three-day rout below 154.00, NFP eyed

USD/JPY is extending its three-day rout below 154.00 in the Asian session on Wednesday, awaiting the release of the closely-watched US NFP report. In the meantime, rising bets on Fed rate cuts keep the US Dollar depressed. In contrast, expectations that PM Takaichi's policies will boost the economy and allow the BoJ to stick to its hawkish stance underpin the Japanese Yen, weighing on the pair amid intervention fears.

Gold recovers to $5,050, focus shifts to US jobs data

Gold turns higher to test $5,050 in the Asian session on Wednesday. Traders assess whether Gold has found a floor following a historic sell-off. The delayed US employment report for January, which was pushed back due to the recently ended four-day government shutdown, will take center stage later on Wednesday.

Ethereum: Whales buy the dip amid rising short bets

Following one of Ethereum's largest weekly drawdowns, whales are slowly returning to action alongside a drop in retail selling pressure. After slightly selling into the decline at the start of the month, whales or wallets with a balance of 10K-100K ETH began buying the dip last Wednesday as prices crashed further.

Dollar drops and stocks rally: The week of reckoning for US economic data

Following a sizeable move lower in US technology Stocks last week, we have witnessed a meaningful recovery unfold. The USD Index is in a concerning position; the monthly price continues to hold the south channel support.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.