Forex trading deals with buying and selling a currency against another one. The aim is to make a profit by identifying the correct market direction.

Finding the correct market direction is not a piece of cake. Traders use both technical and fundamental analysis for this. Moreover, in some cases, notions like astrology and the way stars/planets align and influence people’s behavior are taken into consideration. It may sound crazy, but it’s pure truth.

No matter the forecasting method, one thing should prevail: how to manage a trading account. Traders’ ego and personality influence an account more than the method used to find a trade opportunity.

Hence, risk management is key.

NB: Traders should focus first on how NOT to lose money, and then on how to make some.

Any money management system must start with building the right expectations. While the Forex market gives the impression of prices going in trends all the time, this is not true.

In fact, the Forex market with its huge five trillion dollars daily volume spends most of the time in consolidation. As such, fake moves happen all the time.

The problem with trading the Forex market comes from the way traders perceive it. They come to the trading arena with false expectations. They underestimate the dangers that markets hide.

This is normal. Because brokers use aggressive advertising techniques telling how easy it is to make money, people start on the wrong foot.

Statistically, over ninety percent of the retail traders lose their deposit in the first six months. That’s a terrible percentage!

When this happens, the next step is the so-called “revenge trading”. Traders deposit more funds in a desperate move to get back what they lost.

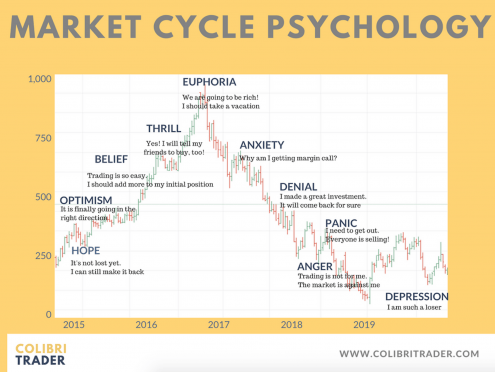

By now, you should know the answer. Margin calls, more money lost… The chart below describes the cycle which the average trader/investor goes through.

Understand the Market Participants

Right from the beginning, retail traders start with a huge disadvantage: they are a minority. To put this into perspective, out of those five trillion dollars that exchange hands every day, only about six percent represent retail traders’ volume.

That’s a powerful statement. When traders lose a trade because of a market swing, they usually blame someone else: the broker, the “market” …it is always someone else’s fault!

Is it? Of course, it is not. Real people trading with real money make the market. If anything, Forex trading is not a video game. As such, the starting point of any Forex money management system is to understand the forces behind the changing numbers on the trading screen.

If retail traders represent such a small percentage, who’s moving the market? Or, why does the market move?

Curious Fact: Not everyone is in the market for making a profit. Retail traders buy and sell exclusively to speculate. Others don’t.

For example, commercial banks have a treasury department. While parts of it deal with investing the extra cash a bank may have, its main mission is to clear customers’ transactions.

In plain English, this means to buy or sell currencies as per customer’s instructions in every bank account.

Believe it or not, central banks have a trading department too. All of them!

When a central bank sets the monetary policy for the period ahead, someone must implement it. If the central bank buys bonds, someone must effectively go on the market and by those bonds. And so on and so forth.

Because financial markets are interconnected, what’s happening in one market might drive prices diametrically on another. If, say, gold falls 2%, on theory the USD will rise in value.

Forex brokers, liquidity providers, high-frequency trading machines, hedge funds, etc., come to complete the list. Why would you think you’re better? No wonder 90% of traders lose their first deposit.

Risk Only a Percentage of Your Trading Account

The next thing in line is to manage risk. Remember? First, the risk, then the reward.

Risking only a small percentage of your trading account keeps you safe. If you don’t believe it, let’s do a simple math exercise.

If you risk one percent of your trading account for every trade, you’ll need seventy-two (72!) consecutive losing trades to lose half your account. Imagine that!

Seventy-two consecutive losing trades…if that’s happening with your account, you’re not ready to trade. Even in this unfavourable scenario, this simple money management rule keeps you afloat: you’ll end up losing only half of your account. You won’t blow it like ninety percent of retail traders.

Aggressive traders do risk two percent per every trade (or even more). I would say that a normal approach is anywhere between one and two percent. Conservative traders will lean towards the one percent threshold, while more aggressive ones towards the two percent or in some cases even more.

Note: I personally do not risk more than 1% per every trade, which I think is a very reasonable figure.

Use Realistic Risk-Reward Ratios

A Forex trader should never ever risk more than the reward he expects to gain. While other industries favor this (e.g. binary options industry), for a Forex trader this is something outrageous.

Therefore, the risk-reward ratio must have a bigger reward than the risk. Of course, you may look for 1:10 or 1:30 (i.e. risking one pip to get ten or thirty pips). But, these are not very easily attainable returns. Even if they are attainable, they would be very rare.

Remember that the Forex market spends most of its time in corrective waves?

Stats: To be more exact, over sixty-something percent of the time the market trades in a range.

As such, a realistic risk-reward ratio is anything between 1:2 or 1:2.5. That means, for every pip risked, the expectation is for two pips or two and a half pips gain. For a higher return, I have outlined a chapter in my trading course that walks your through the process of reaching higher returns (if the market shows favorable conditions of course).

Conclusion

To sum it all up, Forex trading is risky. As such, one needs to approach trading with a cautious eye.

While the potential reward lures traders into unrealistic returns, statistics are telling another story. Therefore, a trader must first deal with addressing the potential for a losses, and only after start looking at the possible rewards.

Moreover, patience and discipline must reign over a trader’s decisions. The market will not go up only because you’re long.

Remember: The market will always be open next Monday.

There’s a saying among Forex traders: “don’t force a trade”. Such a simple trading advice is yet so powerful. Even if you have missed one, there is always a way to get into another.

Like many times in life, try to keep it simple. The same is valid in trading. Keep it simple, control the risk, and with practice the results should follow.

What’s important is your P/L to show a positive growth. Don’t look for doubling your account every other month. Instead, look for the account to grow naturally, because of a proper money management system applied correctly. And remember not to risk more than 1-2% of your capital per trade. This is essential if you want to survive in the longer term.

This material is written for educational purposes only. By no means do any of its contents recommend, advocate or urge the buying, selling or holding of any financial instrument whatsoever. Trading and Investing involves high levels of risk. The author expresses personal opinions and will not assume any responsibility whatsoever for the actions of the reader. The author may or may not have positions in Financial Instruments discussed in this newsletter. Future results can be dramatically different from the opinions expressed herein. Past performance does not guarantee future results.

Editors’ Picks

EUR/USD bounces off lows, back to 1.1860

EUR/USD now manages to regain some balance, retesting the 1.1860-1.1870 band after bottoming out near 1.1830 following the US NFP data on Wednesday. The pair, in the meantime, remains on the defensive amid fresh upside traction surrounding the US Dollar.

GBP/USD rebounds to 1.3660, USD loses momentum

GBP/USD trades with decent gains in the 1.3660 region, regaining composure following the post-NFP knee-jerk toward the 1.3600 zone on Wednesday. Cable, in the meantime, should now shift its attention to key UK data due on Thursday, including preliminary GDP gauges.

Gold stays bid, still below $5,100

Gold keeps the bid tone well in place on Wednesday, retargeting the $5,100 zone per troy ounce on the back of humble gains in the US Dollar and firm US Treasury yields across the curve. Moving forward, the yellow metal’s next test will come from the release of US CPI figures on Friday.

Ripple Price Forecast: XRP sell-side pressure intensifies despite surge in addresses transacting on-chain

Ripple (XRP) is edging lower around $1.36 at the time of writing on Wednesday, weighed down by low retail interest and macroeconomic uncertainty, which is accelerating risk-off sentiment.

US jobs data surprises to the upside, boosts stocks but pushes back Fed rate cut expectations

This was an unusual payrolls report for two reasons. Firstly, because it was released on Wednesday, and secondly, because it included the 2025 revisions alongside the January NFP figure.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.