It's very necessary to translate our manual trading logic into a system to improve working efficiency and reduce mistakes of manual judgment.

There are some key factors which should be taken into account.

I'll make a brief introduction and use my own "Tendency Forex" system as an example.

1. The system should be Backtestable.

Backtesting is the only reliable method to assess any trading system.

Most of us have experience of backtesting automated trading system.

But for a manual trading system, backtesting is always ignored or omitted.

To a simple "moving average cross-over" system, 20 period MA cross-over 50 period MA and 50 period MA cross-over 100 period MA, which one is better?

MACD cross-over and Slow Stoch cross-over, which one is more accurate?

The price closed above 100 period MA and 200 period MA, which one is more likely to indicate a trend reversal?

100 period Simple MA and 100 period Smoothed MA, which one is more reliable?

Ichimoku Cloud is very useful in USDJPY and other Yen-cross, does it work well in other USD majors and Commodities? ...

All these questions need backtesting to tell us an answer.

Video 1: Backtest of Tendency Forex System

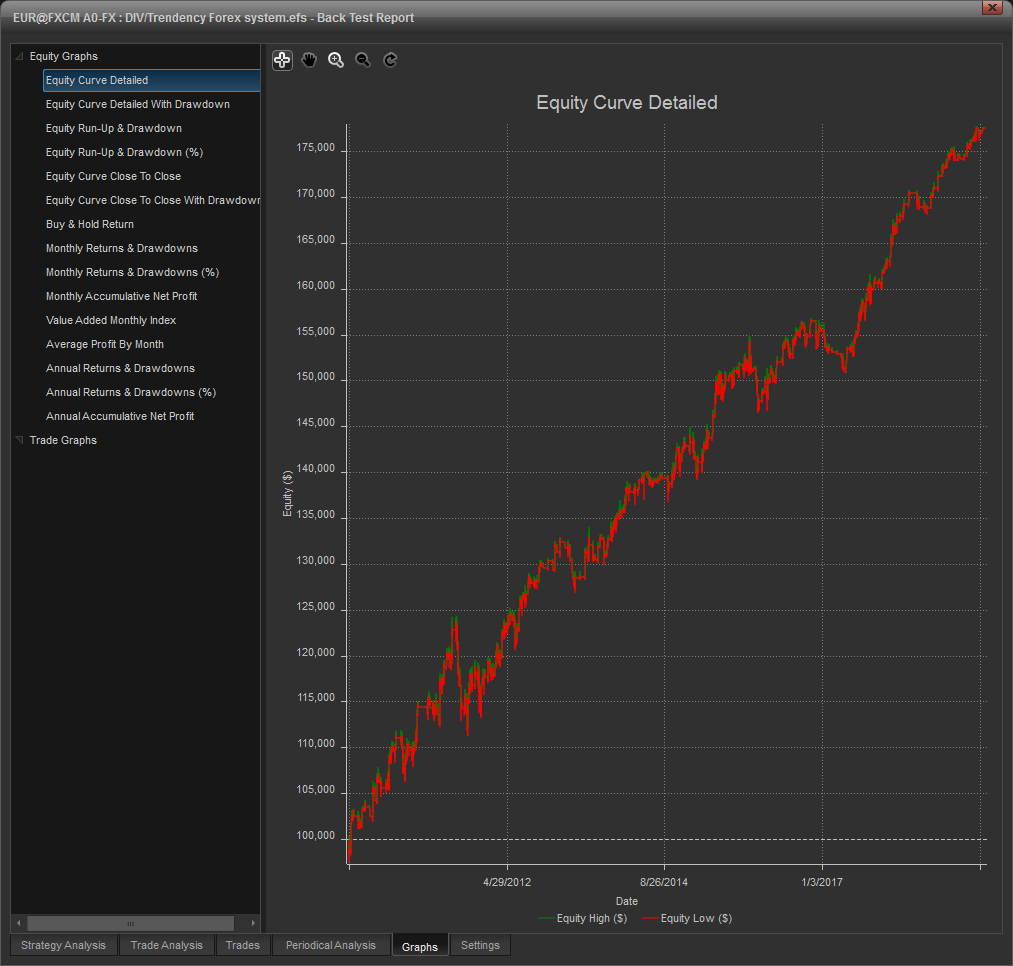

Chart 1: Backtest of ‘Tendency Forex’ System for EURUSD ( Fixed 1.0 lot per trade from 2010 )

2. Key Logic:

①Trend following logic is preferred. But when the market is consolidated, the Trend Following Logic may not work well.

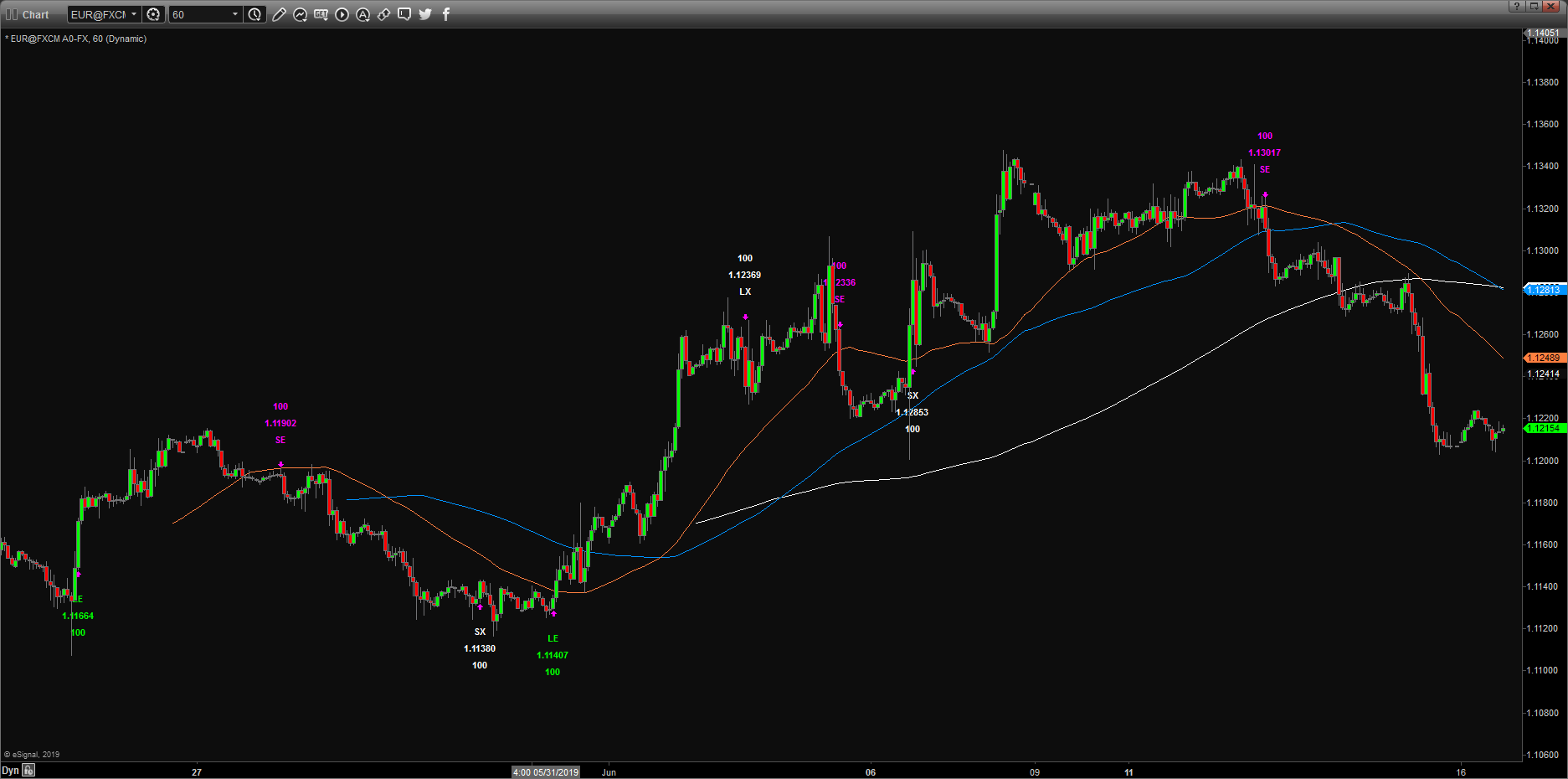

Chart 2: Real time trading signal for EURUSD

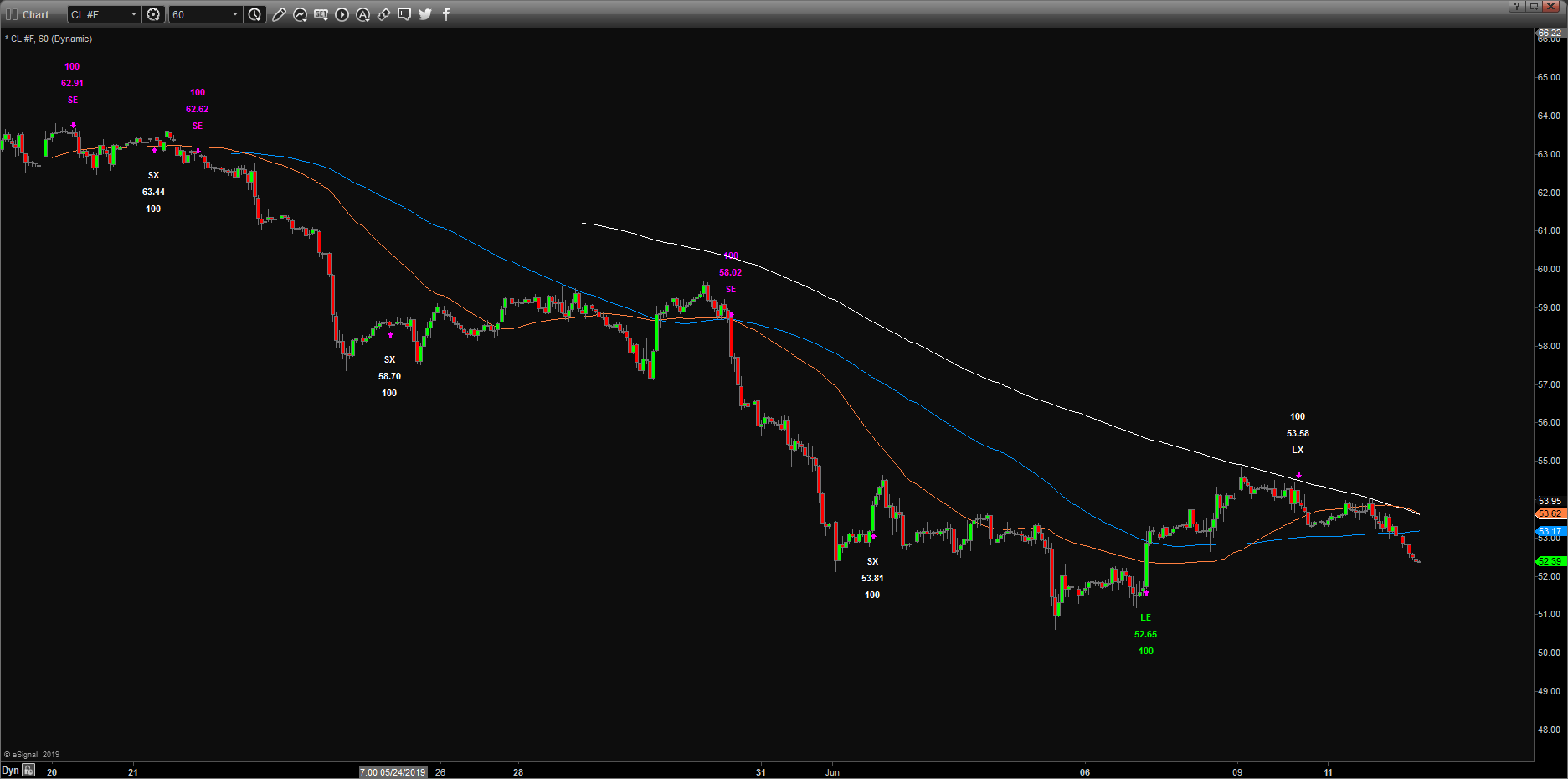

Chart 3: Real time trading signal for WTI Oil

②For manual scalping strategy, if the expected pay-off for each trade is below 5 pips, you must consider whether you could enter and exit the trade in time.

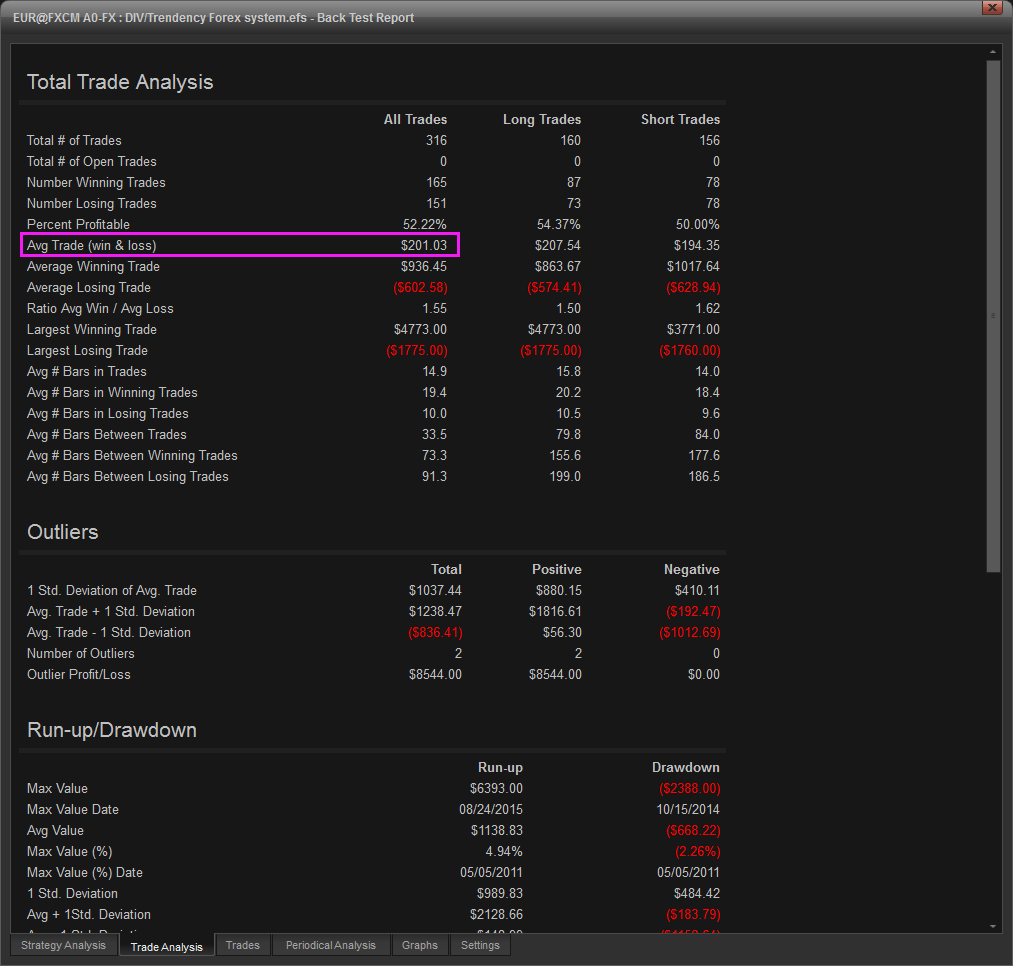

Chart 4: Backtest of ‘Tendency Forex’ System for EURUSD ( Fixed 1 lot per trade, $200 means 20 pips )

③Grid and martingale strategy is very risky for both manual and automated system.

3. Data Feed:

For volume based indicator, we must use Futures data feed. There is no accurate volume calculation in the spot FX market.

4. Over-optimization:

I suggest using default parameters of all indicators in building your system.

Most over-optimized system could work well in backtest, but always failed in live forward test.

5. Alert:

This is a very useful function, we could not sit ahead of the desk 24 hours per trading day.

The alert function could make the work easy.

Chart 5: Email Alert

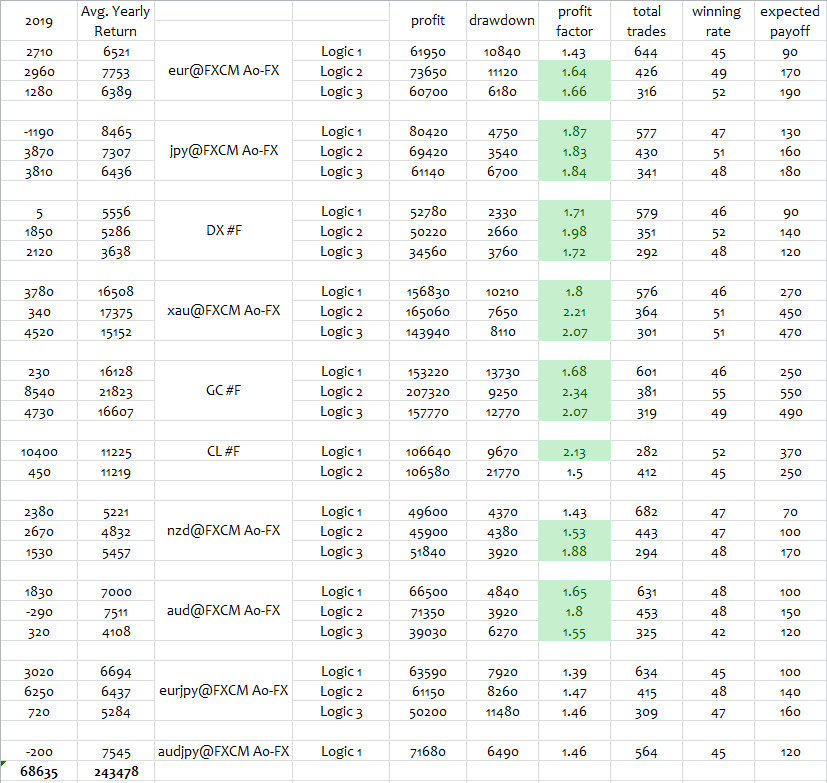

6. Profit Factor:

Above 1.50 is preferred, means that if I invest 1 dollar I can expect to get 1.5$ back from trading that model.

The higher the better.

Chart 6: Profit Factor of different logic of Forex,Gold and Oil

7. Risk Control:

"Tendency Forex" system was created by myself in later 2017 for USD majors, Gold, Oil and LME base metals, when the work was finished, I was very excited.

However, the harassment was coming soon.

I'm a manual trader and mainly trade on Elliottwave theory and my own trend following method.

I always wanted to manually select some signals to follow, just like a "manual filter", but it did not work well.

Until several months ago, I could not concentrate on the market due to some other issues.

Then I told my wife and my brother to follow all the trading signals generated by "Tendency Forex" system.

The results were much better than my own trading!

Then I understand the"Tendency Forex" system is focused on the short term trend of 15-20 four hourly bars, but my manual trading is focused on 10-20 daily bars. It's hard to combine them well unless we are in a strong trend market.

So, it's better to follow all of them with good risk control, such as fixed lot size ( no higher than 1:2 leverage ) or fixed risk (no higher than 0.5% risk).

5 Days' Free Trial of "Tendency Forex System" is available.

Editors’ Picks

AUD/USD meets initial resistance around 0.7100

A decent rebound in the US Dollar is behind the AUD/USD’s daily pullback on Tuesday. In fact, the pair comes under modest downside pressure soon after hitting fresh yearly peaks in levels just shy of 0.7100 the figure on Monday. Moving forward, investors are expected to closely follow the release of Chinese inflation data on Wednesday.

EUR/USD looks offered below 1.1900

EUR/USD keeps its bearish tone unchanged ahead of the opening bell in Asia, returning to the sub-1.1900 region following a firmer tone in the US Dollar. Indeed, the pair reverses two consecutive daily gains amid steady caution ahead of Wednesday’s key US Nonfarm Payrolls release.

Gold the battle of wills continues with bulls not ready to give up

Gold remains on the defensive and approaches the key $5,000 region per troy ounce on Tuesday, giving back part of its recent two day. The precious metal’s pullback unfolds against a firmer tone in the US Dollar, declining US Treasury yields and steady caution ahead of upcoming key US data releases.

Bitcoin's downtrend caused by ETF redemptions and AI rotation: Wintermute

Bitcoin's (BTC) fall from grace since the October 10 leverage flush has been spearheaded by sustained ETF outflows and a rotation into the AI narrative, according to Wintermute.

Dollar drops and stocks rally: The week of reckoning for US economic data

Following a sizeable move lower in US technology Stocks last week, we have witnessed a meaningful recovery unfold. The USD Index is in a concerning position; the monthly price continues to hold the south channel support.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.