Trading during key market events like the NFP? Spread widening is a key condition to factor in when choosing a broker as it can have a significant impact on your overall profitability and performance.

The Nonfarm Payrolls (NFP) are among the biggest market movers in the Forex markets, which makes the monthly jobs report one of the most closely watched events for forex and CFD traders. The report is used by investors to assess the health of the U.S. economy and can have a massive effect on USD pairs; which is why a great number of traders start preparing for the NFP days in advance, studying all the preliminary figures for clues on how the latest jobs report will fare. If the NFP comes in stronger, this is a good indication that the economy is growing and vice versa.

Why is the NFP so Popular with Forex Traders?

In Forex trading, the level of actual non-farm payroll compared to the estimates is what makes the biggest impact. If the actual NFP data comes in higher than the economists' forecast, forex traders will usually buy U.S. dollars in anticipation of the currency getting stronger. The opposite is true when the data comes in lower than economists' expectations. Having a strategy for trading the non-farm payroll report should be in every forex trader’s arsenal, as it is one of the most volatile and potentially lucrative days of the month.

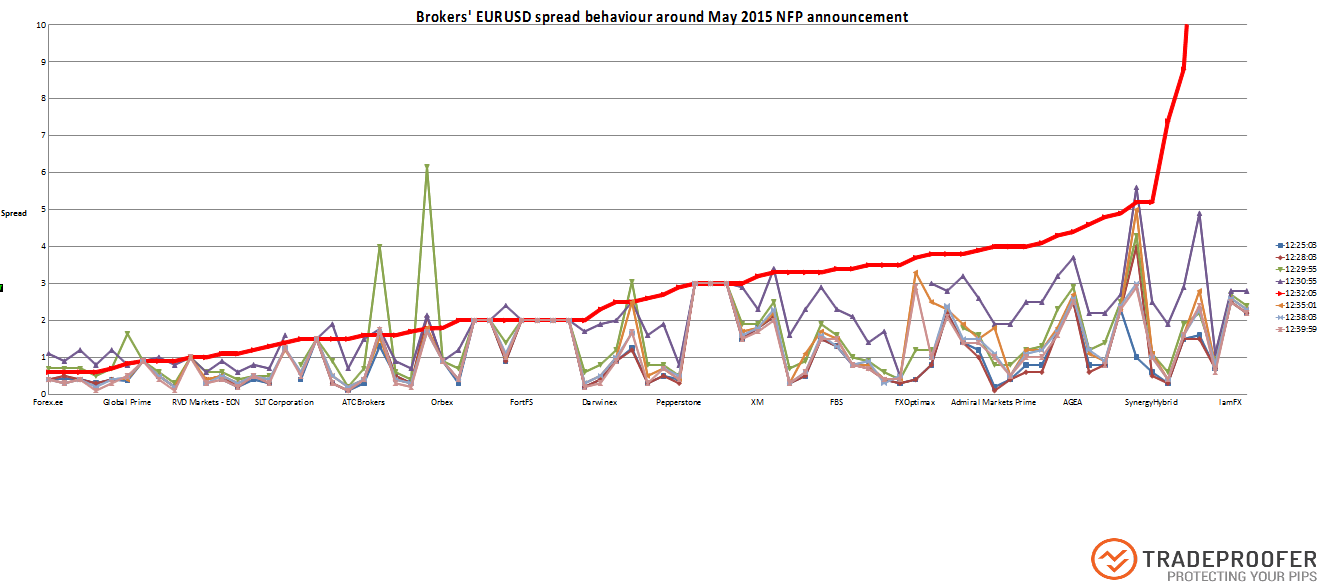

More market movement than usual translates to an opportunity for bigger trades, however, it is important to note that there are a number of parameters that could have a major impact on your profits and losses that go beyond betting on the wrong direction. As BDSwiss’ Leading Analyst and professional trader for more than 15 years, Alexander Douedari notes: “Spread widening during key events and data releases such as the NFP can limit your profits and increase your losses, this is why you need to look carefully into the trading conditions that your broker is offering. Beyond raw spreads, you should look for brokers with less spread widening, faster execution and minimum slippage.”

What is Spread Widening and How Does it Affect Your Profits?

A spread is simply the price difference between where the trader may purchase or sell an underlying CFD asset, this is commonly referred to as the bid and ask price. The difference between the bid and ask is basically what the broker will profit from your trade, regardless of whether your position ends up in profit or loss. You can think of the spread as the trading cost for placing a position, thinner spreads essentially enable you to reduce your trading costs thus making profits larger or losses smaller after you close your positions.

As Alex notes: “During highly volatile events, spreads tend to widen, it becomes, therefore “more expensive” to trade these events, but of course, these events have a higher risk/reward ratio, which is what makes them so popular with forex traders. When spreads widen however, your stop loss can be triggered before prices even begin trending and this can be disastrous for your positions. It is therefore always a good idea to investigate a broker’s spread widening during events of major volatility before attempting to trade with real funds.”

Wider Spreads Equal Larger Costs

A wider spread means larger trading costs, which is why professional traders opt for forex accounts that guarantee fixed or variable raw spreads. Raw spreads usually start from as low as 0 pips and are provided directly from your broker’s liquidity provider. This means that your broker will not be able to manipulate spreads and make them even wider. But even in those scenarios, spreads can differ from broker to broker, depending on their liquidity providers. It is therefore important to choose a broker that offers access to deep liquidity through top tier providers that offer ultra-competitive spreads. This can help reduce your trading costs to a great extent which can translate to bigger profits and fewer losses. Of course, a competitive quote is not the only thing that guarantees lower trading costs, other factors such as latency, execution speed and slippage also play in.

More than Just a Raw Account

Finding the right broker to trade with is key to your success as a trader. “The golden combination in forex trading is thin spreads, minimal slippage, instant execution, no commissions and no markups. Very few brokers in the industry offer such trading conditions, which is what makes BDSwiss one of the most advantageous brokers to trade with,” notes Alex.

With more than 1 million registered clients worldwide, leading forex and CFD financial institution BDSwiss offers its clients ultra-competitive trading conditions including deep institutional liquidity for low spread widening during high volatility, zero markups, zero commissions and a whopping 10 milliseconds execution speed. Specifically, BDSwiss’ revolutionary raw spreads account offers spread trading from 0 pips on all forex and gold pairs for a small monthly subscription fee, enabling all traders no matter their account size to benefit from institutional trading conditions and lower their trading costs. This volume-based account plan starts from just €1 per month and will even upgrade automatically once the trading volume limit is exceeded. Learn more about BDSwiss’ Trading Account Types here

Editors’ Picks

AUD/USD meets initial resistance around 0.7100

A decent rebound in the US Dollar is behind the AUD/USD’s daily pullback on Tuesday. In fact, the pair comes under modest downside pressure soon after hitting fresh yearly peaks in levels just shy of 0.7100 the figure on Monday. Moving forward, investors are expected to closely follow the release of Chinese inflation data on Wednesday.

EUR/USD looks offered below 1.1900

EUR/USD keeps its bearish tone unchanged ahead of the opening bell in Asia, returning to the sub-1.1900 region following a firmer tone in the US Dollar. Indeed, the pair reverses two consecutive daily gains amid steady caution ahead of Wednesday’s key US Nonfarm Payrolls release.

Gold the battle of wills continues with bulls not ready to give up

Gold remains on the defensive and approaches the key $5,000 region per troy ounce on Tuesday, giving back part of its recent two day. The precious metal’s pullback unfolds against a firmer tone in the US Dollar, declining US Treasury yields and steady caution ahead of upcoming key US data releases.

Bitcoin's downtrend caused by ETF redemptions and AI rotation: Wintermute

Bitcoin's (BTC) fall from grace since the October 10 leverage flush has been spearheaded by sustained ETF outflows and a rotation into the AI narrative, according to Wintermute.

Dollar drops and stocks rally: The week of reckoning for US economic data

Following a sizeable move lower in US technology Stocks last week, we have witnessed a meaningful recovery unfold. The USD Index is in a concerning position; the monthly price continues to hold the south channel support.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.