Is Gold a good investment? Is Gold a safe-haven asset?

Gold, due to its rarity and aesthetic value, has been the object of investment love for centuries. It is not only a valuable asset but also part of an integral element in the protection and strategic increase of wealth. The yellow metal is diversified in today's world of finance, hedging against inflation and serving as a value against uncertainty. But is Gold a good investment for all, and how can traders and investors incorporate it effectively?

Investing in Gold: pros and cons

Gold, due to its rarity and aesthetic value, has been the object of investment love for centuries. It is not only a valuable asset but also part of an integral element in the protection and strategic increase of wealth. The yellow metal is diversified in today's world of finance, hedging against inflation and serving as a value against uncertainty. But is Gold a good investment for all, and how can traders and investors incorporate it effectively?

Advantages of investing in Gold

Gold offers several quite compelling advantages as an investment vehicle.

Easy and accessible

The investment in Gold, which has been made far easier with so many tools and platforms in operation today, is quite different from what it was some time back. Till recent times, investors had to physically buy the yellow metal in the form of coins or bars, which again required safe storage and resulted in additional costs.

The advantage of Gold ETFs, digital Gold, and fractional ownership is that any investor can now invest in the precious metal without worrying about an enormously high affordable value.

Hedge against inflation

The most famous characteristic of Gold is that it guards against inflation. When the value of a currency goes down because of inflation, Gold seems to retain its buying ability.

This trait makes it a preferred asset during high inflation and times of instability in currencies.

Portfolio diversification

Gold’s price movements are often independent of other assets like stocks or bonds. This low correlation makes it an effective diversification tool. In a balanced portfolio, adding the yellow metal can reduce overall volatility and smooth returns.

High liquidity

Of all asset types, Gold is among the most liquid ones. Recognized and tradable in almost every country, it is easily convertible into cash. Due to global demand for this particular precious metal, Gold manages to retain its value in every economic climate.

Corporeal and enduring asset

Unlike stocks, bonds, or digital currencies, Gold is tangible and something real. Owning something tangible essentially means it can be literally held, stored, and controlled by the investor. A kind of security that paper or digital assets cannot provide. Besides, it has intrinsic value because of its rarity and universal appeal.

Disadvantages of investing in Gold

However, investment in Gold also has some marked disadvantages.

No income generation

Gold does not pay dividends, interest, or rent. Unlike stocks and real estate, which may yield a stream of income, Gold yields no returns except through capital appreciation. This can make it less attractive for income-focused investors.

Price volatility

Gold prices have mostly been volatile, influenced by the magnitude of inflation, central bank policies, and the movement of currencies. Strong periods of growth or high interest rates have often seen the yellow metal perform dismally because investors flee to other assets that give higher returns.

Storage, security, and insurance charges

Physical Gold needs to be kept very securely in a vault, a safe, or through a third-party storage service, and that can be costly.

Similarly, it should be insured against loss or theft, adding further costs that will eat into returns.

Is Gold a good investment?

Gold has certain unique properties that make it a necessary constituent of any investment portfolio. However, whether it is a "good" investment mostly depends upon the individual financial goals, the prevailing conditions of the market, and one's tolerance for risks.

Therefore, the answer to this question should be based on considering what the asset brings to the table in terms of performance across different market regimes and its comparative behavior against other asset classes.

Gold as a store of value

Some say Gold maintains its value over time. The fact is that Gold does tend to retain purchasing power that may otherwise be lost through the inflation of fiat money or by monetary policy at the hands of central banks and the government.

It is also very often referred to as a "hard asset," due to its supply being naturally limited and not able to be produced at will. The scarcity thus makes the yellow metal intrinsically valuable in an essential way, compared with currencies and even other commodities.

Gold as a source of diversification

In investment, diversification has remained key, considering that it drastically reduces risk without a significant hit on the returns front. Given the usually low correlation between Gold and other asset classes, it can be a very effective diversifier.

Or, in other words, Gold usually goes against the grain, increasing in value or holding it during times when stocks go through a slump.

Equities can significantly lose value during times of economic decline or stock market crashes. During that time, Gold would likely tick up to offset losses in stocks, thereby cushioning the portfolio. Adding even as small as 5% to 10% to one's portfolio may reduce overall volatility and serve as an insurance strategy for a resilient asset mix.

Gold as a hedge asset

- Inflationary periods: When the rate of inflation rises, the real value of the fiat currency falls. Gold tends to retain its value or appreciate given that, conceptually, investors usually consider it a hedge against erosion in the value of money.

- Economic uncertainty and recessions: In times of recession or high market volatility, Gold seems to be a hedging asset. This indicates that the investor would look at it more when the stakes involved in other risky investments like stocks seem high.

- Currency hedging: It acts as a hedge against the loss of any currency. When the value of a currency falls, especially major ones like the US Dollar (USD), Gold often rises in value. This is because it is globally recognized and not tied to any specific country’s economy, giving it intrinsic worth as a universal store of value.

Gold can be a good investment

- Gold can be a very good investment when used strategically within a diversified portfolio. Its unique attributes, stability, intrinsic value, low correlation with other assets, and global demand, make it a powerful asset.

- Whereas its appeal is most during times of inflation, economic uncertainty, and currency devaluation, it retains value over a long period, hence being a good tool for wealth preservation.

- But Gold is not for every investor. Many investors looking for high growth or regular income will find more suitable assets elsewhere. Yet, for investors who set a premium on security, stability, and protection from economic risks, the yellow metal offers a resilient addition to almost any portfolio.

Gold versus other investment tools

First, one needs to put in perspective an investment strategy for Gold amidst other classes of famous assets. Each class of investment – stocks, bonds, real estate, cryptocurrencies – fits within a particular risk-reward profile, growth prospect, and role in a portfolio.

Let's review Gold against the following alternatives in order to understand not only its strengths but also its limitations.

Gold vs stocks

Stocks are usually admired for their higher growth potential than Gold. As companies go well, so does the stock price, reaping capital appreciation and, therefore, possible dividend income.

Stocks are naturally related to corporate earnings, market conditions, and economic cycles, which somehow make them more volatile and susceptible to shrinkage. Gold is considered a less-volatile commodity during economic turmoil. Actually, it appreciates more in value when stock markets tend to go down.

That would be the case because, during an unfavorable market atmosphere or economic slump, the value of stocks may fall while that of Gold either does not get devalued or even grows. The inverse relationship between the two therefore makes Gold an effective hedge.

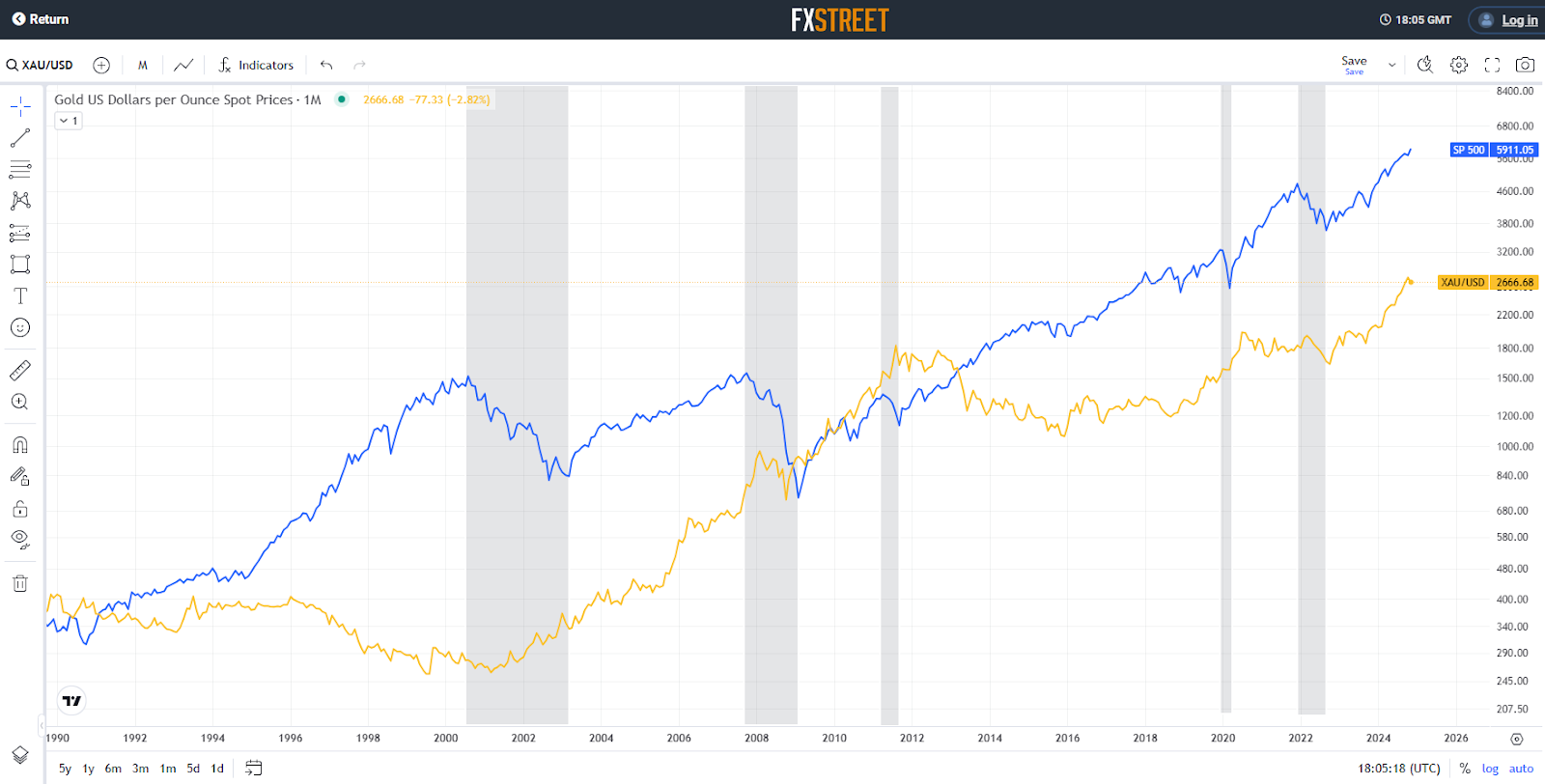

Gold vs S&P 500 prices in log scale. The periods of falling stocks are grayed out.

The only major advantage that stocks have over Gold is passive income in the form of dividends. Large, well-established companies pay consistent dividends to their shareholders and create an income stream. Regarding Gold, it cannot provide any income as it depends solely on capital appreciation.

Dividends from stocks are much more compelling for income-oriented investors, but they can still elect to hold some Gold as a counterweight to equity risk.

In total, stocks may be more attractive when the economy is growing and corporate profits are increasing. During strong economic uncertainty or in the face of market turbulence, the stability and strength of Gold could lower potential losses from stock holdings.

Gold vs bonds

Basically, bonds are considered safer investments than stocks, especially government bonds, which are really low risk.

But bonds are pretty sensitive to inflation and rising interest rates, conditions which erode their real return. On the other side, Gold is considered an inflation hedge, as it is believed that its value appreciates when prices rise quickly. With this, when inflation is up – and the currency's purchasing power falls – the price of Gold remains steady or up, therefore offering some sort of protection to bonds.

When interest rates go higher, bond prices typically go down because more recently issued bonds bear a higher yield, making the existing bonds less desirable. Meanwhile, Gold is not directly attached to interest rates in the same way, though high interest rates do make it less desirable because it doesn't bear interest.

The most attractive feature of bonds is that they generate income in the form of interest payments and, therefore, are ideal for income seekers. The regular flow of income is predictable and attractive to conservative investors who value stability above all else. In contrast, Gold does not yield any income and generates returns on capital appreciation only.

Overall, investors looking for predictable income with low risk could consider bonds, especially in stable, low-inflation economies. In an economy that is suffering from high inflationary pressures, Gold would be a better option for maintaining purchasing power.

Gold vs Bitcoin

Digital Gold is sometimes used to refer to cryptocurrencies such as Bitcoin (BTC) because of the limited supply and its store of value capability. However, the cryptocurrencies are so volatile that extreme changes may result in really short-term frames, so this makes Gold stable and reflective of low volatility.

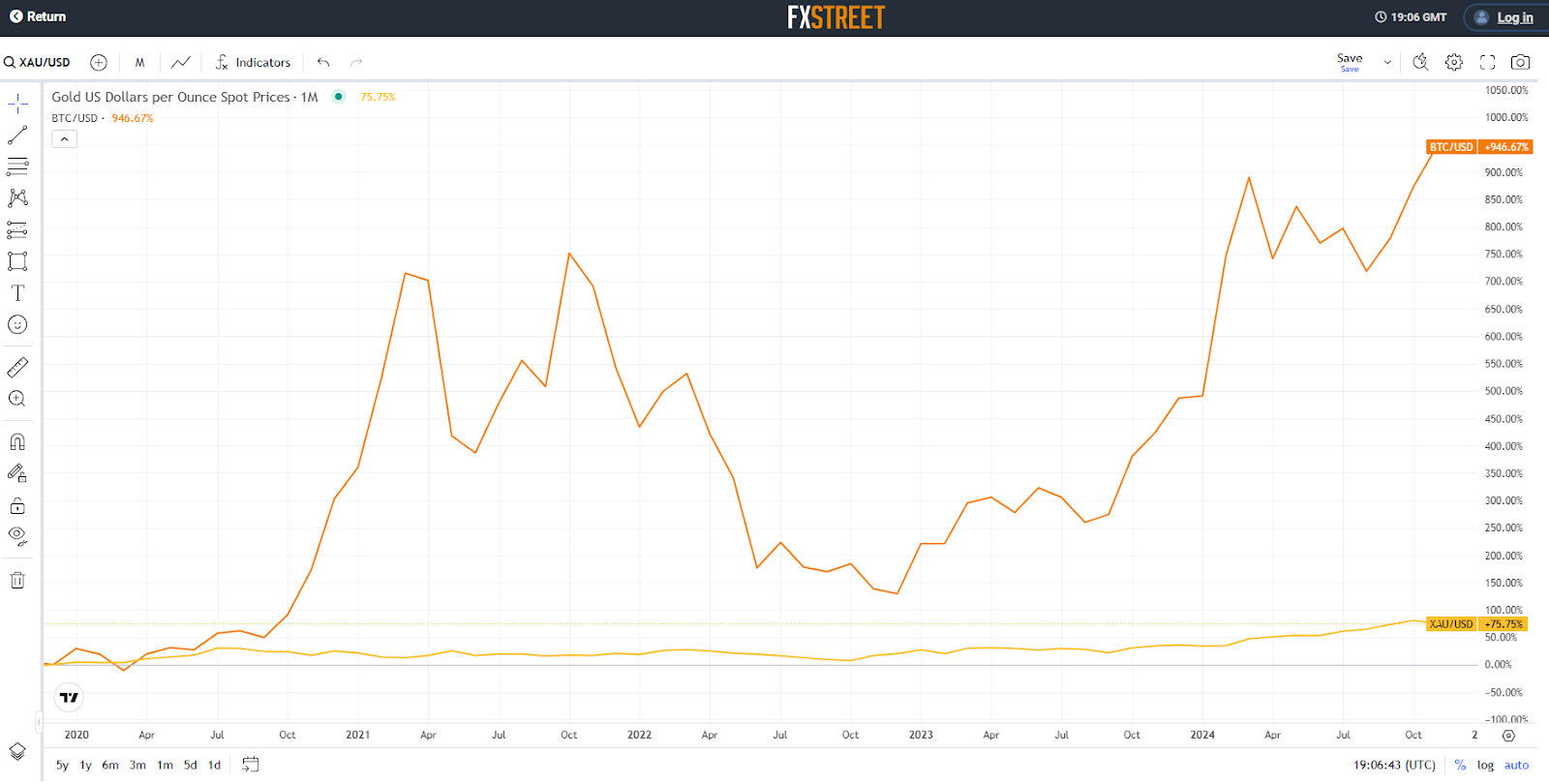

Gold vs. Bitcoin Prices

Besides that, Gold operates in almost any financial market around the globe, it's highly regulated, while cryptocurrencies are very new, and their regulations are not yet determined. Its long history as a valued asset means it is well accepted among banks, governments, and investors from all over the world. Cryptocurrencies are still finding their place and face regulatory obstacles in many countries.

Similarities include the fact that both Gold and Bitcoin have high liquidity. However, the yellow metal is a physical asset, one that might make a person comfortable since it is well acquainted. On the other hand, cryptocurrencies are digital in nature and thus require safe storage. They are susceptible to cyber threats, hacking, and loss of access.

In general, Bitcoin has high growth, though very volatile and risky for investors. For more conservative investors who prefer stability and security rather than speed, Gold is much more suitable.

Gold vs real estate

While both Gold and real estate are tangible assets carrying intrinsic value, both are believed to hedge against inflation. Real estate makes the added bonus of providing rental income in order to make it an income-generating asset, just as it is a store of value.

The yellow metal, on the other hand, has no return attached to it, but it is infinitely liquid. It is considered liquid because investors can turn over an investment into cash almost instantly.

In contrast, real estate will work well when the investor is focused on long-term appreciation or rental income, but it requires high management interaction and transaction costs. For investors needing a more stable, liquid asset, the appeal of Gold may be that it is easier to access or sell in an emergency.

Gold vs cash and cash equivalents

Cash and cash equivalents, such as money market funds, provide liquidity and stability, but they are very vulnerable to inflation. Cash loses buying power in an economy of rising prices and thus is not a very good long-term investment. Gold usually fares well during a period of high inflation, since it holds its value – or even increases in value – when currency depreciates.

Cash and cash equivalents are, by definition, the most liquid investments. Hence, they can be deployed straight away. Of course, Gold is also very liquid, but its sale implies minor transaction costs or small spreads in price. At the same time, the yellow metal offers one added bonus: it is an inflation hedge, whereby it is more strategic in conserving the long-term purchasing power for investors.

Cash, therefore, finds its best use in short-term requirements and contingency funds, given its liquidity. Gold, on the other hand, provides long term preservation of wealth, particularly during those periods of inflation when the purchasing power of cash erodes over time.

Investing in Gold offers lower returns and less risk over time

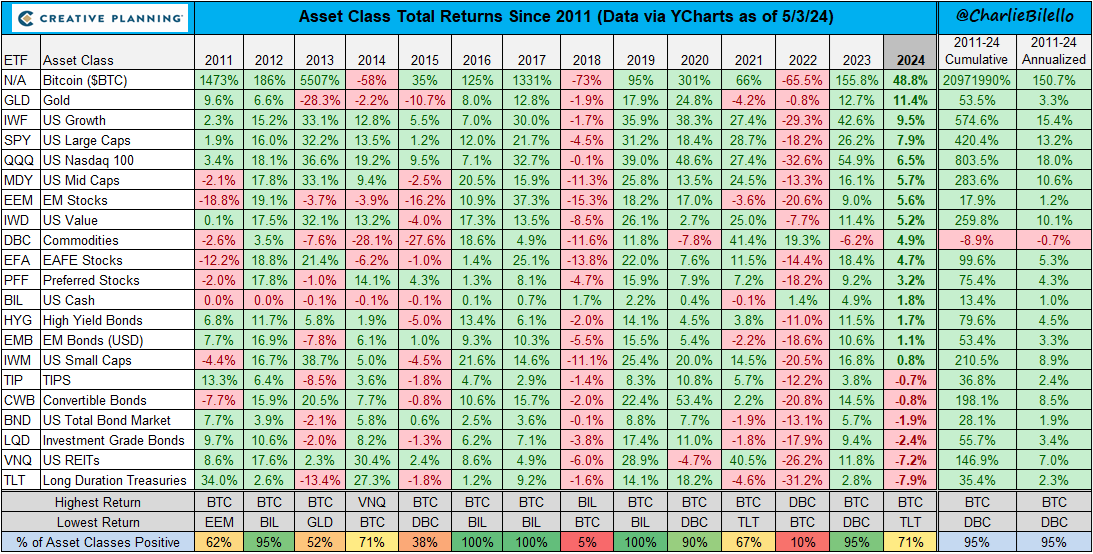

Historically, Gold has shown relatively lower annualized returns compared to stocks, Bitcoin, and real estate (US REITs), while it has outperformed long-term treasuries and cash.

Asset class total returns. Source : @CharlieBiello on X

However, outperformance by assets such as stock and Bitcoin is usually at the cost of enhanced volatility and thus higher risk.

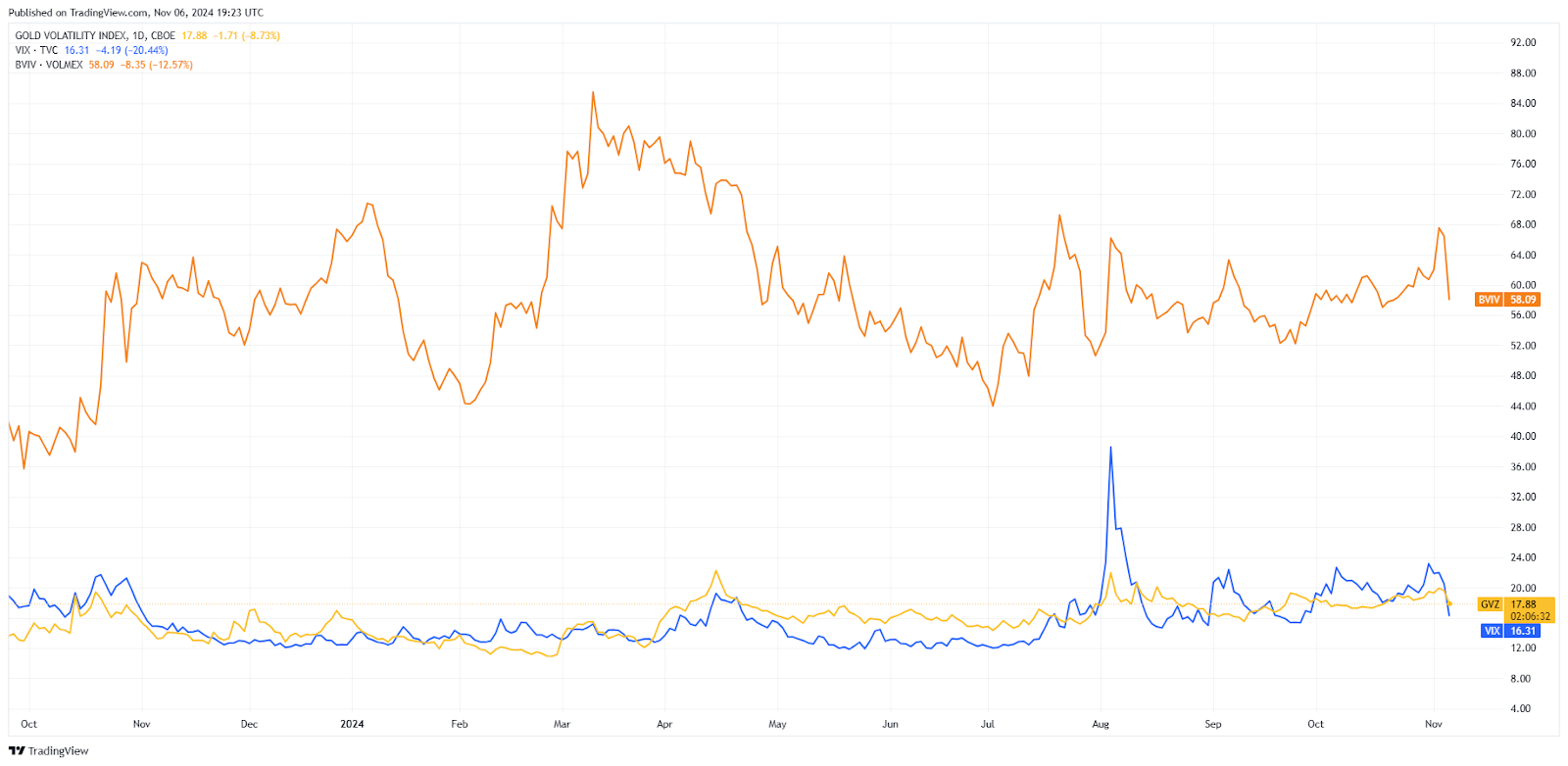

Gold CBOE_DLY, S&P500 VIX, and Bitcoin BVIV volatility indexes

Please note that past performance is not a guide to future performance.

Choosing Gold as investment vehicle

Every asset class in one's portfolio has a special reason for being there, its own merit, and a special risk too. Of course, Gold has its merits too: stability, uncorrelated performance to other assets, hedge against inflation, economic downturn, or poor performance of a currency.

But it does not provide income or high growth, like stocks or cryptocurrencies. Thus, Gold becomes most useful when used to augment other assets in a diversified portfolio, one in which the balancing of risk and wealth preservation across various economic circumstances is a necessity.

With that information, the investor can make an informed decision on how much of that asset needs to be in the portfolio, considering risk tolerance, income requirements, and financial goals. This would not replace other assets but would probably add to the pool in the pursuit of diversification, security, and resilience in a wider investing framework.

Is Gold a safe-haven asset?

Among all assets, Gold was conventionally considered to be the so-called safe haven and has indeed had this status over many centuries and cycles.

A safe-haven asset is one which investors hurry to when there is any kind of economic uncertainty, financial instability, or geopolitical turmoil, since such an asset would retain its value or perhaps appreciate when the rest of the assets are losing ground.

Gold is actually considered one of the best safe-haven assets because it is real, well-known, and independent of the quirks of any single country or system, an enduring value in times of crisis.

Gold has repeatedly proved that it maintains its value, if not appreciating, during the last financial collapses, economic recessions, and geopolitical turmoils. Thus, it is a sure choice for the investor in pursuit of stability.

For example, during the tech bubble burst in 2000, the financial crisis in 2008, and the recent pandemic-induced volatility, Gold’s value remained strong, underscoring its appeal as a safe-haven asset.

While Gold is valuable to hedge, far from a perfect surrogate for growth oriented investments, it works best in a strategic approach toward portfolio diversification that would keep it balanced against extreme market conditions.

It's a very good bet for those investors who fear either economic or geopolitical instability, inflation, or devaluation of currencies in preserving one's wealth and securing it from total loss in case the other assets fail.

Why you should invest in Gold

Among many others, one of the most important reasons to invest in Gold involves hedging against inflation, portfolio diversification, and protection of wealth during economic turmoil. Indeed, the asset class exhibits some distinguishing features, making it valuable in an investment approach.

Hedge against inflation

As inflation rises, some assets like cash and fixed-income investments may lose value in real terms, but the yellow metal typically retains or even increases its purchasing power.

Normally, the price of Gold appreciates when the level of inflation is high because it serves as a store of value. Thus, in times of high inflation, it's a safer investment.

Portfolio diversification and risk lessening

Gold has a very low correlation with other major asset classes, like equity and fixed income, which broadly keeps its price movements noncorrelated to more traditional markets.

It usually shines when the stocks and bonds get trashed, at least in a market downturn.

This negative/low correlation makes the yellow metal a very good asset for reducing the overall portfolio volatility and managing the risk accordingly.

By adding the asset to a diversified portfolio, investors can balance out the volatility of other assets, particularly equities. This may prove useful to any risk-averse investor or simply trying to minimize loss in the event of a correction in the market.

Safe haven during economic and geopolitical turmoil

Gold is considered to be a hedge asset since it either retains its value or rises amidst economic turmoil, financial crisis, and geopolitical uncertainty.

When other investments falter or become unpredictable, investors often seek refuge in Gold. Its enduring appeal makes it universally recognized as a store of value.

Protection against currency fluctuations and weakness

Gold is widely considered an internationally recognized asset unrelated directly to any currency and therefore can serve as an effective hedge against the depreciation of currency.

Whenever any currency, say the US Dollar, depreciates, then Gold tends to go up.

This is highly related to investors who want to protect their wealth against currency devaluation or even changes in the rate of foreign exchange.

Long-term preservation and accumulation of wealth

Gold, for durability and intrinsic worth, lends its value to make it the perfect instrument to preserve fortune over generations. Fiat money risks inflation in its value, while Gold, due to the controlled supply and universal appeal, holds a timelessness that does not fade with time.

So, most investors have the asset as some kind of financial insurance policy, giving them a sense of security.

Gold remains an extremely attractive option for the investment planner who wants to transfer wealth to further generations: it does not depend on the success of corporations or governments, and hence its value is not tied as strongly to the economic and political environment.

Its long history as a store of value corroborates how appealing it is for those who want to safely keep and transfer their wealth across decades.

Although the most orthodox function of Gold is to hedge and store value, it could definitely be used for the purpose of long-term price appreciation, especially during periods of economic or geopolitical turmoil.

Additional attractiveness for the long-term investor is its stability, or rather, the ability of appreciation in its value. Though it may not yield the exorbitant returns of stocks in their bull markets, the potential that Gold carries in appreciation makes it all the more worthwhile in a well-tempered portfolio.

High liquidity

Gold is one of the most liquid assets, with global markets for buying and selling that operate almost 24/5.

Accordingly, investors can liquidate their holdings in Gold into cash in no time. Such liquidity is highly crucial during periods of turmoil, when investors may require quasi-immediate liquidity without large price concessions.

Liquidity is important for those investors valuing flexibility and the ability to quickly access investments. Unlike real estate, which takes longer to sell, or private equity, with a possible lock-up period, one can liquidate or sell Gold with ease in several forms on any market around the world.

Availability and diversified investment options

This, in essence, has made investment easier for any investor, with the different modern investment options in the yellow metal. Ownership of Gold meant the pure purchase of physical bars and coins, but with the newer alternatives of multiple ETFs and futures, the avenues of getting the asset in the portfolio have become plentiful.

Accessibility has enabled investors to align the Gold investments with their aims, budget, and their tolerance for risk so as to suit any portfolio.

Gold options trading strategies

Gold options trading offers a range of strategies, each suited to different market conditions, risk tolerance, and trading objectives. Here are some of the most popular strategies for trading Gold options.

Long call: Betting on a price increase

The long call is one of the most basic strategies in options trading and is ideal for traders who believe that Gold prices will rise significantly.

By purchasing a call option, the trader gains the right to buy Gold at the strike price before the option’s expiration. If price moves above the strike price, the option can be sold or exercised for a profit.

The maximum loss in this strategy is limited to the premium paid, making it a relatively low-risk way to speculate on a price increase.

Long put: Protecting against price decline

The long put is used when a trader expects prices to fall. By buying a put option, the trader acquires the right to sell Gold at a predetermined strike price, even if the market price drops.

This strategy is not only profitable when prices decline but can also serve as a hedge for investors holding physical Gold or futures.

Gold options, on the other hand, limit the buyer’s risk to the premium paid. If the price doesn’t move favorably, the maximum loss is the premium, while the potential gain remains uncapped for a call option if prices rise sharply. For put options, the profit is capped at the strike price because prices cannot drop below zero.

As with the long call, the maximum loss is limited to the premium paid.

Covered call: earning premium income from a bullish position

In a covered call strategy, the trader owns Gold or a futures contract and sells a call option against that position.

This approach generates income through the premium received from selling the call, which can offset holding costs or provide additional returns. However, it limits the upside potential, as the trader may have to sell Gold at the strike price if the market rises above it.

Protective put: Insurance for long Gold holdings

A protective put is a strategy used by investors who own physical Gold or futures and want to protect against downside risk.

By purchasing a put option, the trader creates a "floor" on their investment. If Gold prices decline, the put option gains in value, offsetting losses on the underlying asset.

This strategy functions as insurance for long positions.

Straddle: Profiting from high volatility

The straddle is a neutral strategy designed for situations when a trader expects significant volatility in Gold prices but is unsure of the direction.

The trader buys both a call and a put option with the same strike price and expiration date. If Gold price swings widely in either direction, the strategy can become profitable as one of the options moves into the money, potentially covering the cost of both premiums.

Strangle: A cost-effective bet on volatility

A strangle is similar to the straddle, but instead of purchasing options at the same strike price, the trader buys a call option with a higher strike price and a put option with a lower strike price.

This approach reduces the premium cost, as the options are farther from the money, but requires a more substantial price movement to be profitable.

Strangles are useful when expecting volatility but with less certainty about extreme price shifts.

Butterfly spread: A low-volatility strategy

A butterfly spread is a sophisticated strategy that profits when Gold’s price remains stable.

It involves buying a call (or put) at a low strike price, selling two calls (or puts) at a middle strike price, and buying another call (or put) at a higher strike price.

This setup creates a position that benefits from low volatility, as it achieves maximum profitability if Gold’s price settles near the middle strike at expiration.

Calendar spread: Profiting from time decay differences

A calendar spread (or time spread) is used to exploit differences in time decay rates between options with different expiration dates.

The trader buys a long-term option and sells a short-term option at the same strike price. If Gold’s price remains stable, the near-term option loses value faster due to time decay, allowing the trader to profit from the spread.

Strategies for managing expiring options

Traders have several strategic choices as an options contract nears expiration:

- Close the position: By selling or buying back the option, traders can realize any profit or loss based on the market value of the option. This approach prevents automatic exercise and can be useful when an option has some remaining time value.

- Roll the option: If a trader wants to extend their exposure to Gold, they can roll the option by closing the current contract and opening a new one with a later expiration. This strategy maintains the position while managing time decay.

- Let it expire: If the option is out-of-the-money or has minimal value, the trader may choose to let it expire worthless, incurring a loss equal to the premium paid.

Conclusion

Gold options trading is an exciting investment that can offer great profits in any kind of market, whether rising or falling.

Gold options enable traders to develop tailored strategies and modify them depending on their views on the market and appetite for risk, since they give the right, and not the obligation, to buy or sell Gold at a certain price.

However, as with any sophisticated financial instrument, Gold options come with their own set of risks, which require disciplined management techniques.

For those willing to invest the time to understand the mechanics of options trading, they offer a powerful tool for traders looking to take advantage of Gold price movements.