Since beginning my trading career I have encountered many ups and downs along the way attempting to discover how the financial markets really work. Some lessons were certainly costly ones while others paid me back in more ways than just the financial kind. These lessons in particular served their purpose in showing me aspects of the market, and the FX market in particular, which I had never considered and which now I am aware of and factor into my own trading plan each and every day. I also discovered that one has to be open to these lessons if they really want to take advantage of them. In the novice trader’s experience though, it is not always easy to be open to the right things when so much information is being thrown at you and all you want to focus on is making money as quickly as possible. Nobody knows this better than me, I can assure you.

A much wiser person than me once said, you can only pour into an empty cup. If it is already full, then you will only see what you are pouring go to waste. When teaching the various classes online and on-location for Online Trading Academy, I try to suggest to my students to take the very same advice themselves in their trading and investing endeavours. It is very easy to question and try to figure out exactly why something went up or down in the FX markets and, let’s face it, there is literally an overwhelming amount of information out there to focus on as a currency trader. There is economic news, fundamentals, chart patterns and technical analysis to name but a few. This is more than enough to fill your cup I would say.

Based on the amount of information available to us online and at the click of a button, any of us looking at FX pairs on a day to day basis could easily justify why the markets went up or down couldn’t we? That’s what the news does every day, doesn’t it? The papers and news websites always like to tell us why the markets went up or down that day but they never seem to tell us what the market is likely to do the next day, do they? To me, that simple fact alone tends to make all financial and market news completely and utterly redundant. I look at it like this: When I was new to trading FX, all I did was read the news sites and try to implement the information into my decision making process for taking trades, but the experience ultimately was not a good one at all. It certainly didn’t help me to make money. In fact, I probably lost more along the way from always being on the wrong side of the news.

I realized very quickly that if making consistent profits in trading was as simple as following the financial news to make our choices of buying and selling, then that’s what everyone would do and they would all make money. I always felt there must be more…and there was. It was price itself and the only two components which truly impact it: Demand and Supply. In itself, the principles of Demand and Supply couldn’t be more simple and logical. We all know that when Demand and Supply are out of balance, then prices have to move either up or down. There is no getting away from this, whatever way you want to look at it. The larger the imbalance, the larger the move; and when it comes to market participants, you don’t get bigger than the major banks and financial institutions. Track their footprints on a price chart and you’ll have all you need to know about when to buy or sell, irrespective of what the news is saying. I don’t hear the major institutions making announcements when they plan to enter the markets, do you? If they did, then they would lose their trading edge altogether and they make far too much money to sacrifice that. We just have to be objective, patient and follow our plans to do what they do.

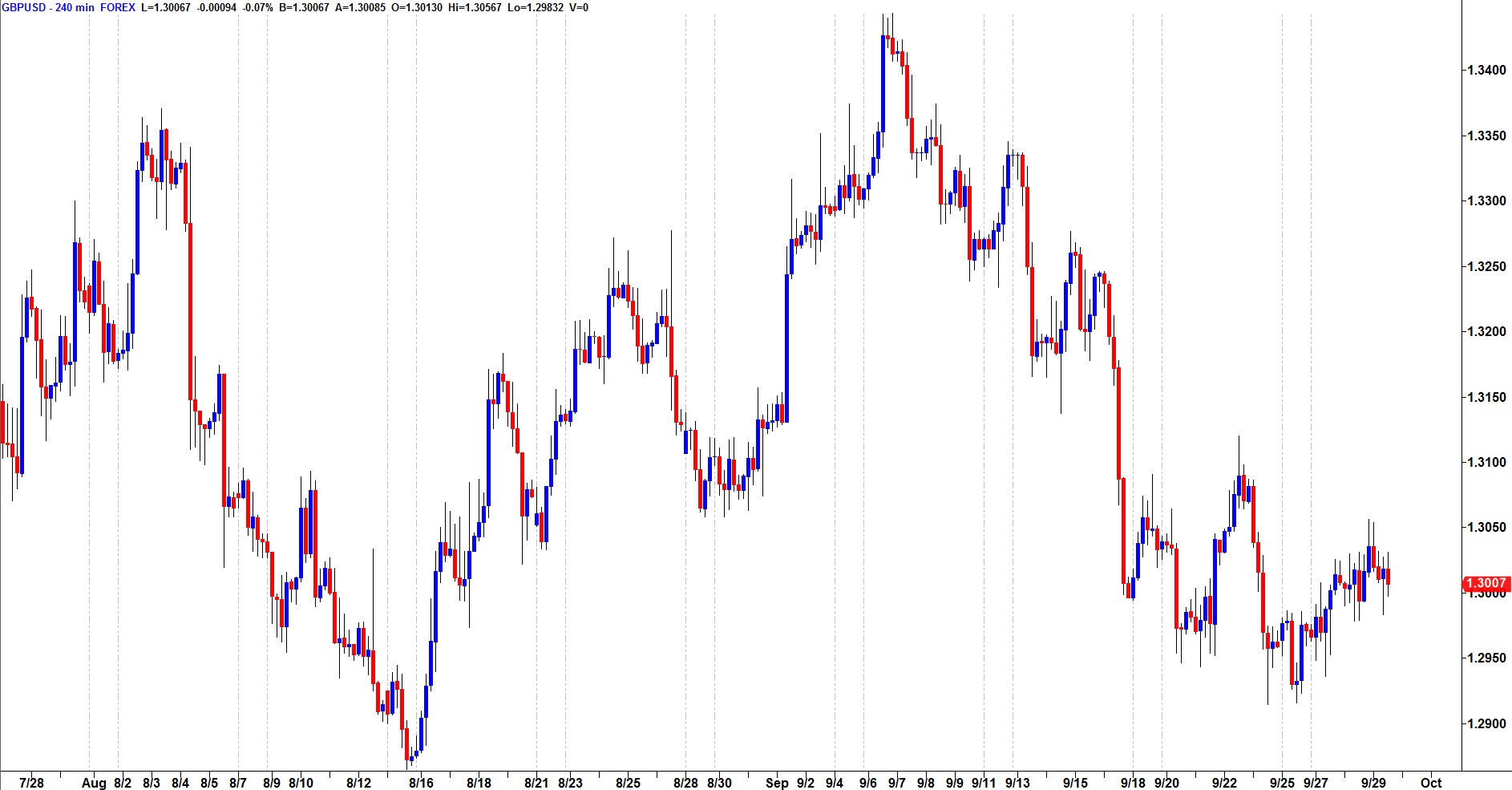

The big talk in the FX markets lately has been Brexit. To be frank, I am pretty tired of hearing about it but the chat still goes on anyway. After the vote to leave the EU and the consequent sell off of the GBPUSD, it has been a turbulent and indecisive market to say the least. Let’s take a look at a recent chart of the price action:

Pretty it is not. Following any kind of trend has been nothing short of frustration after frustration. Even major moves we have seen on the market have been followed by some kind of justification based on figures like GDP, employment and now the latest talk which follows the line of thinking that the UK will be leaving the EU sooner rather later. It’s pretty much a minefield of speculation and to trade based on the news is just misery waiting to happen. But many traders are out there attempting to do just that, buying and selling based off any news they can find and no doubt finding frustration along the way. My question is this: do you really think the banks are reading all this news before making their choice to buy or sell? I would say that it is they who are creating these moves ahead of time due to their huge order size creating major imbalances in price and then the news wires attempt to explain it afterwards.

Take a look at this chart instead for a clearer picture of the price action:

Suddenly things look a whole lot clearer when we see the true footprints of the big players. A professional trader is patient enough to wait for the big picture forces to show their hand before making a move either way and irrespective of the news too. We can’t beat the banks after all, so instead we choose to join them at Online Trading Academy. It becomes much easier to accept that you will never really know why something goes up or down, aside from simple Demand and Supply imbalances. Accept that and you can be well on your way to consistency, only if you empty your cup first.

The information provided is for informational purposes only. It does not constitute any form of advice or recommendation to buy or sell any securities or adopt any investment strategy mentioned. It is intended only to provide observations and views of the author(s) or hosts at the time of writing or presenting, both of which are subject to change at any time without prior notice. The information provided does not have regard to specific investment objectives, financial situation, or specific needs of any specific person who may read it. Investors should determine for themselves whether a particular service or product is suitable for their investment needs or should seek such professional advice for their particular situation. Please see our website for more information: https://bustamanteco.com/privacy-policy/

Editors’ Picks

EUR/USD holds lower ground near 1.1850 ahead of EU/ US data

EUR/USD remains in the negative territory for the fourth successive session, trading around 1.1850 in European trading on Friday. A broadly cautious market environment paired with modest US Dollar demand undermines the pair ahead of the Eurozone GDP second estimate and the critical US CPI data.

GBP/USD keeps losses around 1.3600, awaits US CPI for fresh impetus

GBP/USD holds moderate losses at around 1.3600 in the European session on Friday, though it lacks bearish conviction. The US Dollar remains supported amid softer risk tone and ahead of the US consumer inflation figures due later in the NA session on Friday.

Gold trims intraday gains to $5,000 as US inflation data loom

Gold retreats from the vicinity of the $5,000 psychological mark, though sticks to its modest intraday gains heading into the European session. Traders now look forward to the release of the US consumer inflation figures for more cues about the Fed policy path. The outlook will play a key role in influencing the near-term US Dollar price dynamics and provide some meaningful impetus to the non-yielding bullion.

US CPI data set to show modest inflation cooling as markets price in a more hawkish Fed

The US Bureau of Labor Statistics will publish January’s Consumer Price Index data on Friday, delayed by the brief and partial United States government shutdown. The report is expected to show that inflationary pressures eased modestly but also remained above the Federal Reserve’s 2% target.

A tale of two labour markets: Headline strength masks underlying weakness

Undoubtedly, yesterday’s delayed US January jobs report delivered a strong headline – one that surpassed most estimates. However, optimism quickly faded amid sobering benchmark revisions.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.