- Economic releases shape interest rate expectations and rock currencies.

- Even those focusing solely on the price should at least be aware of the publication time of critical events.

- Below are five basic tips to start using the calendar in forex trading.

Why has the price gone wild at a specific time? The answer usually originates from the economic calendar. New data has come to light, causing investors to change their expectations for monetary policy in a specific country and reprice the underlying currency. Here are the basics of using the calendar.

*Note: This content first appeared as an answer to a Premium user. Sign up and get unfettered access to our analysts and exclusive content.

1) Better or worse

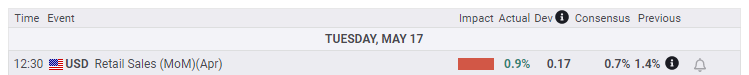

When looking at the economic calendar, what is important and what is not? The Actual figure, when compared to the Consensus, is what matters most. If an economic indicator has come out better-than-expected, the Actual is highlighted in green and if it is worse-than-expected, it is in red.

In the example below, US Retail Sales were expected to come out at 0.7% (Consensus) and the actual figure was 0.9%, highlighted in green. Therefore, it is positive for the underlying currency, USD. Note: You can receive notifications for your preferred events by clicking the bell icon.

2) High or low?

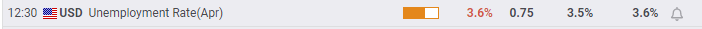

In some cases, such as the number of jobs added, a higher figure is better-than-expected and a lower one is worse. In others, such as the unemployment rate, a higher figure is worse-than-expected and a lower one is better-than-expected. In any case, the economic calendar will denote which is which by its color.

In this example, the US Unemployment Rate came out at 3.6%, higher than the 3.5% expected, thus economically speaking worse-than-expected.

It is essential to note that inflation is somewhat paradoxically both better and worse. While it is worse for most people who have to pay more for goods and services, and is generally a negative indicator for the economy, it is usually good for the currency, as it implies higher interest rates, which make the currency more attractive to carry traders.

3) More than one indicator

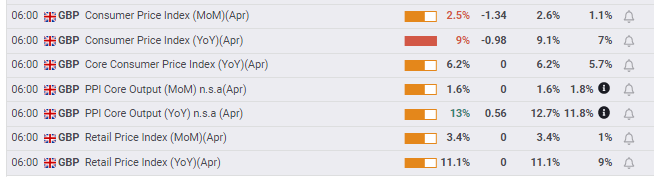

When more than one indicator is released at once – usually components of the same release – the ones with the highest volatility tend to have the highest impact. On the FXStreet Calendar, the highest volatility level is in red, while orange in medium, and yellow is light.

For example, if the most important component comes out significantly better than expected, the currency is set to rise regardless of the other figures. When it comes out as expected, the medium and low-tier figures might have a bigger impact.

The example in the image below are UK inflation figures. Some are better-than-expected, some exactly as expected and some are lower. The most important one is the Consumer Price Index YoY. It came out below expectations. That is why the pound, the underlying currency, responded negatively.

4) Does the Previous figure matter?

Usually, it doesn't, as investors tend to focus on the most recent data point and ignore the past. However, in some cases, there are revisions to past data which can impact markets. If the latest figure comes out as expected but the one for the previous month is revised down, it is negative for the currency.

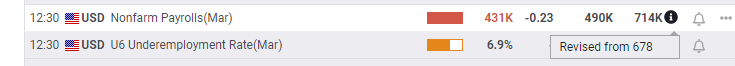

When you see the i icon, it implies there is additional information. Hovering over it will provide an update about the revision.

For example, in the Nonfarm Payrolls report for March, the Actual figure came out at 431K, below expectations for 490K. However, this smaller increase in the number of jobs came on top of upwardly revised data for February – 714,000 vs. the 678K originally reported. That meant that the disappointment from the most recent data release was not as bad as initially seen.

5) Special cases:

There are also special cases like the US Nonfarm Payrolls when expectations change ahead of the release. If new data in the two days before the NFP point in a different direction than what economists foresaw one week before the release, the reaction can be different than what is seen on the calendar and it is important to get ready for this special event by reading updated previews. I personally recommend new traders to avoid trading Nonfarm Payrolls.

Final Thoughts

Understanding the basics of the economic calendar is essential to every trader. I recommend trading economic events first on a demo account to get the feel, and only then moving to a real account later.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Editors’ Picks

USD/JPY slides back below 156.00 as Tokyo CPI backs further BoJ rate hikes

USD/JPY attracts fresh sellers for the second straight day following the release of Tokyo CPI, which grew slightly more than expected in February. This comes on top of hawkish comments by BoJ officials and backs the case for further policy tightening, providing a modest lift to the Japanese Yen. Apart from this, sustained safe-haven buying, amid trade-related uncertainties and geopolitical tensions, benefits the JPY's safe-haven status. However, reduced Fed rate cut bets underpin the US Dollar and could help limit losses for the currency pair.

AUD/USD consolidates around 0.7100 as trade and geopolitical uncertainties counter hawkish RBA

AUD/USD steadies around 0.7100 following the previous day's modest pullback and remains on track to register gains for the sixth week in a row as the RBA's hawkish stance continues to underpin the Aussie. However, reduced bets for a more aggressive easing by the US Fed keep the US Dollar close to the monthly peak. Furthermore, trade uncertainties and threats of imminent US strikes on Iran act as a headwind for the risk-sensitive Australian Dollar.

Gold remains below $5,200 despite tariff jitters and geopolitical risks

Gold is seen consolidating in a range below the $5,200 mark during the Asian session on Friday amid mixed cues. Trade jitters, along with the risk of a potential US-Iran war, act as a tailwind for the safe-haven bullion. Meanwhile, the Fed's hawkish outlook keeps the US Dollar close to the monthly high and caps the non-yielding yellow metal. Nevertheless, the commodity remains on track to register gains for the fourth straight week, though the fundamental backdrop warrants some caution for bullish traders.

Top Crypto Gainers: Stable and Decred rally, Pippin approaches record highs

Altcoins, such as Stable, Decred, and Pippin, are extending gains so far this week, defying the risk-averse conditions in the broader cryptocurrency market. Stable and Pippin are near record high levels, while Decred extends its breakout rally above $30.

Changing the game: International implications of recent tariff developments

The Supreme Court ruling on International Emergency Economic Powers Act (IEEPA) tariffs provides limited relief for the rest of the world, with weighted average tariff rates modestly lower.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.