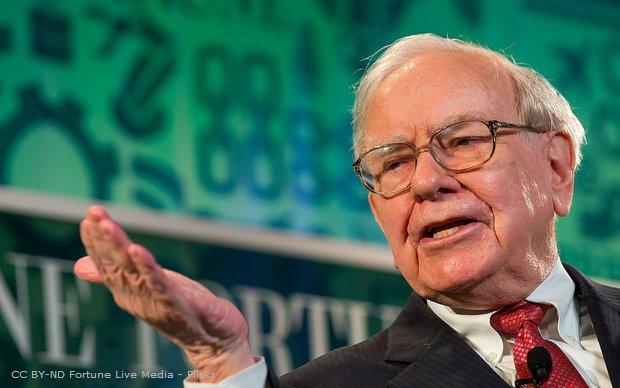

One of the most famous and influential billionaires in the world, Warren Buffett has a brilliant and clear vision that helped him to built a consistent reputation in the business world.

Buffett is the chairman, CEO and largest shareholder of Berkshire Hathaway. He started doing business from an early age and has acquired a fortune estimated at $70.2 billion.

We share with you some of the cleverest thoughts and quotes of the Oracle of Omaha, as some call him, on how to manage life and business to become successful.

1. You are your best investment

"Investing in yourself is the best thing you can do. Anything that improves your own talents”

Read More: Hamish, FTA student: From a diverse career, to a diversified portfolio

2. Stay healthy

“You only get one mind and one body. And it's got to last a lifetime. Now, it's very easy to let them ride for many years. But if you don't take care of that mind and that body, they'll be a wreck forty years later, just like the car would be.”

Read More: Are You Physically and Fiscally Fit for your Later Years?

3. To invest well, master the basics

“Price is what you pay. Value is what you get.”

4. Change routines and bad habits as soon as possible

"I see people with these self-destructive behavior patterns," he says. "They really are entrapped by them."

Buffett advised graduating students at the University of Florida to form good habits as soon as possible. "You can get rid of it a lot easier at your age than at my age, because most behaviors are habitual," he told them. "The chains of habit are too light to be felt until they are too heavy to be broken."

5. Increase your saving habit

“The biggest mistake is not learning the habits of saving properly early. Because saving is a habit. And then, trying to get rich quick. It’s pretty easy to get well-to-do slowly. But it’s not easy to get rich quick.”

Read more: To Become an Elite Trader You Must Develop Strong Positive Habits

6. Let excellence surrounds you

“It's better to hang out with people better than you. Pick out associates whose behavior is better than yours and you'll drift in that direction.”

Read more: 5 Qualities of A Good Forex Trading Mentor

7. ...and choose the right adviser

“You can't make a good deal with a bad person.”

Watch the video: Social trading: how to profit from it and what to be careful about!

8. Read, read, read

"I just sit in my office and read all day," Buffett told. "Look, my job is essentially just corralling more and more and more facts and information, and occasionally seeing whether that leads to some action." Reading was his obsession from the very beginning of his career. He admits that this habit is crucial to achieve all his goals.

9. Never lose a good opportunity

"Big opportunities in life have to be seized. We don't do very many things, but when we get the chance to do something that's right and big, we've got to do it. And even to do it in a small scale is just as big a mistake almost as not doing it at all. You've really got to grab them when they come, because you're not going to get 500 great opportunities."

10. Do what you love

“Take a job that you love. You will jump out of bed in the morning. I think you are out of mind if you keep taking jobs that you don't like because you think it will look good on your resume. Isn't that a little like saving up sex for your old age?”

11. Know your limits

"You don't have to be an expert on everything, but knowing where the perimeter of that circle of what you know and what you don't know, and staying inside of it, is all important."

Read more: Knowing Yourself is Important for Your Trading

Other article of interest:

- Warren Buffet: Dicing with the Devil

Warren Buffett once challenged Bill Gates to a game of dice. Gates immediately became suspicious when he was offered to choose first from a selection of unconventionally...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Editors’ Picks

EUR/USD climbs to two-week highs beyond 1.1900

EUR/USD is keeping its foot on the gas at the start of the week, reclaiming the 1.1900 barrier and above on Monday. The US Dollar remains on the back foot, with traders reluctant to step in ahead of Wednesday’s key January jobs report, allowing the pair to extend its upward grind for now.

USD/JPY recedes to multi-day lows near 155.50

USD/JPY is pulling back sharply at the start of the week, slipping back toward the 155.50 area as speculation mounts that authorities could step in to rein in further Yen weakness. That narrative gained traction after PM S. Takaichi secured a landslide victory in Sunday’s election, stoking expectations of a tougher line in defence of the domestic currency.

Gold treads water around $5,000

Gold is trading in an inconclusive fashion around the key $5,000 mark on Monday week. Support is coming from fresh signs of further buying from the PBoC, while expectations that the Fed could turn more dovish, alongside concerns over its independence, keep the demand for the precious metal running.

Crypto Today: Bitcoin steadies around $70,000, Ethereum and XRP remain under pressure

Bitcoin hovers around $70,000, up near 15% from last week's low of $60,000 despite low retail demand. Ethereum delicately holds $2,000 support as weak technicals weigh amid declining futures Open Interest. XRP seeks support above $1.40 after facing rejection at $1.54 during the previous week's sharp rebound.

Japanese PM Takaichi nabs unprecedented victory – US data eyed this week

I do not think I would be exaggerating to say that Japanese Prime Minister Sanae Takaichi’s snap general election gamble paid off over the weekend – and then some. This secured the Liberal Democratic Party (LDP) an unprecedented mandate just three months into her tenure.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.