First, let me wish you all a very Merry Christmas! What a year this has been with Presidential Elections, Brexit and the almighty bounce back of the US Dollar. With this much activity in the second half of 2016, we can only imagine what’s to come in 2017.

For this week’s article, I thought it would be good to look at some of the recent activity on a few of the more popular currencies and make some notes of key levels to watch out for in the coming months. There is plenty of trading action to anticipate and look forward to over the coming months and there is no better place to start than the US Dollar itself.

US Dollar

It is a well-known fact that I have been long-term bullish on the Greenback for quite some time now. Ask any of my students and they will tell you that I have been predicting upside in the US Dollar since the end of 2009, and the recent rate hike by the Fed which put rates at 0.75% has only helped the cause.

Back then, the Dollar Index was trading at the lowly price of 74.50. At the time of writing this piece, we are currently at the lofty height of 103.02. Obviously, I am not encouraging you to run out and buy as many Dollars as you can because things are a little too high right now, but if a pullback happens I would expect to see this trend to continue a little more.

Let’s look at the chart:

As it stands, we see potential for the market to challenge the area of 106.42 to 110.00. Of course, this could take a run up easily from this point but I would like to see a retest of 100.00 for a better buying opportunity. Should we reach our higher level of Supply, and if it holds, the marked demand level of 96.00 to 91.90 would be the area to expect a bounce. This market is still in an uptrend and there is no reason for it to end yet, with a potential rally to 120.00 if the upper supply is removed, but that level is a big challenge for the US Dollar so I wouldn’t expect it to happen any time soon.

EURUSD

What can I say but wow; this is an ugly currency market indeed! I have not really enjoyed trading the EURUSD for quite some time now. We have seen some very choppy and ranging conditions and it has paid us well to play this range up until recently, but now things have finally broken lower and it looks like the pair is going to have a tough time making a recovery. As you know, I am not a big guy for using fundamentals in my analysis but news out of Europe has hardly been great and with the recent referendum in Italy it seems that there is little faith in the single currency as of late.

When we see such an oversold GBP too, if the pound does decide to rally and depending on the outcomes of the UK exit from the EU, there is the potential for lower prices on the Euro in the coming year. Here’s how the chart is looking right now:

It is hard to not see a test of the major demand zone at 1.000 which is only a few hundred pips lower as we speak. Sure, I would expect a bounce from this area as it is such a strong buying opportunity, but I really don’t like the chances the EURUSD has if it makes a recovery rally to the above level of supply at 1.1122 to 1.1500. It is looking like a strong zone and a great place to re-engage a downwards trend on the pair if we get a decent rally to the zone. I would not be surprised to see plenty of ranging activity between these two major zones for the coming months ahead, and the future state of the European Union hangs in the balance.

GBPUSD

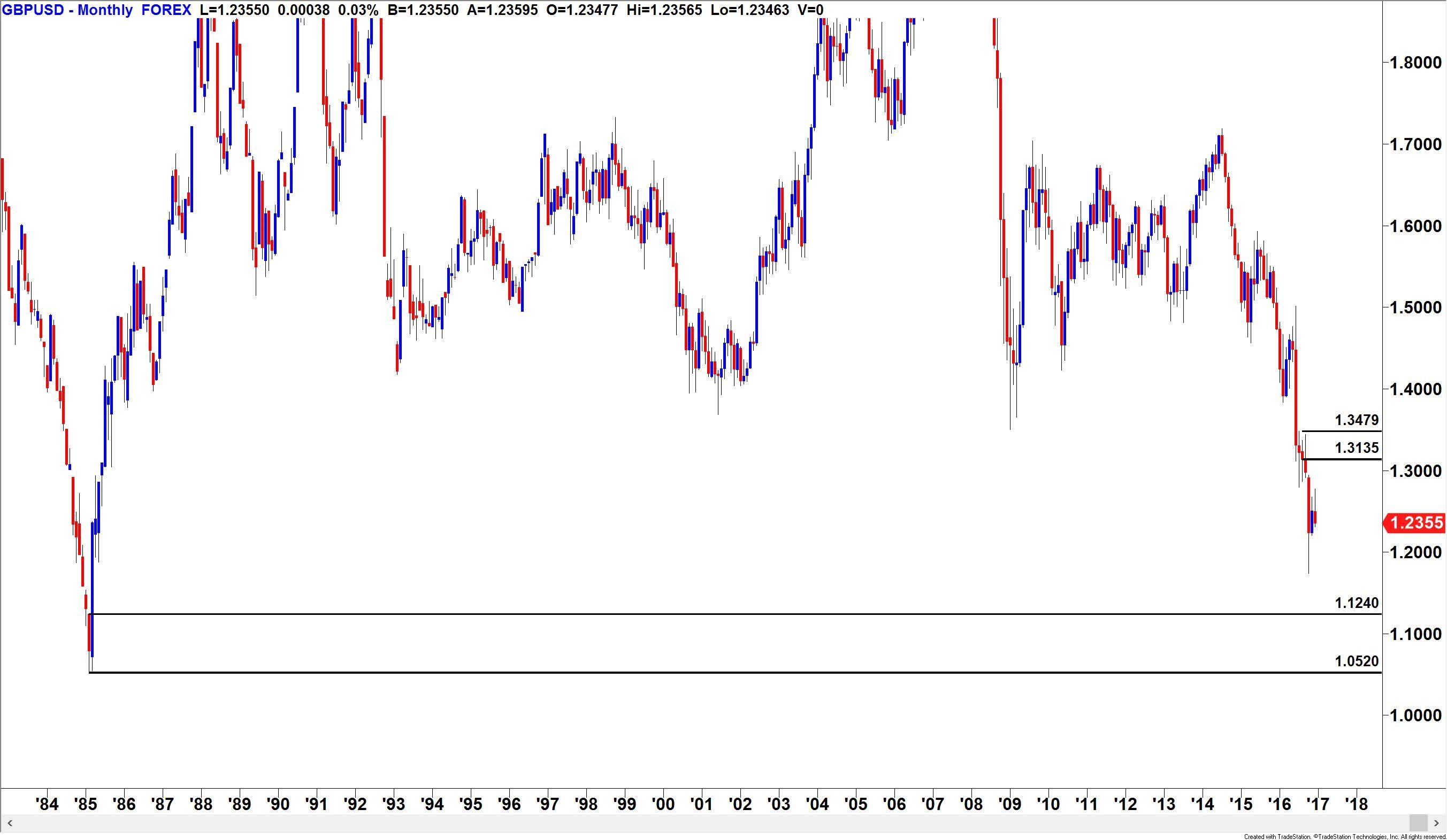

Finally, we have the British Pound, a currency in the world of FX that has seen some of the biggest moves not only in its own history but also in the overall history of currency trading itself. June 23rd 2016 was a surprise for most, with the public voting to leave the EU and the ramifications of this decision still completely unknown. 2017 will likely see a little more clarity on how the Brexit will turn out, but in the meantime we should expect more ranging activity and the uncertainty to continue as the news from Europe and the UK continues to pour in. Our chart looks like this right now:

As much as I hate to say it (being an Englishman) this pair could fall to 1.1000 but I would be shocked if we didn’t see a pretty huge bounce from there considering the demand in the area. The major ceiling for now is in the region of 1.3000 to 1.3500, but there is a smaller range established too between 1.2800 and 1.2000 which must not be ignored. Again, much like the Euro, I see plenty of action around 1.2000 as an equilibrium point with prices exploring around this region as we wait for more clarity on the Brexit itself and the true consequences of the event to Europe and the UK.

So it seems as far as the currency market goes, we have more indecision ahead in 2017 but plenty of volatility to go with it! Pick your spots, be patient and stick to your plan and this could be a great year ahead as the world faces a whole new era of political landscapes unlike any other before. Thank you sincerely for your ongoing support and I wish you all a very happy and healthy New Year!

The information provided is for informational purposes only. It does not constitute any form of advice or recommendation to buy or sell any securities or adopt any investment strategy mentioned. It is intended only to provide observations and views of the author(s) or hosts at the time of writing or presenting, both of which are subject to change at any time without prior notice. The information provided does not have regard to specific investment objectives, financial situation, or specific needs of any specific person who may read it. Investors should determine for themselves whether a particular service or product is suitable for their investment needs or should seek such professional advice for their particular situation. Please see our website for more information: https://bustamanteco.com/privacy-policy/

Editors’ Picks

EUR/USD makes a U-turn, focus on 1.1900

EUR/USD’s recovery picks up further pace, prompting the pair to retarget the key 1.1900 barrier amid further loss of momentum in the US Dollar on Wednesday. Moving forward, investors are expected to remain focused on upcoming labour market figures and the always relevant US CPI prints on Thursday and Friday, respectively.

GBP/USD sticks to the bullish tone near 1.3660

GBP/USD maintains its solid performance on Wednesday, hovering around the 1.3660 zone as the Greenback surrenders its post-NFP bounce. Cable, in the meantime, should now shift its attention to key UK data due on Thursday, including preliminary GDP gauges.

Gold holds on to higher ground ahead of the next catalyst

Gold keeps the bid tone well in place on Wednesday, retargeting the $5,100 zone per troy ounce on the back of modest losses in the US Dollar and despite firm US Treasury yields across the curve. Moving forward, the yellow metal’s next test will come from the release of US CPI figures on Friday.

Ripple Price Forecast: XRP sell-side pressure intensifies despite surge in addresses transacting on-chain

Ripple (XRP) is edging lower around $1.36 at the time of writing on Wednesday, weighed down by low retail interest and macroeconomic uncertainty, which is accelerating risk-off sentiment.

US jobs data surprises to the upside, boosts stocks but pushes back Fed rate cut expectations

This was an unusual payrolls report for two reasons. Firstly, because it was released on Wednesday, and secondly, because it included the 2025 revisions alongside the January NFP figure.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.