It is a well known behavioural fact that humans have a round number bias. We just like round numbers. During a visit to the gym recently keeping the RPM’s over 100 was a keen aim. If the RPM’s dropped under 100 something psychologically kicked in to give an extra push in order to hit the ‘big round number’.

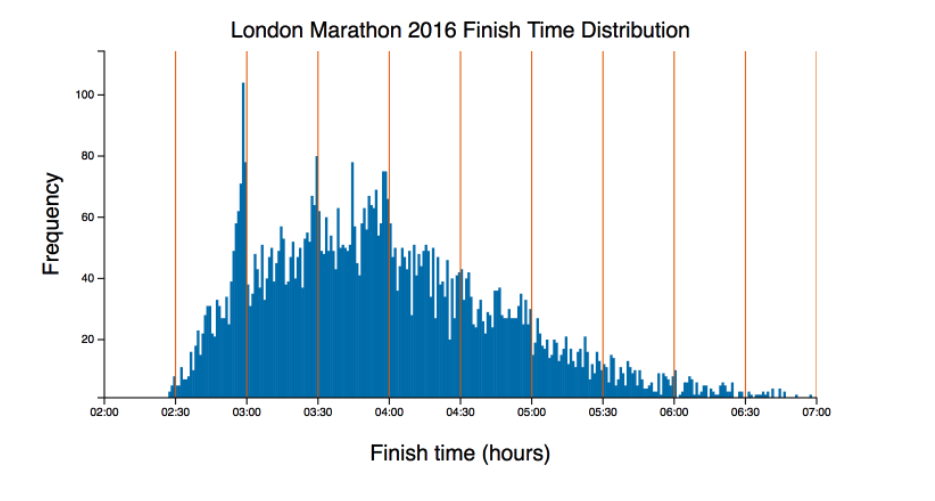

This phenomena turns up all over the place. Look at the London Marathon finishing times and how they cluster around the big round numbers of 3 hours, 3:30 hours, and 4 hours.

Most of us are very familiar with pricing that keeps under a big round number. Most goods for about £3 will be priced as £2.99. Staying clear fo the ‘£3’ label, even by a penny, means more sales will be encouraged.

Humans love big round numbers as key reference points. You will have noticed this yourself when you say ‘I will close my position when my equity hits £10,000’ or ‘I will sell the stock when it reaches $100’. This means that traders need to be aware of this impact when trading.

The big round number effect

Whenever you are trading, this has a number of implications for placing orders.

For limit orders: Place buy or sell limit orders at, or near, big round numbers.

For a take profit : Place your TP just a few points BELOW a big round number

For a stop loss: Place your SL just a few points BELOW a big round number.

Also, keep a careful eye out for how big round numbers act as key support and resistance numbers. You will see how influential they are.

Our products and commentary provides general advice that do not take into account your personal objectives, financial situation or needs. The content of this website must not be construed as personal advice.

Editors’ Picks

GBP/USD defends 1.3550 after UK inflation data

GBP/USD is holding above 1.3550 in Wednesday's European morning, little changed following the UK Consumer Price Index (CPI) data release. The UK inflation eased as expected in January, reaffirming bets for a March BoE interest rate cut, especially after Tuesday's weak employment report.

EUR/USD hovers around 1.1850 ahead of FOMC Minutes

EUR/USD stays on the back foot around 1.1850 in the European session on Wednesday, pressured by renewed US Dollar demand. Traders now look forward to the Minutes of the Fed's January monetary policy meeting for fresh signals on future rate cuts.

Gold: Is the $5,000 level back in sight?

Gold snaps a two-day downtrend, as recovery gathers traction toward $5,000 on Wednesday. The US Dollar recovers from the overnight sell-off as rebalancing trades resume ahead of Fed Minutes. The 38.2% Fib support holds on the daily chart for now. What does that mean for Gold?

Pi Network rally defies market pressure ahead of its first anniversary

Pi Network is trading above $0.1900 at press time on Wednesday, extending the weekly gains by nearly 8% so far. The steady recovery is supported by a short-term pause in mainnet migration, which reduces pressure on the PI token supply for Centralized Exchanges. The technical outlook focuses on the $0.1919 resistance as bullish momentum increases.

UK jobs market weakens, bolstering rate cut hopes

In the UK, the latest jobs report made for difficult reading. Nonetheless, this represents yet another reminder for the Bank of England that they need to act swiftly given the collapse in inflation expected over the coming months.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.